Whether it's a passing curiosity or a harbinger of a trend in risky assets, Bitcoin and the crypto market are giving way on supports marking major bearish breaks. Few tokens in the ecosystem have not shifted into medium-term bearish trends following a 1st week of July marked by a purge. Let's take stock of the technical state of BTC!

It is Monday, July 8, 2024, and the price of Bitcoin (BTC) is hovering around $57,000.

Last week was nevertheless well underway, a rebound on support oriented the market towards a retest of the highs. However, in a perfect decorrelation with risky markets, The rebound quickly subsided, generating enough inertia for a break of the supports.

Following this break, Many holders who were already losing money since the break of $65,000 saw their stops triggered, or where appropriate, panic-sold their tokens. driving price action close to the demand zone between $50,000 and $53,000, largely filling the skinny leg, one-sided trading zone left behind.

As mentioned above, this impulsive downward movement in a macroeconomic context tending more and more towards a pivot in the FED's key rates raises many questions:

Are we experiencing the ultimate bearish trap? On the contrary, would cryptos enter a medium-term bearish phase?

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

A summer consolidation?

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin / USDT | +0.40% | -7.90% | -16.50% |

| ETH / Bitcoin | +1.50% | -4.20% | -0.30% |

On this Monday morning, uncertainty hovers, between bearish excess, the start of a marked downward trend or opportunities, everyone chooses their side. However, What predominates on the networks is a very negative feeling. This feeling is often suitable for building low points especially with momentum indicators like the RSI close to historical levels.

In the life of Bitcoin, following this kind of excess, the price action pauses to digest and build a structure. This movement of -25% from the top of the range is not exceptional in a bull market phase.

However, This correction brings into play medium-term dynamic trends and supports, leaving room for a large number of scenarios. We are likely to see some consolidation in the next 60-90 days, which could give price action time to develop. As it stands, it is very complex to favor one scenario over another.

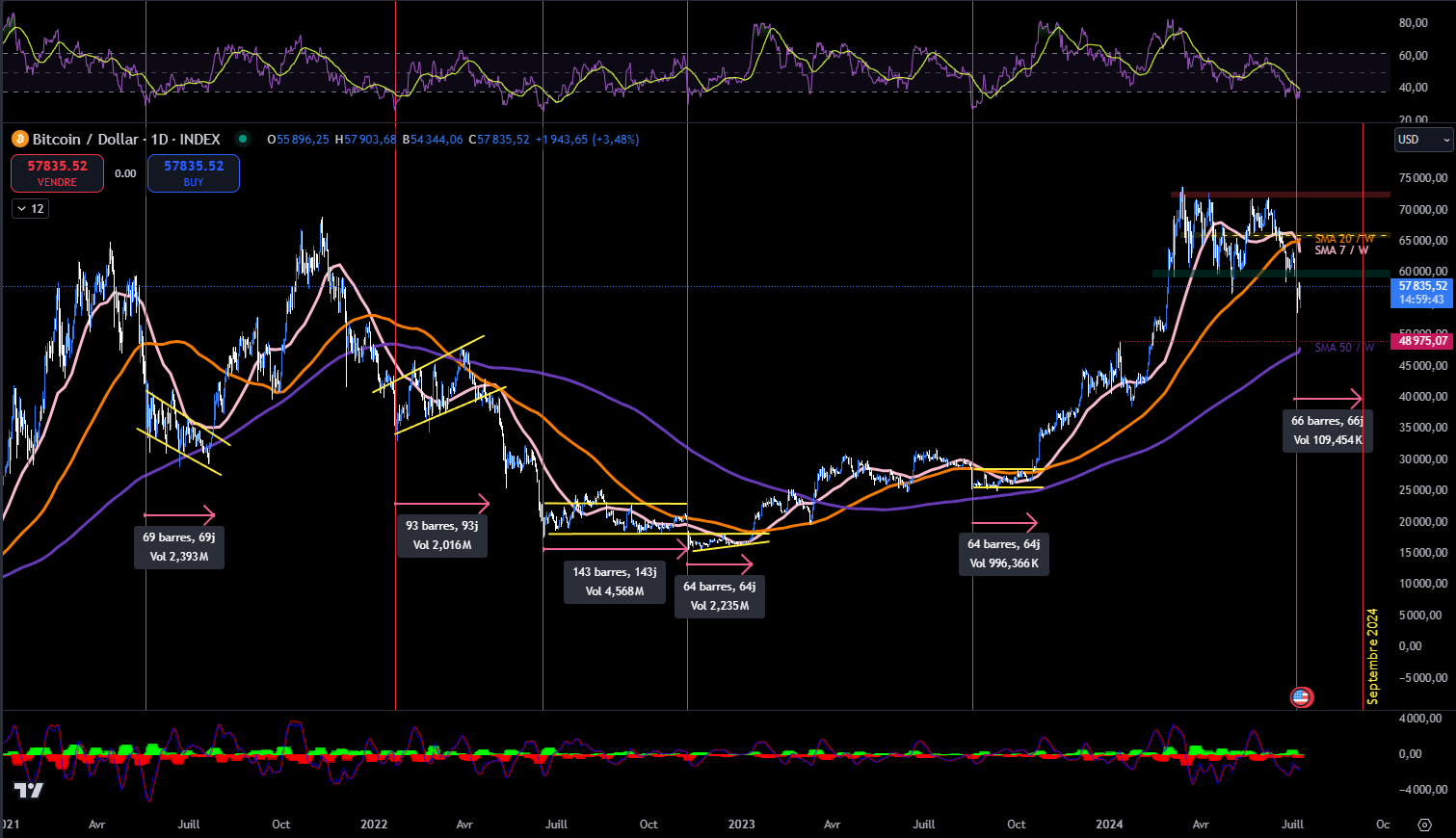

Below, you will find represented in red vertical line the RSI zones equivalent to or slightly lower than the current daily RSI zone (21 periods). Plotted in yellow, the figures which follow are spread over the period mentioned above.

History of daily corrections on BTC with an RSI 21 in excess.

Buy crypto on eToro

BTC, reintegration objective?

While the most likely scenario for Bitcoin is a multi-week consolidation, This could aim at a rapid reintegration of the range and thus show all its strength taking a pessimistic crypto market from behind in ensuring a continuation of the bull market in denial.

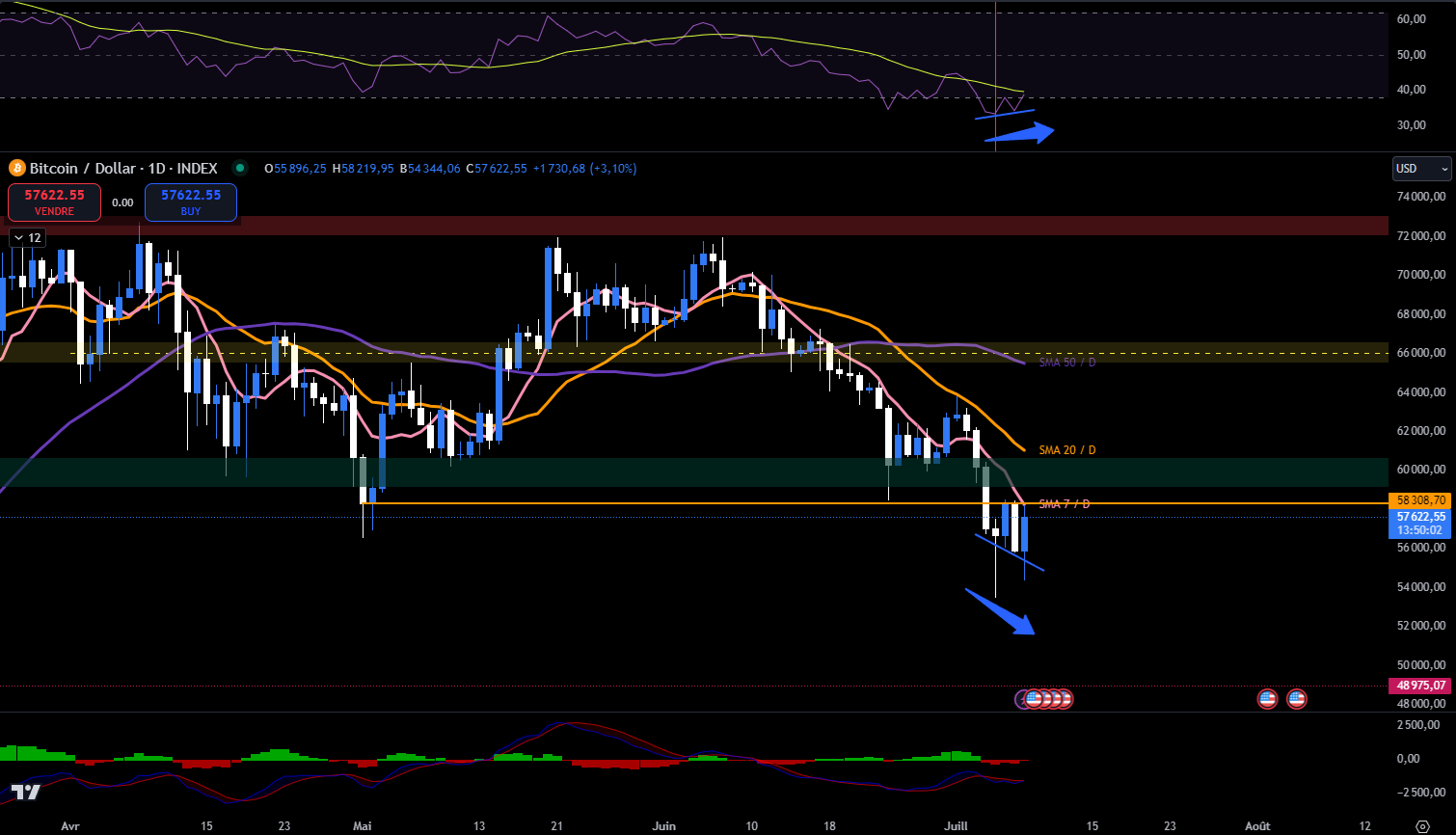

To signal a slowdown in the daily downtrend with a view to stabilization, it will be necessary to cross the 7-day moving average in confluence with the close of May 1 and the low of June 24. This is an important pivot that will have to be reconquered before considering any reintegration above $60,000.

This reconquest would also mark the validation of a bullish divergence.. Finally, if this movement were to materialize in the next 2 days, it would also mark a return of the RSI beyond the bearish acceleration zone.

Bitcoin price chart daily

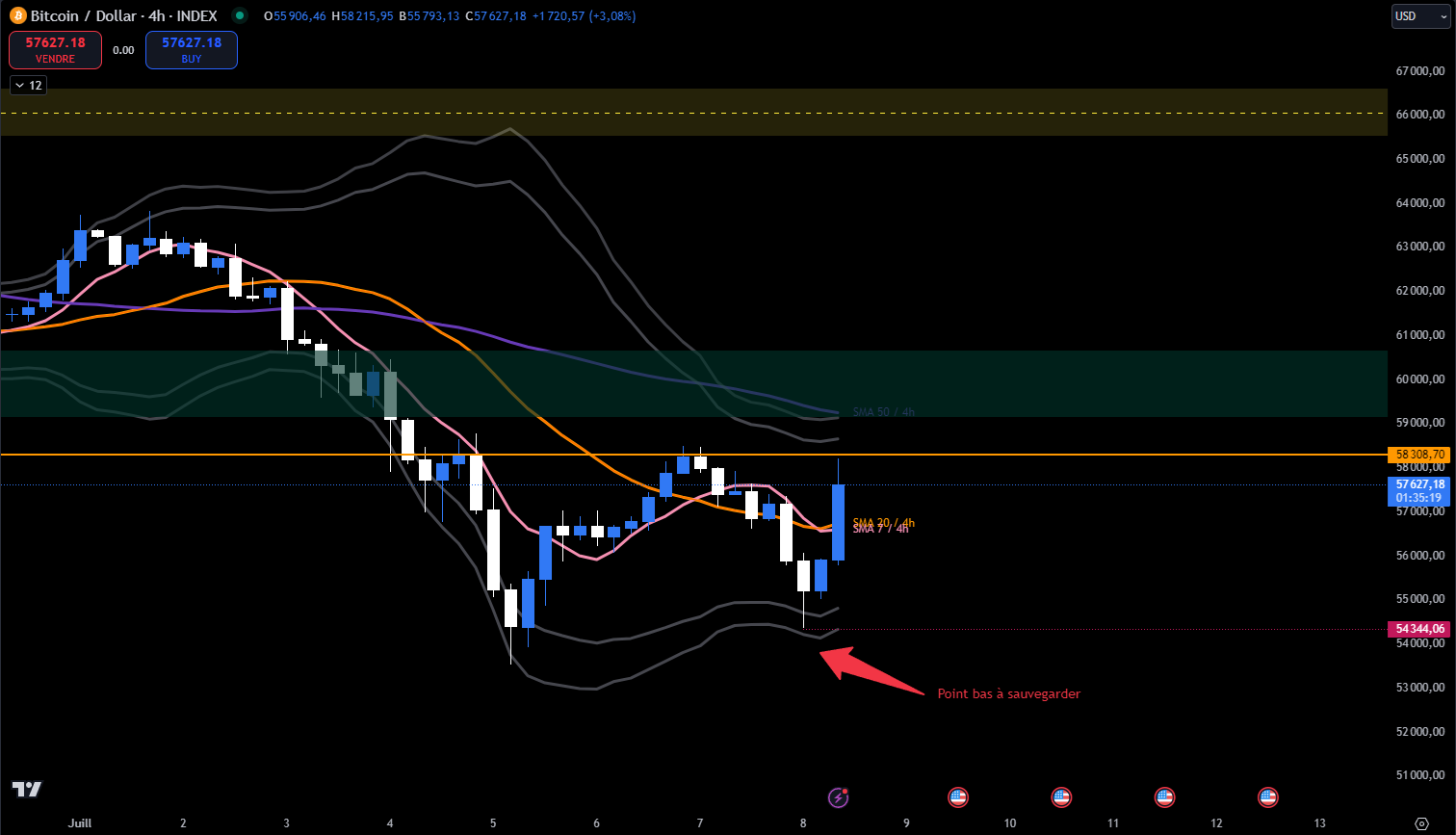

In shorter time units (4 hours), Bitcoin marks a higher low than the previous one, indicating the presence of buyers. Price action manages to break above the 7 and 20 moving averages in a candlestick that has not yet closed at the time of writing.

However, we can observe closed Bollinger Bands and a bearish 50 moving average aligned with the upper BB. This is a major resistance that should block BTC's path in the short term.

Bitcoin will need to find the strength to break through the $58,300-$59,300 zone to reclaim its range. The challenge of this reconquest is a return to the $65,000 to $66,000 zone initially.

For the bearish camp, it is the low point of this morning's 4 hour candle that must be broken in search of a bearish continuation!

Bitcoin Price Chart Weekly

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

In summaryBitcoin is in a complex situation. The underlying trend remains bullish, but the short and medium term trends have reversed, favoring work in the direction of this trend: downwards.. So the high points are more likely to be sold as the resistances act by pushing back the prices. The bearish target is a revisit below $50,000.

However, we observe signs of calm in short UTs and potential divergences in daily time. The objective for the bullish camp is a reintegration of the range in order to target the opposite limit in a movement which will only return to the medium-term trend when the ATH is crossed!

So, do you think BTC can revisit the top of the range? Please feel free to give us your opinion in the comments.

Have a great day and we'll see you next week for another Bitcoin analysis.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter

Receive a daily crypto news recap by email

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.