Although attention to the crypto ecosystem is still widely carried on Bitcoin (BTC), a survey by a subsidiary of S&P Global suggests that altcoins would also have their say in asset managers. What to remember from this investigation?

Towards an expansion of altcoins at the institutional level?

If Bitcoin (BTC) leads the dance during this Bull Market for the moment, some altcoins are not to be outdone, too, like Solana (Sol), XRP, or SU, to cite some examples. In this context, Crisil Coallition Greenwich, a subsidiary of S&P Global, conducted a survey of 19 asset managersin order to better understand their position in terms of crypto investment.

From this survey, it appears that 40 % of them would be particularly enthusiastic about Altcoins:

40 % of asset managers want to trade 10 altcoins or more, thus expanding the range of assets requiring support.

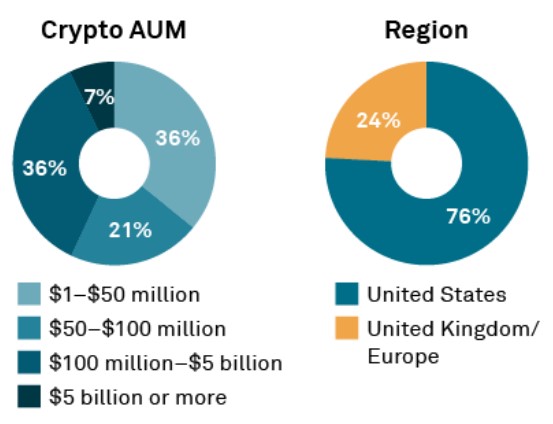

Among the population studied, 14 of the respondents are already involved in the investment in digital active ingredients, while the remaining 5 study the question. In addition, 43 % of participants have more than $ 100 million in crypto-active in management, 7 % of which manage amounts greater than $ 7 billion.

💡 What cryptos in 2025 on?

On the geographic distribution side, it is the United States which is mainly represented, and this, up to 76 %:

Financial profiles of asset managers and their distribution

Buy cryptos on etoro

Although the term “altcoin” can include almost all cryptocurrencies, the actors interviewed would rather focus on the leaders of their sector:

Yes, the same tokens are fun and interesting, and companies want to exchange them. But investors focus more on level 1 such as Bitcoin, Ethereum and Solana, Altcoins like Avalanche and Chainlink, as well as DEKENS DEFI and a growing range of Stablecoins […].

If this investigation seems particularly positive for altcoinshowever, we can see that it quickly reaches these limits. Indeed, only the data of 19 respondents were operated on 50 interviews carried out between September and October last.

On the one hand, it seems a little light to estimate real trend, while the atmosphere within the crypto ecosystem has changed strongly since this fall. In addition, the report really has only 2 pages of statistics.

👉 In the news also – End of cycle for the same? Humorous cryptocurrencies in clear fall over the week

More broadly, it is also a question of taking a little height as to the fact that if an asset manager opens with more altcoins, it is essentially to meet a demand. Admittedly, said request can contribute to an increase in prices, but the fund generating income on rising or downward costs, this is not necessarily characteristic of a bias bias on the part of the active manager in question.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Source: Crisil

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital