The bullrun is on! Bitcoin is developing a new bullish leg as a continuation of the underlying trend. The goal is targeted: $100,000 and more. Can we achieve this without making a correction?

The long-awaited bull run is underway!

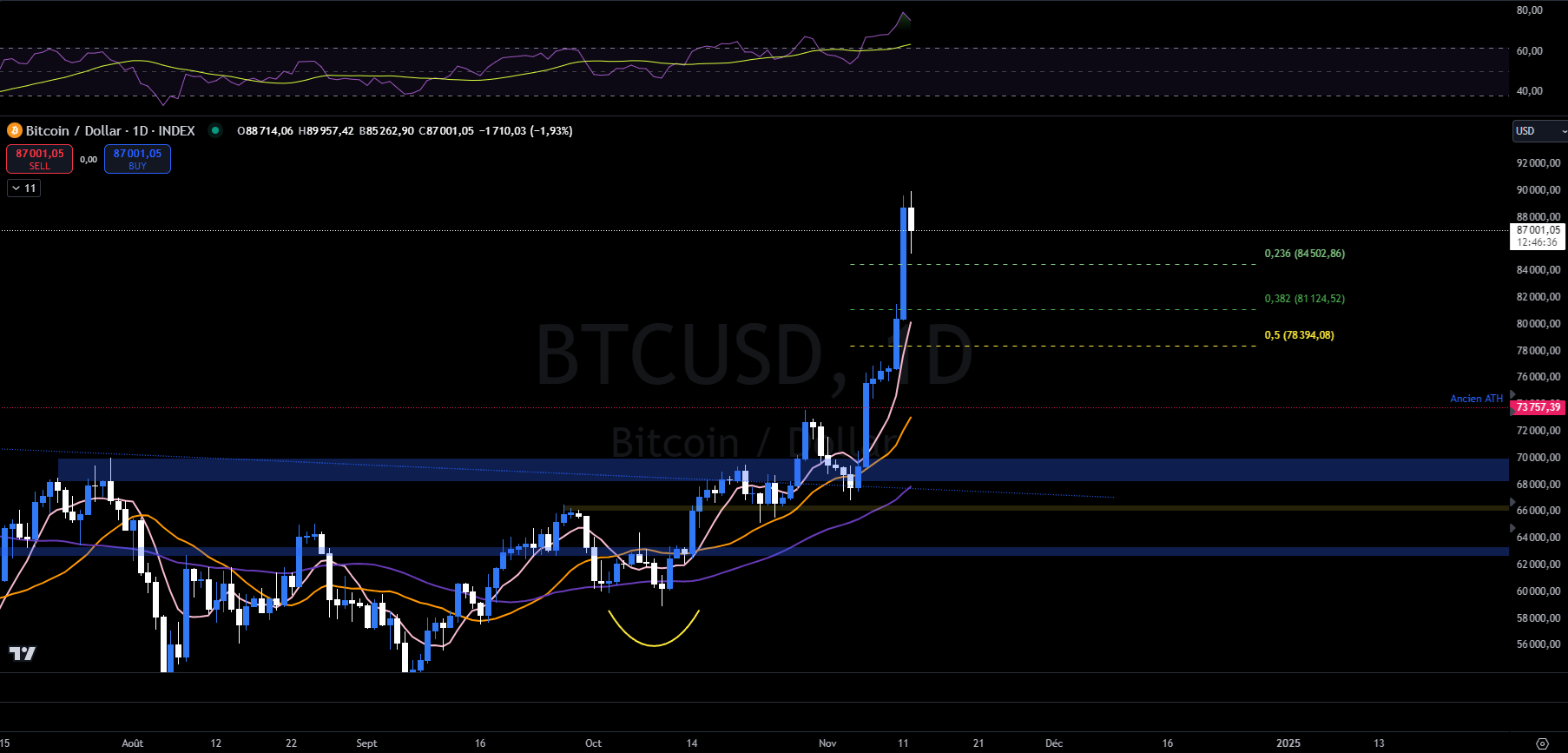

It is Tuesday, November 12, 2024 and the price of Bitcoin is moving around $87,000.

It is relatively complex to find a definition on which everyone agrees to define the bull run. Some will say that it begins at the end of the bear market, others when crossing the previous ATH of the cycle, or even when the feeling remains in euphoria for several weeks.

For others, it is simply an uptrend alignment of all time units. If this is the case, we are in a bull run, and this trend could persist for several weeks.

A bull run is nevertheless not without corrections: market turmoil and sentiment cause very impulsive movements, both bullish and bearish; the fear of missing the train or panic are phenomena that come together frantically.

6 days ago, when we last analyzed, Bitcoin was at $74,000. Since then, price action has rallied 20%, a positive shift of $15,000. In this context of price discovery, psychological levels are more important than ever. The biggest level above our heads is $100,000!

The euphoria is very present, at a level that we have not seen in a long time. Can we see this as a signal of an upcoming correction or a boom in the markets?

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin/USDT | +5.90% | +26.00% | +38.60% |

| ETH/Bitcoin | -3.00% | +7.00% | -3.40% |

📈 Surf the bull run by surrounding yourself with experts! Join us now at Cryptoast Academy

Cryptoast Academy: 75% off before Black Friday to celebrate the bullrun

Cleaning shorts, long ones dominate

Long positions on derivatives markets seem to have taken over short positions during the night from Monday to Tuesday. The latter have been regularly liquidated since crossing $75,000, showing a desire by speculators to find the high point in a psychological state of denial.

From now on, the psychological switch seems well and truly underway with greater confidence in a bullish scenario, which could soon encourage the triggering of a deep correction. Looking back at previous cycles, the first corrections in the euphoria phase led to retracements of around 10%. Later, we were able to reach 30% correction before rebounding to make new highs.

In previous bullruns, phases of euphoria like the one we are currently experiencing could last for 2 to 3 days before correcting.

Evolution of Bitcoin derivative markets in 4 hours

Buy cryptos on eToro

Bitcoin: in price shortfall, psychological levels are essential

BTC has just completed an unprecedented bullish rally following the election of Donald Trump. In price discovery now, with a daily succession of historical records, psychological levels gain importance where technical analysis becomes less effective. We are therefore at the gates of $90,000, the last major level before the $100,000 that the ecosystem has been targeting since 2021.

👉 Find out how to easily buy Bitcoin

At a time when the next move could be corrective, due to our proximity to the last bastion of a psychological level that some believe can never be reached, the question we can ask is what support BTC could seek if it were to take a break.

Building on Fibonacci retracements and with the idea of a short and quick bullish revival, the 0.236 retracement ($85,000) could mark a working zone above which prices could consolidate before crossing the $90,000.

Deeper, 0.382 at $81,000 is also an ideal rebound zone for Bitcoin before resuming its upward momentum in search of new all-time highs.

Finally, with the idea of maintaining positive polarity, the 50% retracement of the entire increase since the start of the impulse allows us to identify $78,000 as the area to maintain at the weekly close.

Daily Bitcoin price graph

👉 Would you like to discover more technical analyzes on Bitcoin or altcoins? Join our premium Cryptoast Academy group where we share altcoin analysis charts every week!

Cryptoast Academy: 75% off before Black Friday to celebrate the bullrun

In summaryBitcoin has embarked on a very powerful bullish rally. Observers see the level of $100,000 approaching very quickly, which raises many questions. The price of BTC is now facing the last bastion in this race which is taking root in the 2021 bullrun. With derivatives markets accelerating on long positions, might it not soon be time for a correction?

So, do you think BTC can cross $100,000 before the end of 2024? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new analysis of Bitcoin.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.