While the FED has begun a new cycle of monetary easing and the Chinese authorities have initiated an impressive package of support measures for their economy and their stock market, Bitcoin will soon enter a period where it develops its best performance statistics.

The FED and China in support of risky assets on the stock market

Western central banks, notably the FED and the ECB, have initiated a downward cycle in their interest rates, a factor of bullish support for risky assets on the stock market, including cryptos.

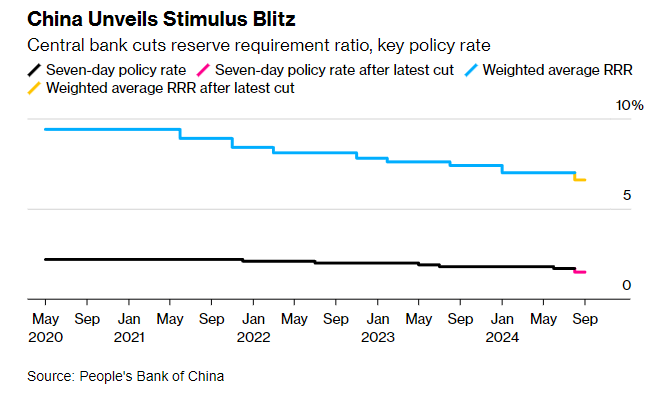

What is interesting is now the alignment of Western and Chinese monetary policies in an accommodating trajectory, a cycle of “ monetary easing “. Add to this the announcements this week from the Chinese authorities of massive support measures for the Chinese economy and the Chinese stock market.

Even if the risks are not lacking (the probability of an economic recession in the USA and the risks of geopolitical conflagration), the fundamentals of traditional finance are therefore increasingly favorable to the upward trend in the price of Bitcoin.

The S&P500 stock index, the benchmark index for Western finance, sets new historical records and the Chinese stock market (stock markets of Hong Kong, Shanghai, Shenzhen, Beijing) is giving powerful technical signals of a bullish reversal this week.

Among the measures announced by China, we must notably retain strong support for the stock market with an injection of liquidity into the stock markets, including a potential stabilization fund and measures encouraging companies to buy back their shares.

The upcoming upward cycle will not be linear like the previous cycle which was based on the zero rates of the health crisis. The fundamental difficulties remain very numerous, but the alignment of Western and Chinese monetary policies should be a sufficient combined factor to reach the 100,000 dollars, my technical target which would offer a good Christmas present this year.

The Central Bank of China continues to deploy an increasingly accommodative monetary policy to support its economy and its stock market

🎥 Also find the technical analysis of Vincent Ganne in video 👇

Bitpanda: receive €50 bonus in BTC by creating an account

👉 Our ranking of the best sites to buy Bitcoin

Bitcoin, the goal of 100,000 dollars can be your Christmas present

Patience, patience, patience! This is what I write every week in the Cryptoast columns and I repeat it to you again today. Only the strategy of “ buy and hold » allows you to make 3-digit % gains on a bullish cycle so you must hold your positions.

📈 You want to have Vincent Ganne's trading opinion on Bitcoin every morning as well as his best configurations on altcoins, then join the professional Cryptoast Research service! Satisfied or refunded for 15 days, so don't hesitate!

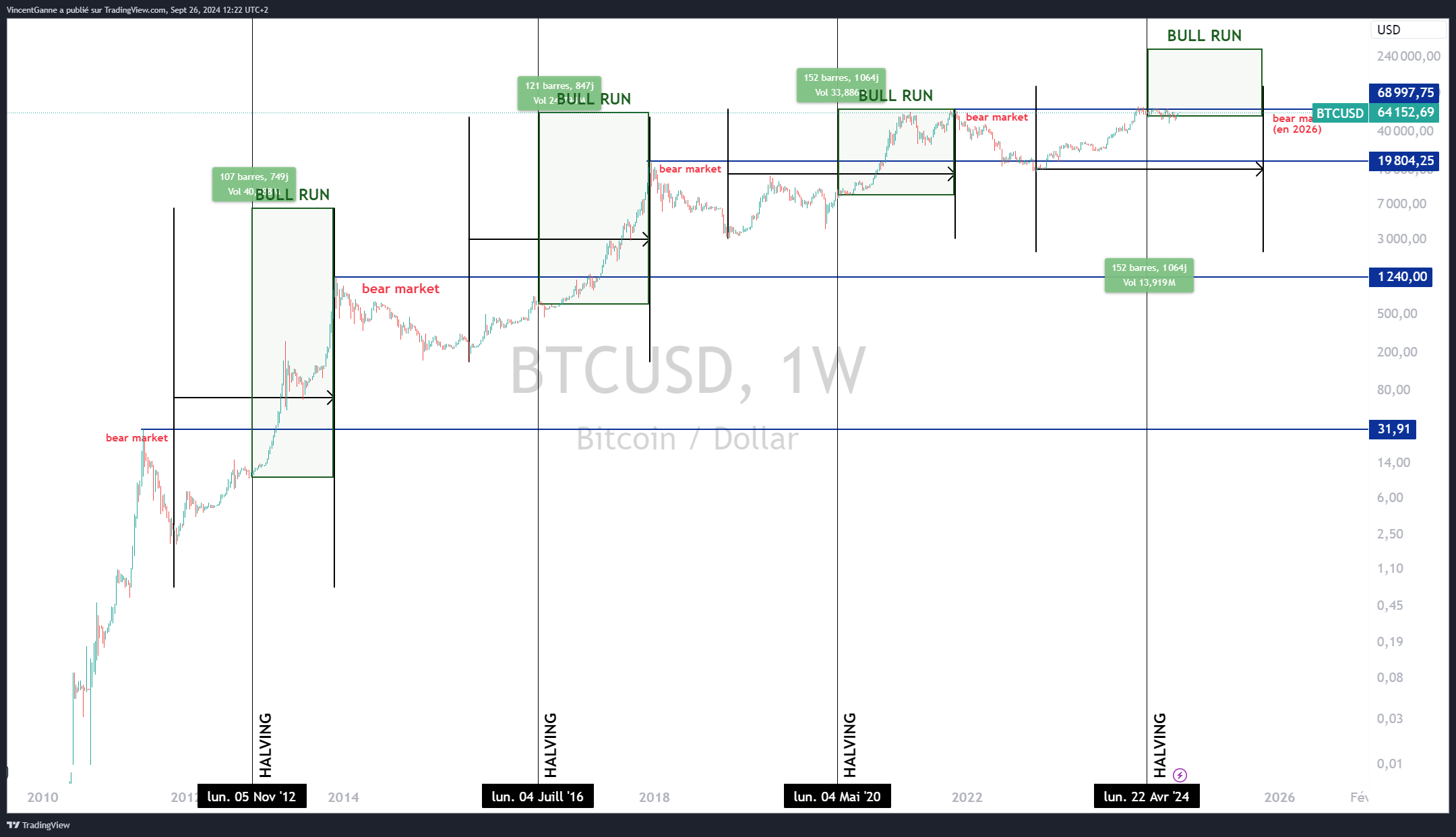

I think the technical target of $100,000 can be made by December 24, 2024 and I am publishing below a long-term graph which recalls the alternation of Bitcoin's bullish and bearish cycles in temporal connection with the four-year halving.

Graph which shows the alternation of halving, bull run and bear market phases of BTC since 2010

Graph which shows the alternation of halving, bull run and bear market phases of BTC since 2010

Would you like to have Vincent Ganne's trading opinion on Bitcoin every morning as well as his best configurations on altcoins?

Then join the Cryptoast Academy professional service! You will learn how to position yourself on strategic price levels, spot investment opportunities and anticipate price movements. Join this premium community now and take charge of your crypto investments. Satisfied or refunded for 14 days so don't hesitate any longer!

Bitpanda: receive €50 bonus in BTC by creating an account

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.