The FTX affair ushered the cryptocurrency market into the final phase of the bear market, which began in the spring of 2021, when interest rates started to rise and the US dollar hit a long-term low. The price of Bitcoin (BTC) is now developing its last wave of decline, the 5th, the one which constitutes (in my humble opinion), a long-term opportunity.

The FTX Affair and Systemic Risk

Sudden return to earth for the price of Bitcoin (BTC) which had been clinging to the support of $19,000 for more than 6 months and which was beginning to benefit from a more favorable cross-asset context (interest rates and the dollar US on Forex no longer rise).

But the crypto market had to look for a reason to fall of its own, the risk of bankruptcy of a major crypto exchange on a global scale.

Our team has published and continues to publish many informative articles on the subjectI invite you to follow them closely on our website.

My specialty is graphics. But it must be borne in mind that the FTX affair, if it does not result quickly in a rescue solution, would then represent a systemic risk for the ecosystemthus sweeping away any relevance to the technical view.

In my two previous analyses, I had highlighted that the volatility of the BTC reached its historical low, an event likely to create an explosion of flight. We are there and the market has decided for the bearish trajectory.

On a fractal level, specifically the Elliott wave approach, I believe bitcoin price is now building wave 5 of the bear marketthis is the last leg of decline, the one that is a long-term technical opportunity (barring systemic risk).

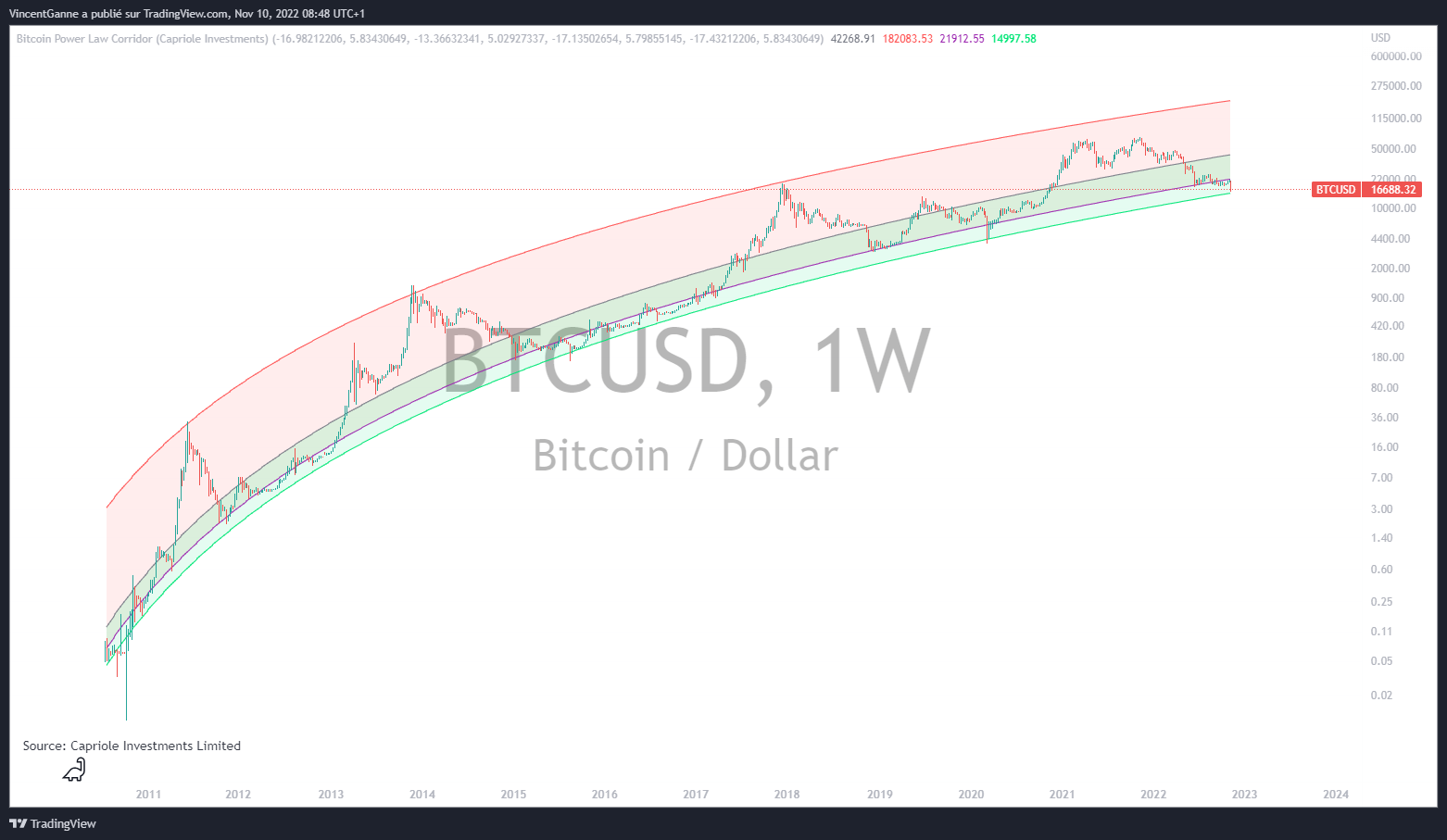

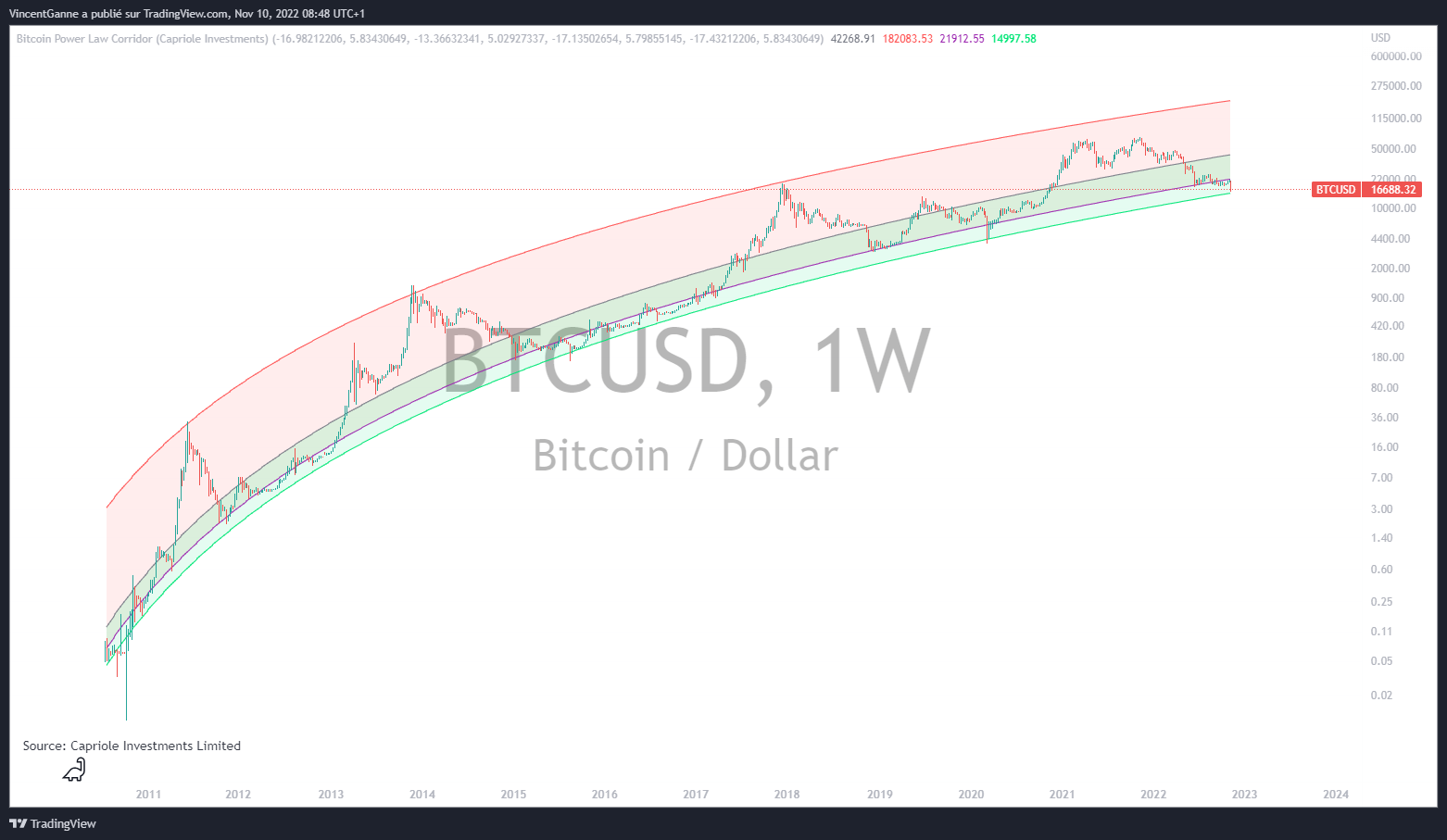

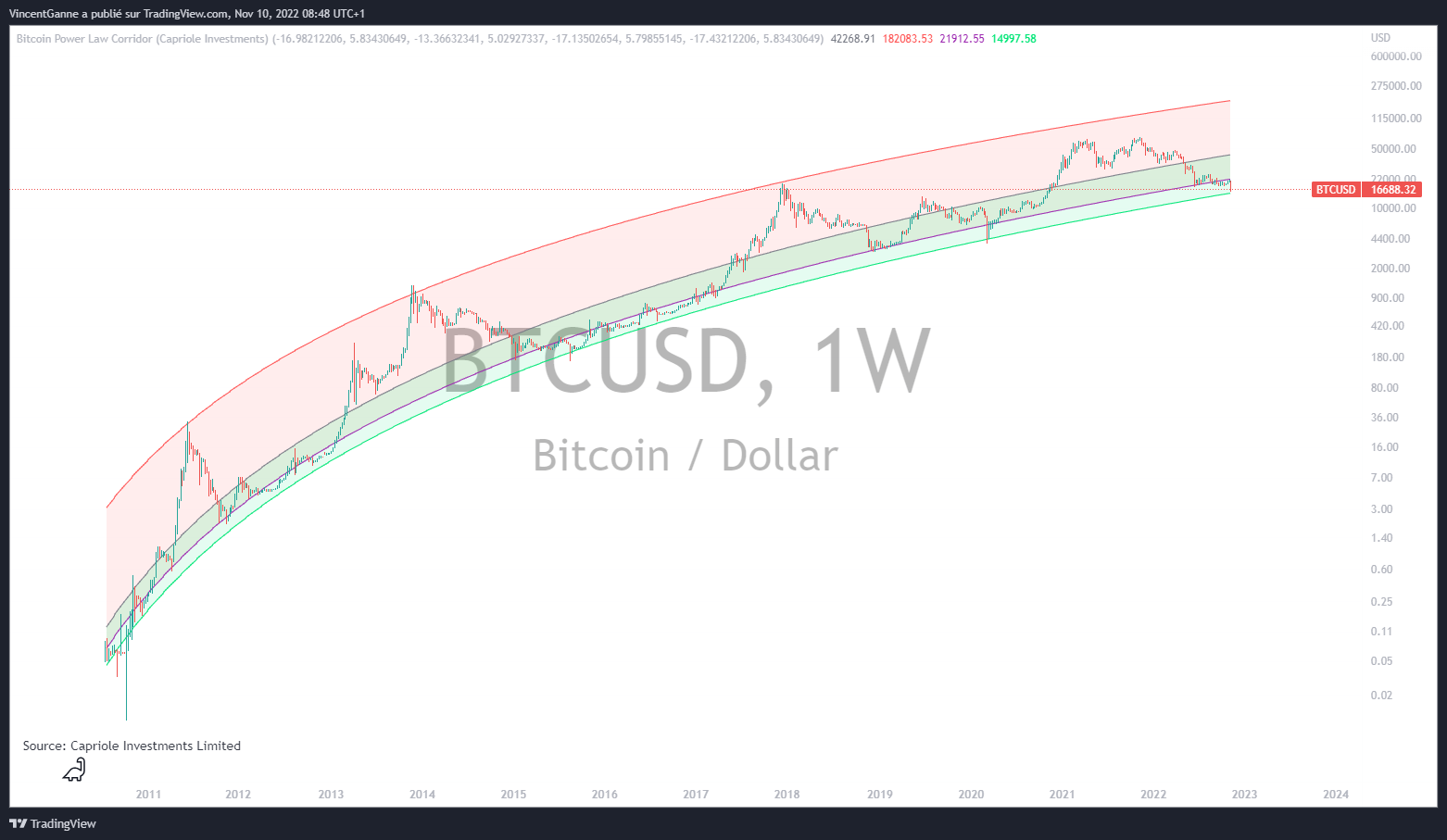

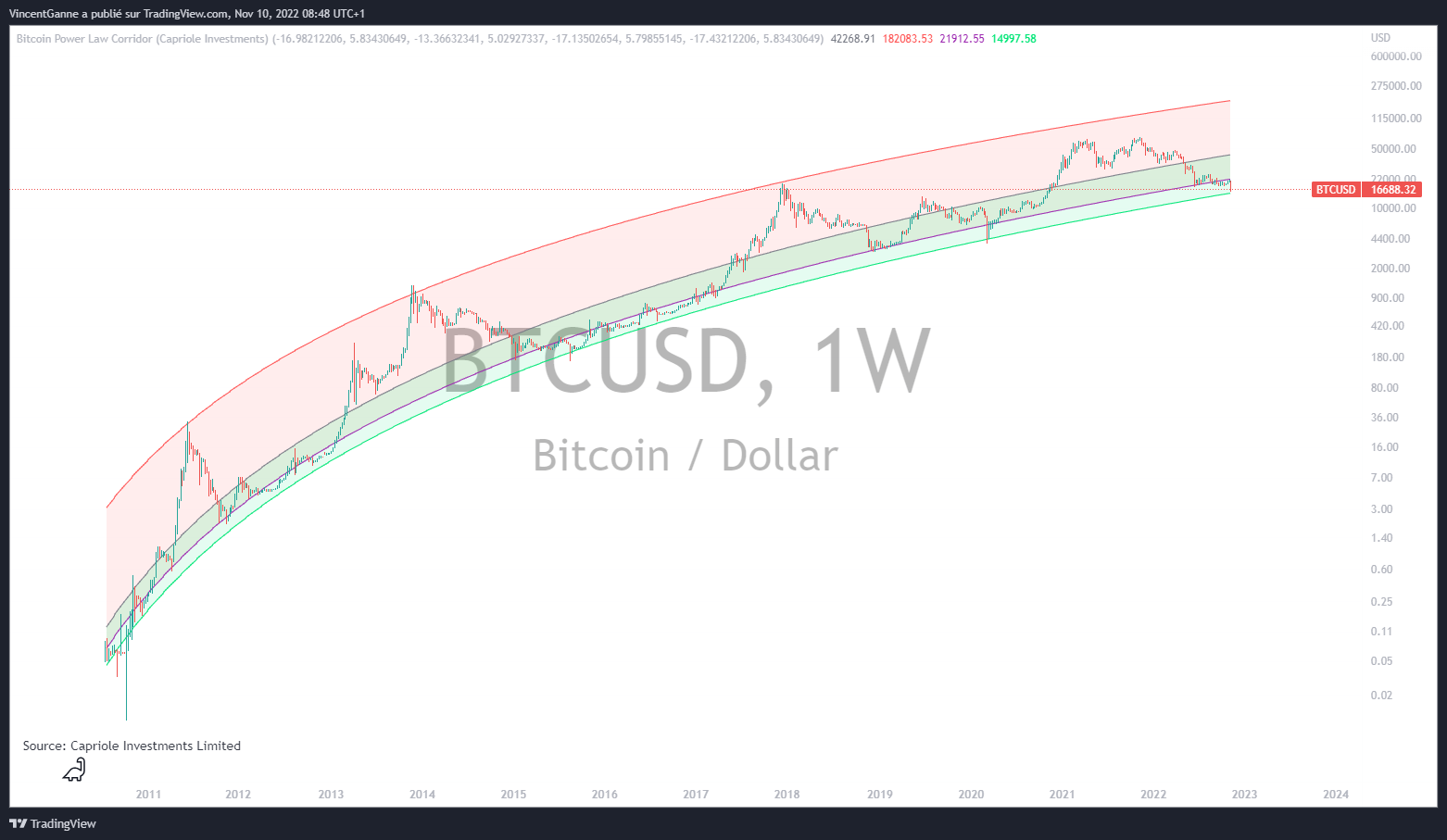

The chart below shows BTC’s weekly Japanese candles, with a logarithmic scale and the 5-count count. The “theoretical” target for this wave 5 is between $9,800 and $13,800.

This is the price range that must be defended, otherwise the long-term uptrend will be called into question..

Do you like Vincent Ganne’s technical analysis? Daily, he carries out exclusive analyzes on the Toaster, our group of experts to help you progress in the cryptocurrency market:

Vincent Ganne analyzes the crypto markets every day on our Premium group

Two graphs that point to the area of long-term interest of this last purge

I have selected two graphs which each represent in their own way the deviation from the mean of the price of Bitcoin.

The common message is: in a market context that eliminates systemic fundamental risk, then the price of bitcoin is very close to a very long-term buy zone.

It is therefore imperative that a financially reliable solution be found for FTX, because otherwise the market would sink into a technical no man’s land, which would sign the end of the upward momentum started more than 13 years ago.

This first chart shows that a support line is in sight on Bitcoin’s drawdown percentage curve against its former all-time high.

This second chart should make you think of the Stock To Flow model, but it’s a little different.

This is primarily a standard deviation plot that demonstrates that if the market does not make a major bottom in the $10,000/$14,000 price zone, then it will enter a technical phase still unknown in its young history.

Join Experts and a Premium Community

PRO

Invest in your crypto knowledge for the next bullrun

Newsletter

Receive a summary of crypto news every Monday by email

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.