The pressure is mounting for Binance, which has seen the SEC ban the issuance of its BUSD stablecoin. What continue to worry investors, who already tended to withdraw their cryptocurrencies from online platforms. We are indeed witnessing massive withdrawals of cryptocurrencies on Binance and Kraken since yesterday. Update on the subject.

$1 billion worth of stablecoins flew out of Binance

According to data shared by a Nansen researcher, the user exodus was particularly visible on Kraken, which was forced to shut down its staking services, as well as Binance, which saw a suspension of coin issuance. its stablecoin BUSD. The $1 billion worth of stablecoins that were pulled from Binance correspond to 6% of its reserves. It’s a big share, even for Changpeng Zhao’s empire.

Another notable point: $144 million of BUSD was “burned” by a user. That means that they were converted into dollars, arguably considered more secure than the stablecoin. Furthermore, Paxos deposit addresses have seen massive inflows of funds, which also suggests that many stablecoins will continue to be traded against USD.

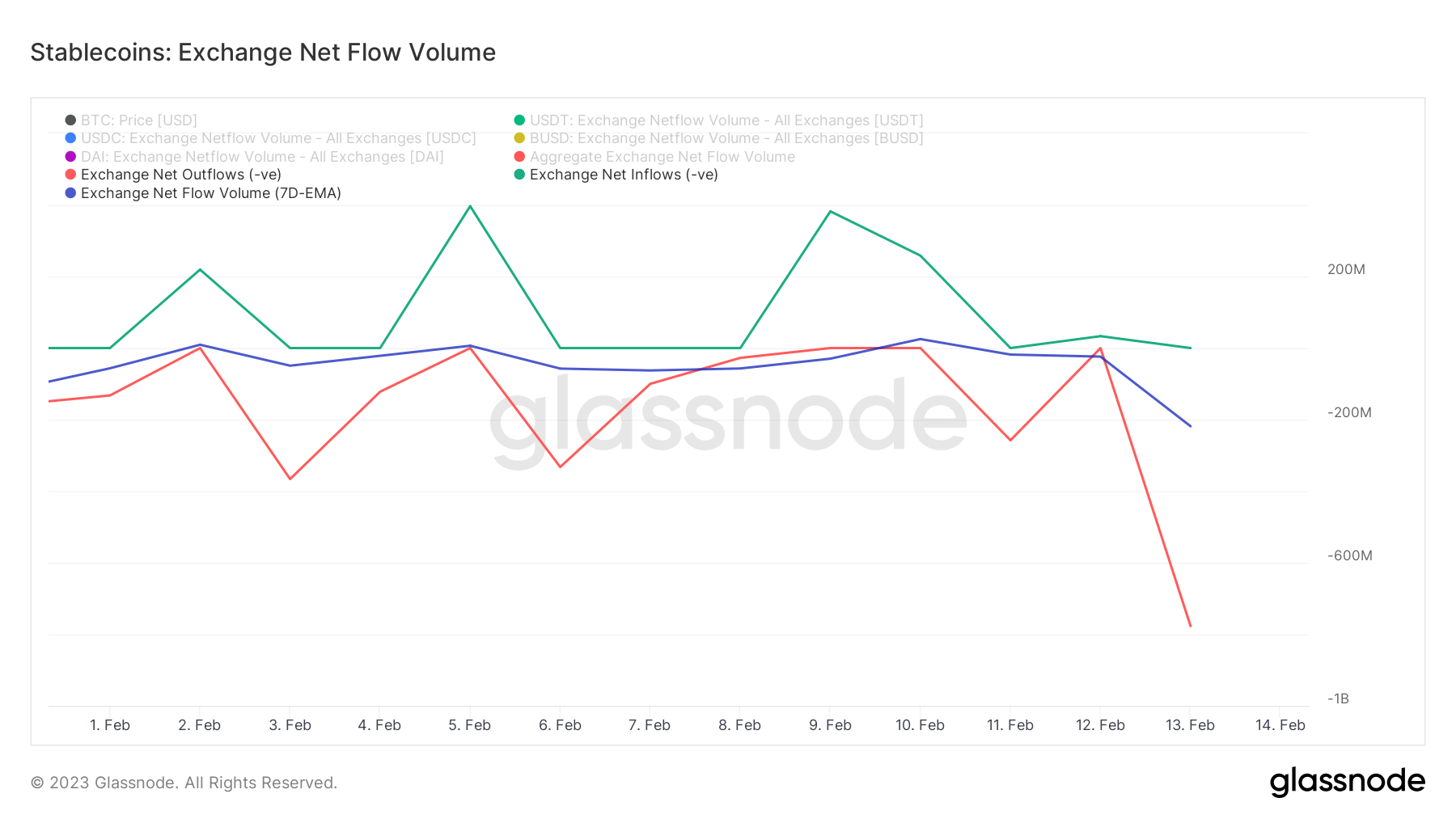

Same scenario on the side of Kraken, which sees an even larger part of its reserves being withdrawn. Glassnode data also confirm this exodus since two days :

Total stablecoin withdrawals on exchanges (in red)

So we can clearly see that users suddenly feel chilly against these cryptocurrencies historically considered “stable”.

👉 To learn more on the subject – Stablecoin, all about this type of cryptocurrency

The best way to secure your cryptocurrencies 🔒

🔥 The world leader in crypto security

The ambivalence towards stablecoins

Currently, however, there are opposite trends when it comes to stablecoins. Although the SEC is shaking the ecosystem of the United States, the enthusiasm for this type of asset does not seem – for the moment – to have started. We keep seeing the emergence of stablecoins in a more institutional framework, for example at commercial banks. In Europe, the arrival of the EUROe thus shows a desire to play the appeasement card with the regulators.

Another proof of this marked interest: the rating agency Moody’s would be working on a system for evaluating stablecoins, a particularly clear proof of the preponderant place they now occupy. Still, the SEC’s crusade could do damage, so we will continue to monitor this area carefully.

👉 Listen to this article and all other crypto news on Spotify

🎁 Cryptoast Research Launch Offer

1st Newsletter Free with the code TOASTNL

Source: Nansen, press release

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.