With the number of active addresses and on-chain transactions on the rise, the long-term adoption of Bitcoin (BTC) is real and clearly visible. A fundamental usage floor seems to be building since the end of the 2014 – 2015 bearish cycle. On-chain analysis of the situation.

Bitcoin is testing participants’ patience

Once again, theBitcoin price (BTC) hit an all-time low of volatility, leaving the new year to begin with uncertainty about the price’s short-term path.

Although the $16,000 level has held firm for the time being, the former support at $18,000 is now acting as resistance on the upside of the price.

Figure 1: Daily price of BTC

After a year 2022 dominated by sales pressure, the current stagnation of BTC augurs the formation of a new low pointwhich could signal the cyclical bottom expected by so many investors.

Today we will observe the status of block space demand (on-chain activity) of the networkwhich moves increasingly through cycles and provides a clear signal of Bitcoin network adoption.

👉 Enjoy a month with 40% off to test our premium group at a reduced price with the PROF code when you register:

Prof Chaîne intervenes every week on our Premium Group

Slow but palpable adoption

Block space demand, commonly referred to as “on-chain activity”, measured through various metrics, observes the state of transactional demand on the Bitcoin network, as well as its congestion.

The study of this parameter provides a gauge of the degree of network usage and adoption over market cyclesmaking it possible to characterize the overall behavior of the participants over a given period.

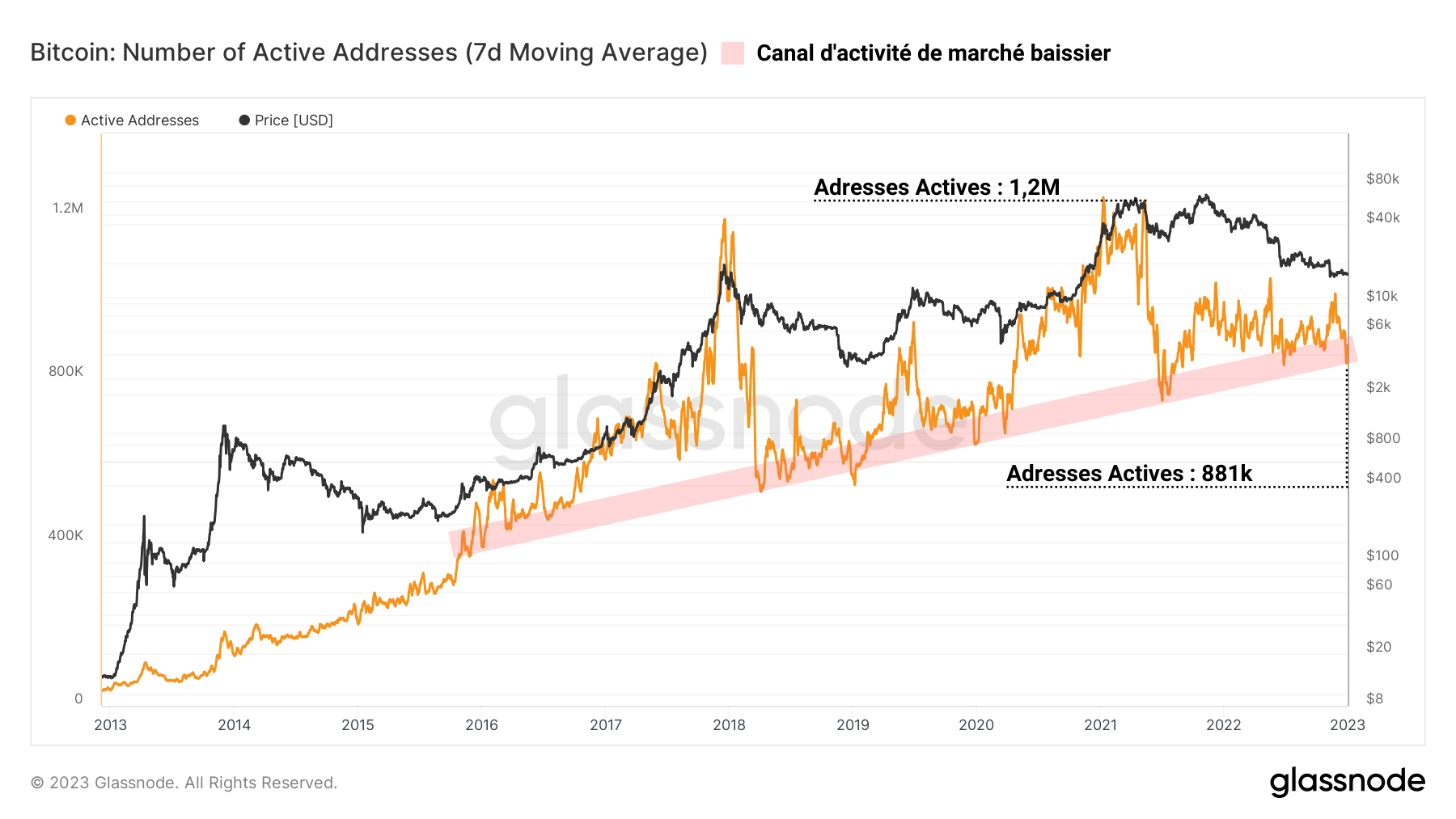

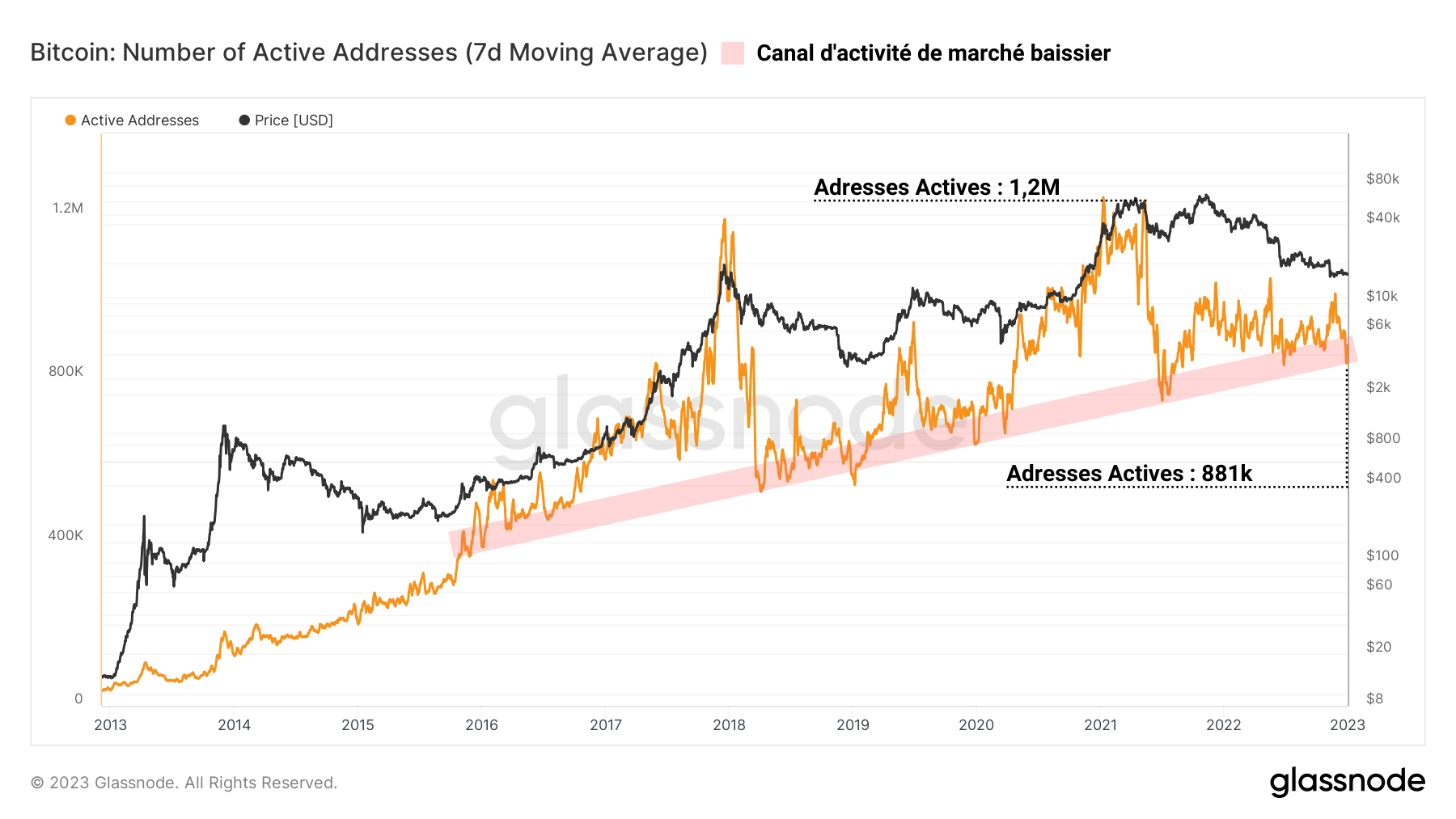

From a long term perspective, a fundamental usage floor (in red) appears to be building since the end of the 2014 – 2015 bear cycle.

Currently, activity on the network is recovering values coinciding with this ascending channel, also reached during the capitulation of May 2021, and amounts to almost 880,000 active addresses per day.

This observation is also visible through the measurement of the number of transactions adjusted by entity. Evolving in a bearish regime since mid-2021, the metric is now close to the 212,000 daily transactions.

Figure 3: Daily Bitcoin Transactions

This nearly one-third drop in transactional demand over the past few months marks participants’ lack of interest in on-chain transactional settlement during long-term market declines.

However, over the long term, the number of on-chain transactions is growing visiblywith extensions above the fundamental activity channel during bull markets and returns to “normal” (long-term user base) during bear markets.

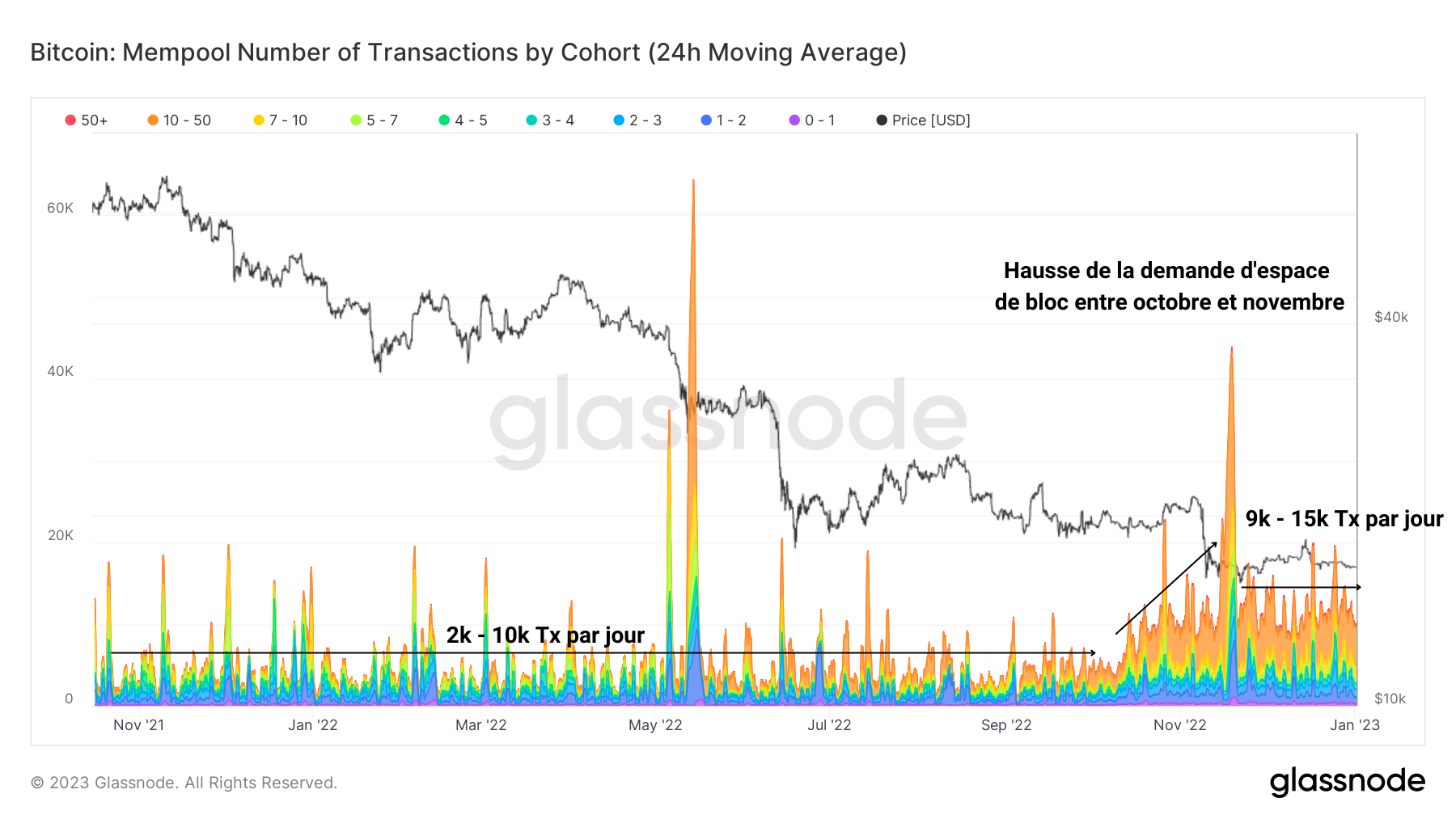

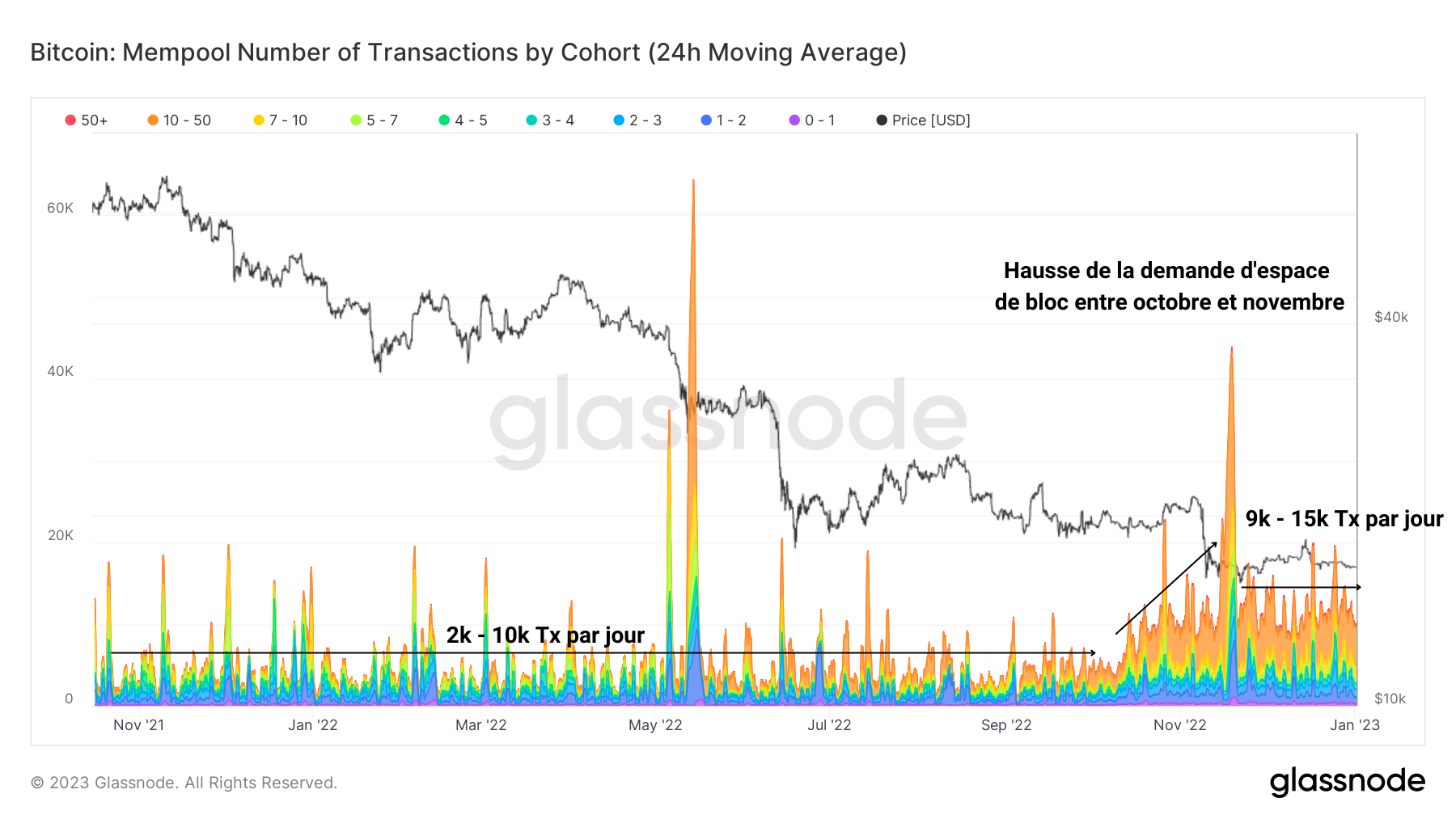

In the short term, and despite a drop in the rate of transactions made since the collapse of FTX, the number of transactions pending in the mempool indicates a palpable increase in demand for block space.

Figure 4: Bitcoin transactions in the mempool

Going from a range of 2,000 – 10,000 pending trades to 9,000 – 15,000 pending trades since the October – November period, the following chart signals that many participants want to see their trade completed.

So, following the spike in late November, activity levels have fallen, but remain at a higher level than before the FTX crash, signaling an overall uptick in participant interest.

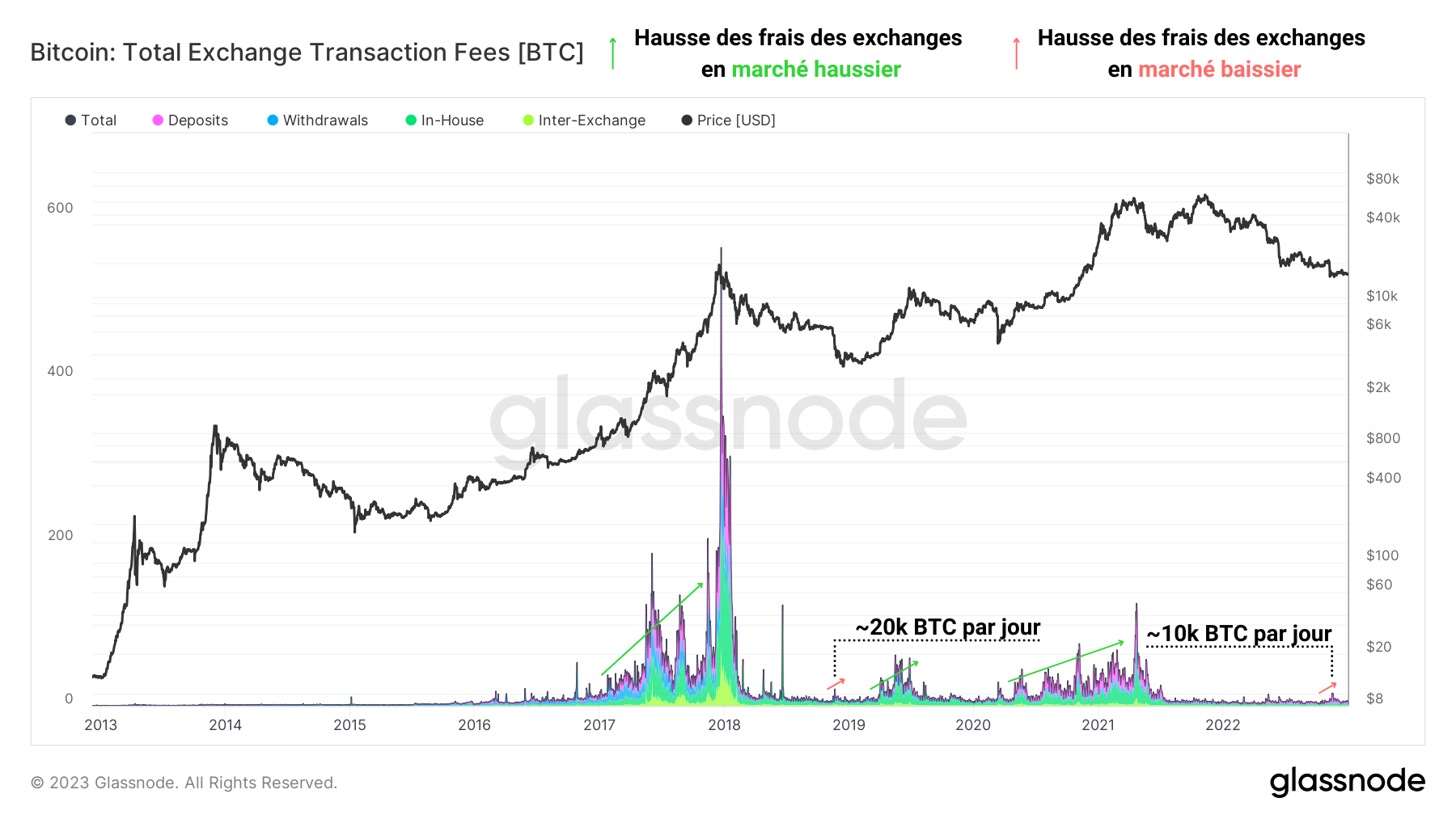

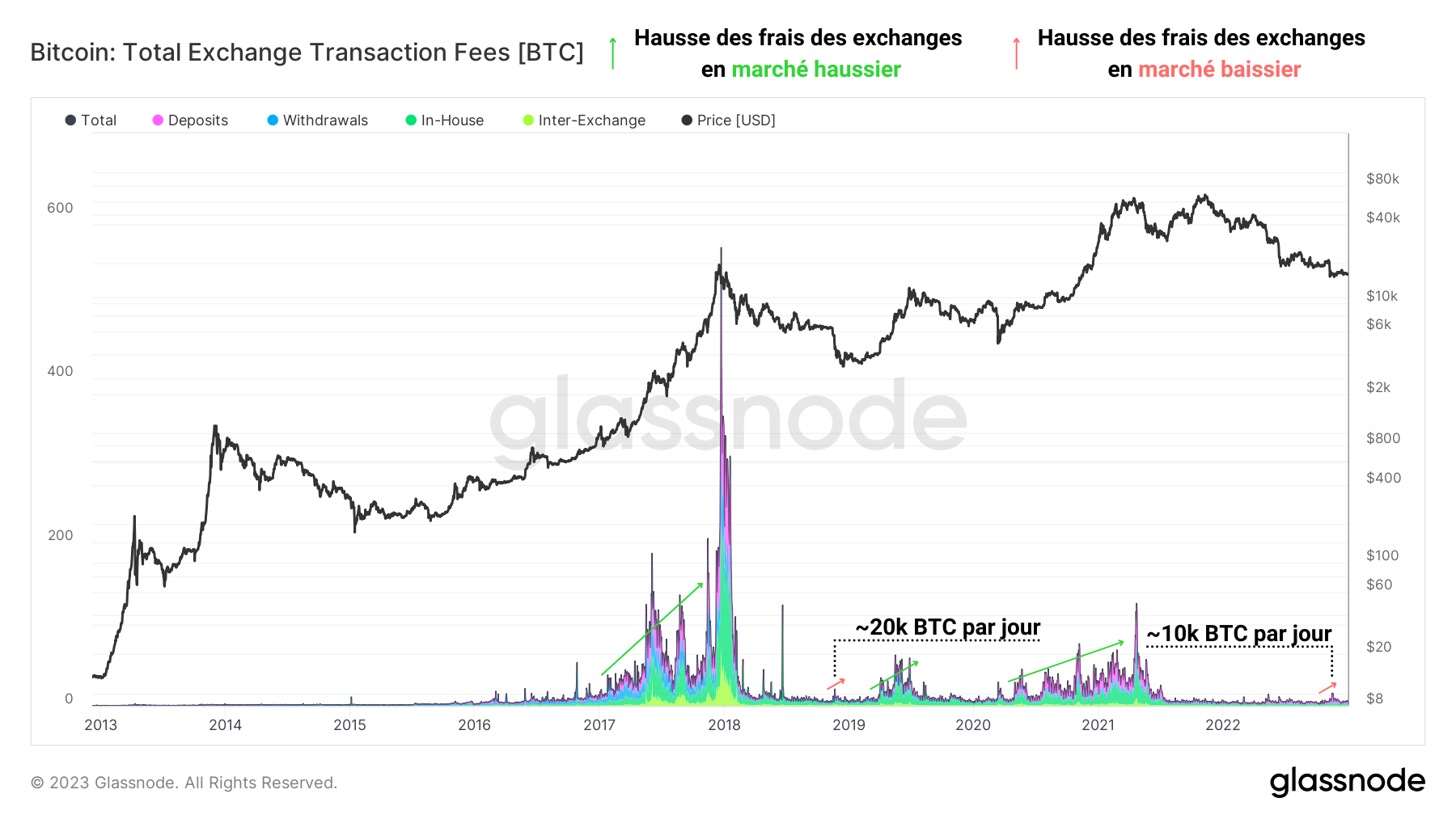

Finally, we can observe a parallel dynamic via the measurement of transaction fees paid to centralized exchanges (CEX) by their users.

Figure 5: Fees of centralized exchanges

Although the total daily fees are decreasing over time – notably thanks to the expansion of DeFi – we can observe notable increases in fees:

- During bull markets (in green), as newcomers flood the CEX with liquidity;

- Close to bear market lows (in red), when less resilient hands capitulate and pay a high price to sell their holdings as soon as possible.

In November 2022, we thus witnessed a rise in fees paid to CEXs similar to that recorded during the November 2018 capitulation, although the magnitude was reduced by half.

👉 To better understand and apprehend on-chain analysis, discover our podcast on this subject:

Summary of this on-chain analysis of BTC

In sum, this week’s data tells us that the long-term adoption of Bitcoin is real and clearly visible via the measurement of the network’s on-chain activity.

On the long term, the number of active addresses and the total of transactions carried out daily show a notable increasemeaning that the number of users increases gradually over the cycles.

In the short term, the number of pending transactions in the mempool indicates a slight increase in interest from participants following the collapse of FTX and the breakout of the $18,000 support.

👉 Access the full analysis of Prof. Channel via our private group: Le Grille-Pain

Prof Chaîne intervenes every week on our Premium Group

Sources – Figures 1 to 5: Glassnode

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.