On Friday, Bitcoin (BTC) saw its price increase to the point of going back above the symbolic $60,000 mark. What level should we watch to validate this increase? We take stock.

Bitcoin (BTC) climbs back above $60,000 again

Bitcoin (BTC) rose more than 4% on Friday, allowing it to once again move above the symbolic threshold of 60,000 dollars. After a week of increases, this gives some breathing space to the asset which had a mixed summer.

💡 Find our complete tutorial to buy Bitcoin easily

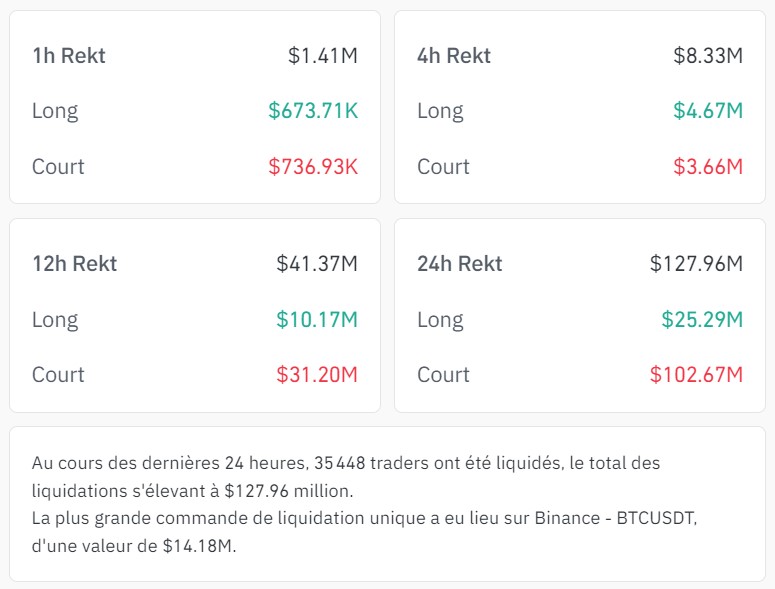

A look at the liquidations allows us to see that, without much surprise, it is the short sellers who come out on the losing end of this movement. Indeed, they have suffered more than $100 million in losses in 24 hours on centralized exchanges:

Figure 1 — Liquidation statistics for the last 24 hours

20 € offered when you register on Bitvavo

While it is generally accepted that Bitcoin price soars higher after halvingthese positive effects can be felt with a delay of up to several months. For the time being, this is still confirmed, although it should also be noted that prices had also risen sharply before the halving of April 20, thanks to ETFs.

From, BTC even shows a bearish trend with increasingly lower highs, and it will be a question of confirming a rise above $65,000 to remove the prospect of a longer-term decline:

Figure 2 — Bitcoin (BTC) price in daily data

In the shorter term, it is reassuring that the $50,000 level has held, after the $60,000 level failed to provide resistance for most of August.

👉 To go further — Find the latest detailed analysis by Vincent Ganne

In the immediate future, BTC trades near $60,400and we will have to wait until Sunday evening to validate the current positive week. During the coming weeks, we will also be able to take stock of the underlying trend, to see if a real increase is emerging again.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Sources: TradingView, Coinglass

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.