The FTX black swan and its offshoots, along with the cost of energy for mining activities, continue to exert downward pressure on Bitcoin and cryptocurrency prices, all the more damaging as the market pull equities has made a comeback since the short squeeze on Thursday, October 13. Let’s ignore this difficult context and establish an unfiltered technical diagnosis of the crypto market.

A trust issue that will be resolved in the coming weeks

The bankruptcy of the FTX platform, the scammer that is the person of Sam Bankman-Fried, the powerful movement of distrust of cryptocurrencies that followed via a very large amount of withdrawals from centralized platforms (CEX) is a black swan.

For the financial markets, the black swan is the worst fundamental event that can occur, as its exceptional nature poses systemic riski.e. a risk of the market in question collapsing due to an unpreparedness to deal with it.

By definition, it is indeed a market risk that had not been listed in the potential risks at the beginning of the year. In the current case, FTX was still considered a “top ranking and safe” player a month ago and its CEO, as a beneficial personality for the ecosystem.

Gold, this gentleman turns out to be a black sheep (no relation to the swan), a dirty trickster who ultimately finds himself excluded for the sake of the future of the crypto ecosystem.

But do not dream, the long time will be necessary to erase the crisis of confidence that this event has triggered. In turn, the downward trend in the price of cryptocurrencies in place since the fall of 2021 is developing further, making fewer and fewer mining farms profitable.

It is therefore becoming urgent to stabilize the total market capitalization of cryptos, in order to be able to start an upward trend in 2023, on a sound structural basis.

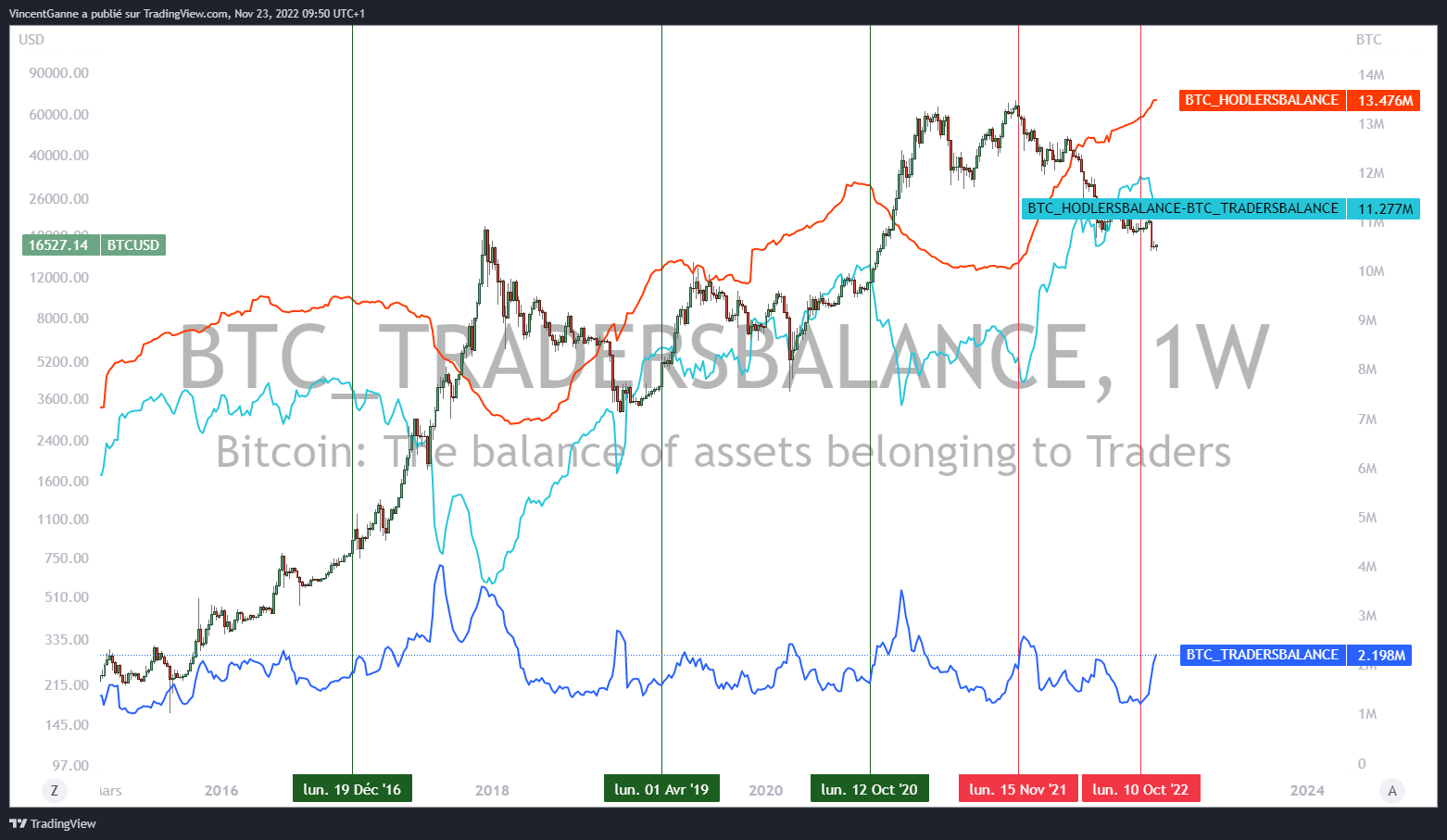

In the meantime, the balance of holders continues its upward slope, confidence vis-à-vis the CEX is not yet making a big comeback.

Figure 1: Chart that juxtaposes the price of Bitcoin with the balances of holders and traders

Figure 1: Chart that juxtaposes the price of Bitcoin with the balances of holders and traders

💡 Do you like Vincent Ganne’s technical analysis? Daily, he carries out exclusive analyzes on the Toaster, our group of experts to help you progress in the cryptocurrency market:

Vincent Ganne analyzes the crypto markets every day on our Premium group

On a technical level, volume and participation data are the key to evaluating a possible buying remobilization

In order to measure the evolution of the general confidence towards cryptos, volume, engagement and participation data are the most relevant within the tools of the technical analysis of the financial markets.

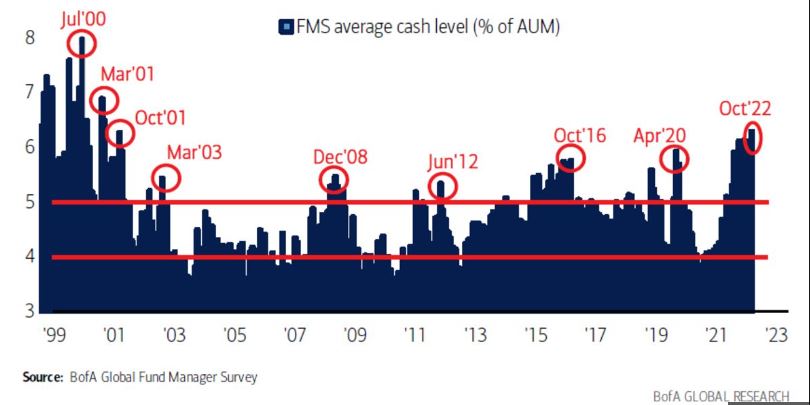

The evolution of deposits and withdrawals at centralized platforms (CEX), the measurement of Open Interest (OI) on crypto futures contracts, Asset under Management (AUM) on crypto ETFs as well as the evolution of the share of liquid assets at institutional managers.

The latest data from these metrics does not yet show a movement back from available liquidity to cryptos, but there is nevertheless a stabilization which shows that the post-bankruptcy haemorrhage of FTX has stopped.

I remain convinced that the available liquidities (their amount among institutional traders is close to its record which followed the bursting of the speculative bubble 2.0 at the beginning of the century) will be partly reinvested in the crypto market as soon as confidence is income, a trust that first and foremost requires accounting transparency and the financial solvency of the key players in the ecosystem.

To conclude on the chartist level, the price of Bitcoin (BTC) must exceed the old lows of last June to resume an upward trend, be the resistance at $19,000/$20,000.

Figure 2: Graph showing the evolution of the share of cash among institutional managers

👉 Find our complete guide to buy Bitcoin (BTC)

The platform that simplifies trading

Buy crypto in minutes

Sources: Figure 1 – TradingView; Figure 2 – Bank of America monthly survey

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.