The financial markets got off to a flying start in 2023 with an astonishing positive performance on shares in the most offensive sectors on the stock market. As for the crypto market, it offered a small rebound, in a reduced volume, however. The risk now is that all these movements will be reversed by disappointment in the inflation figures in the United States.

Bitcoin, the fundamental issue of inflation figures in the United States

Equity markets record an astonishing bullish performance since the beginning of the year, in particular the major European stock indexes which are almost back in contact with their historic highs. In parallel with this rise in equities in the most cyclical sectors, bond interest rates stabilized and the US dollar is now down more than 10% on the floating exchange market since last October.

In the pre-FTX world, all of these inter-asset class stock movements would have caused a sharp rise in the price of the crypto market; but the latter is still largely hampered by the crisis of confidence vis-à-vis the major crypto intermediaries, as well as by its fall of more than 70% since its historic peak in November 2021.

👉 Listen to this article and all other crypto news on Spotify

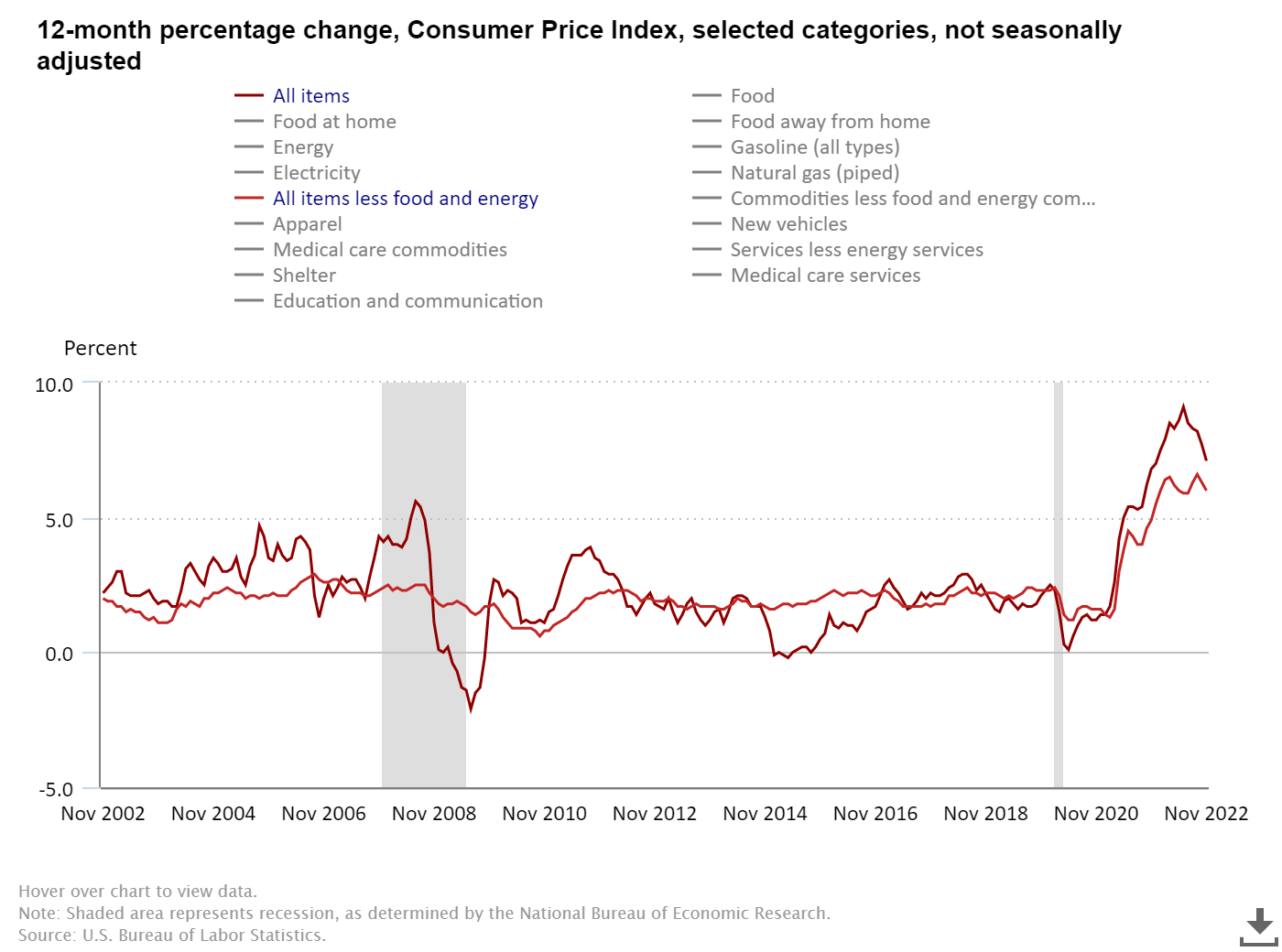

The rise in risky assets at the start of 2023 was forged on the conviction of investors that the process of disinflation is well underway. The inflation rate in the United States has risen from 9% to 7.1% in the space of three months and the consensus for this Thursday, January 12 stands at 6.5%. It is precisely here that there is a market risk, because the consensus is very optimistic. The risk for the equity market and the price of bitcoin is to be taken from the back by inflation, which would slow down much less than expected.

This ongoing disinflation is fueling hopes that the Federal Reserve of the United States (FED) will limit itself to a rate of 5% for its Terminal rateto then perform its famous “pivot” during the first quarter of 2023. But a rebound in the price regime would upset this fundamental narrative and would represent a major market risk for high-beta assets on the stock market.

The answer, during the publication of the US CPI this Thursday, January 12 at 2:30 p.m.

Chart showing the evolution of the components of the annual inflation rate in the United States

Chart showing the evolution of the components of the annual inflation rate in the United States

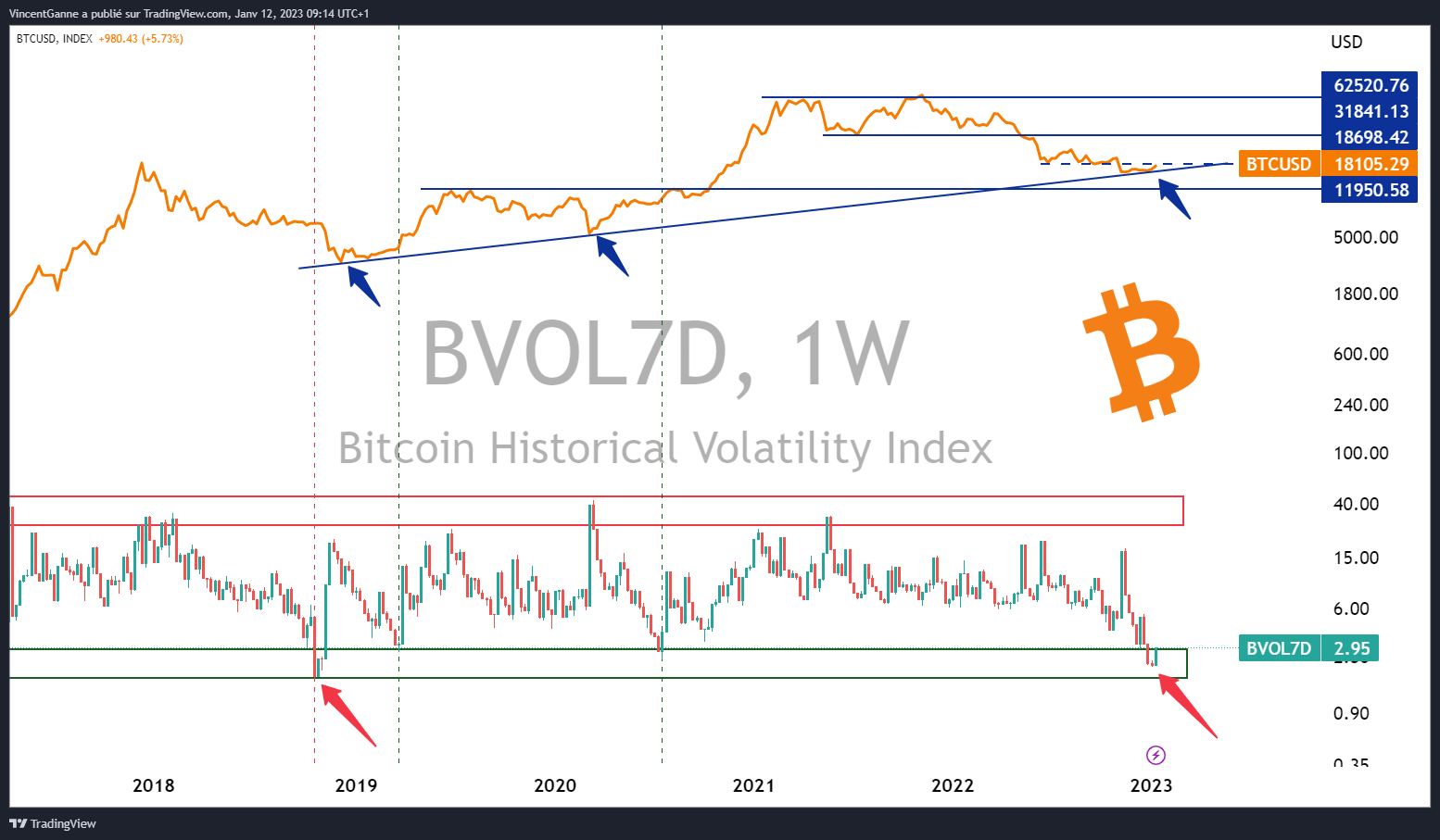

In terms of technical analysis of the bitcoin price, here is a reminder of the dominant graphic factors of the moment:

- An uptrend line that joins all the most salient lows of the weekly time horizon for the past 5 years;

- The price of $16,000 which represents a 50% retracement of the entire rise since the low point of the health crisis;

- The price of $12,000 that the doxa is impatiently awaiting (beware of the consensus, sometimes it is taken the wrong way);

- The resistance of $20,000 that must be exceeded to return bullish.

Chart that exposes the weekly closing price of bitcoin, juxtaposes its 7-day realized volatility

Chart that exposes the weekly closing price of bitcoin, juxtaposes its 7-day realized volatility

👉 Vincent Ganne intervenes every day on our Cryptoast Premium group with exclusive analyzes

Vincent Ganne analyzes the crypto markets every day on our Premium group

The trend of the American dollar will act by correlation on Bitcoin this beginning of the year 2023

Finally to conclude this new contribution within the columns of Cryptoast, I draw your attention to the level of support on which the American dollar returned on the Forex. The most favorable scenario for the crypto market would be for the US dollar to break this support, at the very least it does not offer a strong bullish bounce.due to the inverse correlation with the crypto market.

Chart that exposes Japanese candles in weekly US Dollar (DXY) data against a basket of major Forex currencies

Chart that exposes Japanese candles in weekly US Dollar (DXY) data against a basket of major Forex currencies

👉 Check out our complete guide on how to buy Bitcoin in 2022

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.