Bitcoin could become the new global monetary standard, according to Jack Dorsey. During a conference in Italy, the Twitter founder claimed that Bitcoin could one day replace the dollar, emphasizing the importance of decentralization and individual freedoms that BTC offers.

Bitcoin as a monetary standard: this is Jack Dorsey's bias

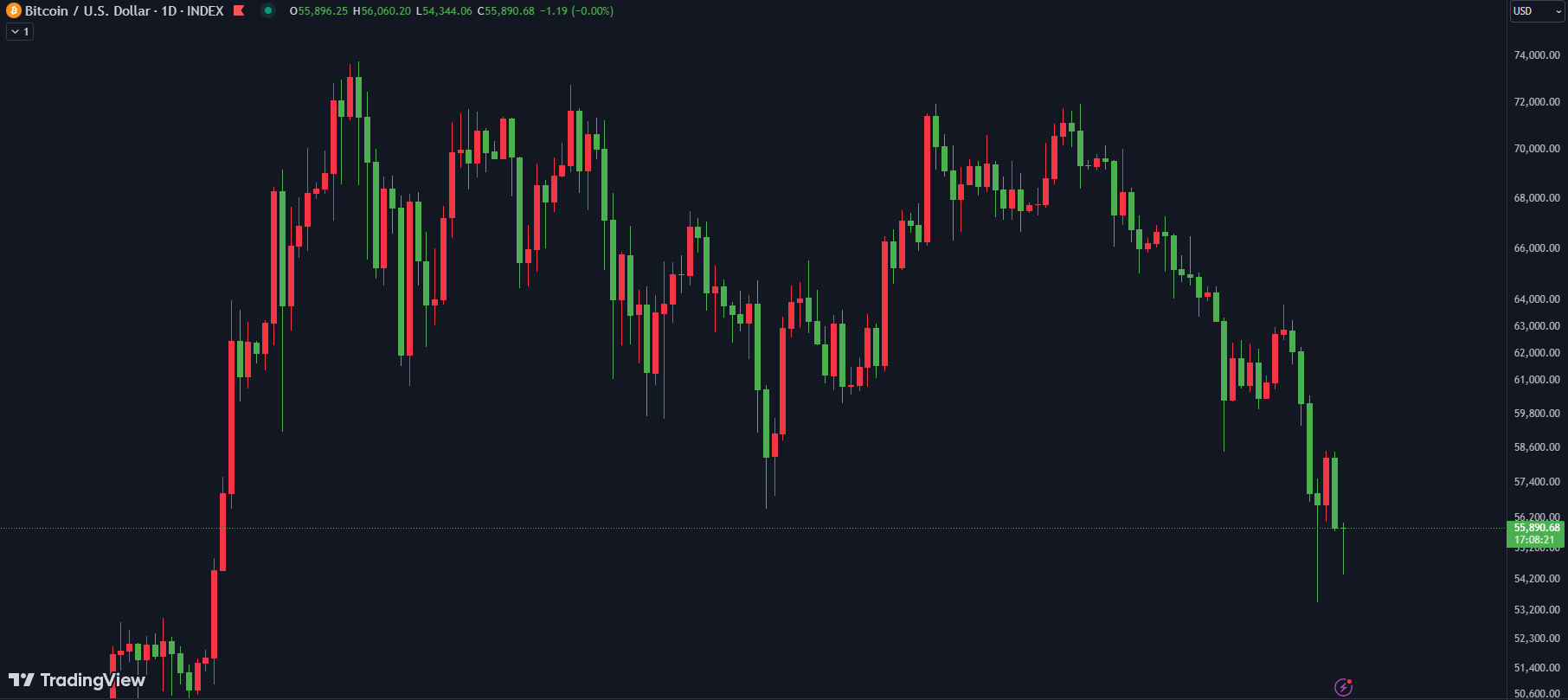

Since March 2024, the price of Bitcoin has fallen by more than 27%, from its all-time high of $73,750 to $53,500, its low reached at the end of last week.

Some analysts predict a continuation of the decline towards new supports, while others believe that the bottom of the correction has been reached and that the summer period, when the world's markets are usually in decline, is about to end.

Bitcoin price against the dollar since March 2024

Despite the short-term negative price action on BTC, some predictions coming from influential members of the Bitcoin ecosystem seem almost too optimistic, even dizzying.

At the “Festival of the Sun” conference in Italy, Jack Dorseythe founder of Twitter and CEO of payments company Block, shared his vision for the future of the economy and said he sees BTC replacing the dollar :

“It will take time, but gradually people will see the value of this system, why it is so powerful and why it could potentially be a complement or replacement for the U.S. dollar, which rules everything and is currently being challenged by the Chinese yuan.”

Regarding the central banks of China and the United States, he said:

“These are two entities that control the value of your money and you don’t elect them, whereas with Bitcoin you have much more control and freedom of action.”

Jack points out that the decline of the dollar's hegemony, questioned by China and other BRICS+ members, opens the door to Bitcoin as a fairer monetary alternative that protects individual freedoms.

Trade Republic: The Easiest Way to Buy Cryptocurrencies

Bitcoin to be capitalized at 20,000 billion dollars in the next 6 years

A few weeks earlier, Jack Dorsey said he expects the price of Bitcoin to reach $1 million by 2030, which would bring its market cap to $20 trillion.

Jack's prediction echoes a similar statement from Cathy Wood, CEO of Ark Invest, the asset manager behind ARKB, the market's fourth-largest spot Bitcoin ETF.

This prediction is very optimistic for Bitcoin, but especially very pessimistic for the global economy. Indeed, the market capitalization of gold is currently $16 trillion, and Seeing BTC exceed this amount would be synonymous with a profound failure of the system and a sharp decrease in the value of the dollar and its use.

In such a scenario, BTC would indeed be a good candidate as a store of value alongside gold, but would represent the end of a certain economic comfort, impacting all levels of society.

Enjoy 20% off Ledger Nano Color (S Plus and X)

Source: Forbes, Festival of the Sun

The #1 Crypto Newsletter

Receive a daily crypto news recap by email

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.