As the market sessions pass, the debate on the future monetary action of the Federal Reserve (FED) is enriched with new aggregates of economic conditions, reinforcing the scenario of a final hike in the Fed funds rate. For bitcoin, it’s about resisting the headwind of the rise of two of its fiercest enemies, the US dollar and rising interest rates.

Bitcoin VS the US dollar & rates couple, the devastating inverse correlation

It’s been 6 weeks now Bitcoin price is in retracement after testing $30,000. The hole in bullish quotations (gap) of Monday, May 29 did not allow to leave this corrective configuration. The latter takes the form of a clearly visible bearish chartist channel on BTC and Ether (ETH), as well as on the graphic representation of the total market capitalization of cryptos.

How to explain that this corrective sequence lasts so long. Is it threatening to wipe out the entire rise since the start of the year? This is what we will see together in this technical analysis of the cryptocurrency market.

Remember that at the beginning of June, the price of bitcoin is still up 62% since the beginning of the year. As for the ETH/USD pair, it appreciated by 55% over this same period.

The first reason is fundamental with the debate still unresolved on the likelihood of an economic recession in the Westin a context where the rate of inflation, admittedly falling, is still too high to allow central banks to adopt an accommodating monetary policy.

But it seems to me that the most powerful brake on a resumption of the annual rise of BTC is on the side of cross-asset factors. The foreign exchange market and the credit market (bonds/interest rates) are the two largest markets in the world in terms of daily trading volume and amounts under management. In these two markets, the young crypto asset class encounters two enemies, both fierce and powerful:

- The US dollar against a basket of major currencies (market code, DXY);

- The upward trend in Western bond yields, particularly those of the United States resulting directly from the monetary policy of the FED.

The bear market’s starting point in the fall of 2021 was triggered by the simultaneous bullish reversal in interest rates and the US dollar, and currently it is these same bullish moves that are generating the BTC retracement below $30,000.

Chart produced with the TradingView site and which juxtaposes 3 market information: the price of bitcoin in weekly Japanese candles on an arithmetic scale, the curve of the US dollar against a basket of major currencies (DXY) and the 2-year bond yield of UNITED STATES.

Chart produced with the TradingView site and which juxtaposes 3 market information: the price of bitcoin in weekly Japanese candles on an arithmetic scale, the curve of the US dollar against a basket of major currencies (DXY) and the 2-year bond yield of UNITED STATES.

👉 Discover our guide to buy Bitcoin (BTC) simply

Trade on the leading DEX

⛓️ A platform at the heart of DeFi

Will the FED, yes or no, raise its rates one last time in June or July?

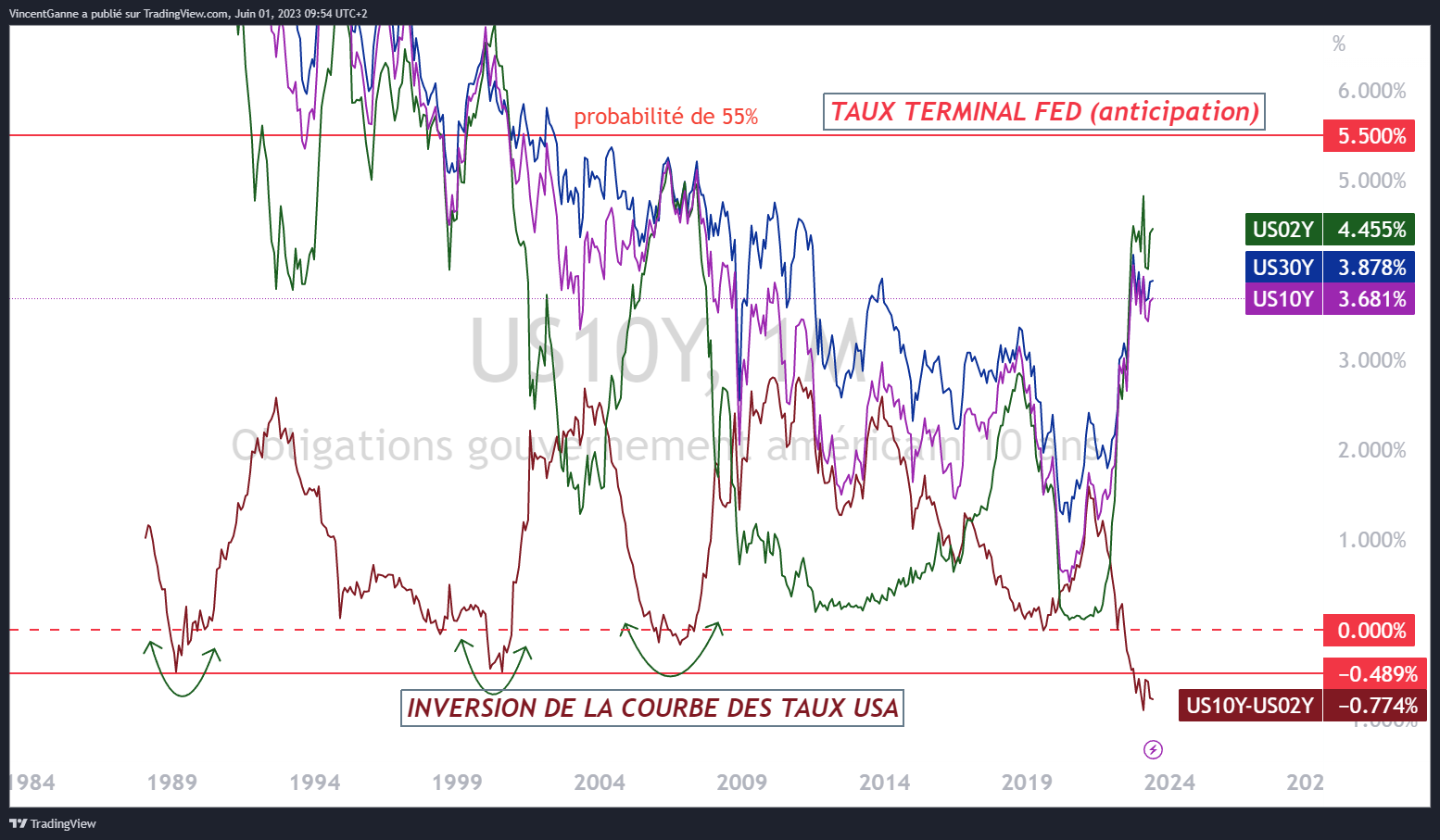

So is Bitcoin price threatening to retrace further and break the major support at $25,000? Only members of the Fed’s monetary policy committee know the answer because their decisions at the June 14 and July 26 meetings will shape market moves. The Fed’s key rate is currently 5.25% and the probability that it will rise to 5.50% this summer is 55% (compared to less than 10% at the beginning of May).

To allow BTC to resume its forward march, the FED must quickly specify that it has reached its terminal rate, because if the doubt remains then the crypto market will have difficulty finding a catalyst for the resumption of the rise. In the meantime, the $25,000 support remains the graphical boundary between reviving the rebound momentum of the year and its complete obliteration.

Graph produced with the TradingView site and which juxtaposes the bond yields of the United States at 2, 10 and 30 years as well as the terminal rate of the FED considered the most likely

Graph produced with the TradingView site and which juxtaposes the bond yields of the United States at 2, 10 and 30 years as well as the terminal rate of the FED considered the most likely

👉 Find exclusive and daily analyzes of Vincent Ganne on Cryptoast Research

Take your investments to the next level with the analyzes of Vincent Ganne

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.