In March, Bybit toppled Coinbase, becoming the second largest centralized cryptocurrency exchange (CEX) in the world after Binance. What are the reasons explaining the emergence of Bybit in this market sector?

Bybit and Binance: the happiness of some makes the misfortune of others

The introduction of spot Bitcoin ETFs in the United States has caused a surge in cryptocurrency trading volumes across the world. However, not all exchanges have benefited equally from this development.

In any case, Bybit stood out by overtaking Coinbase in March, becoming the second largest centralized cryptocurrency exchange (CEX) after Binance.

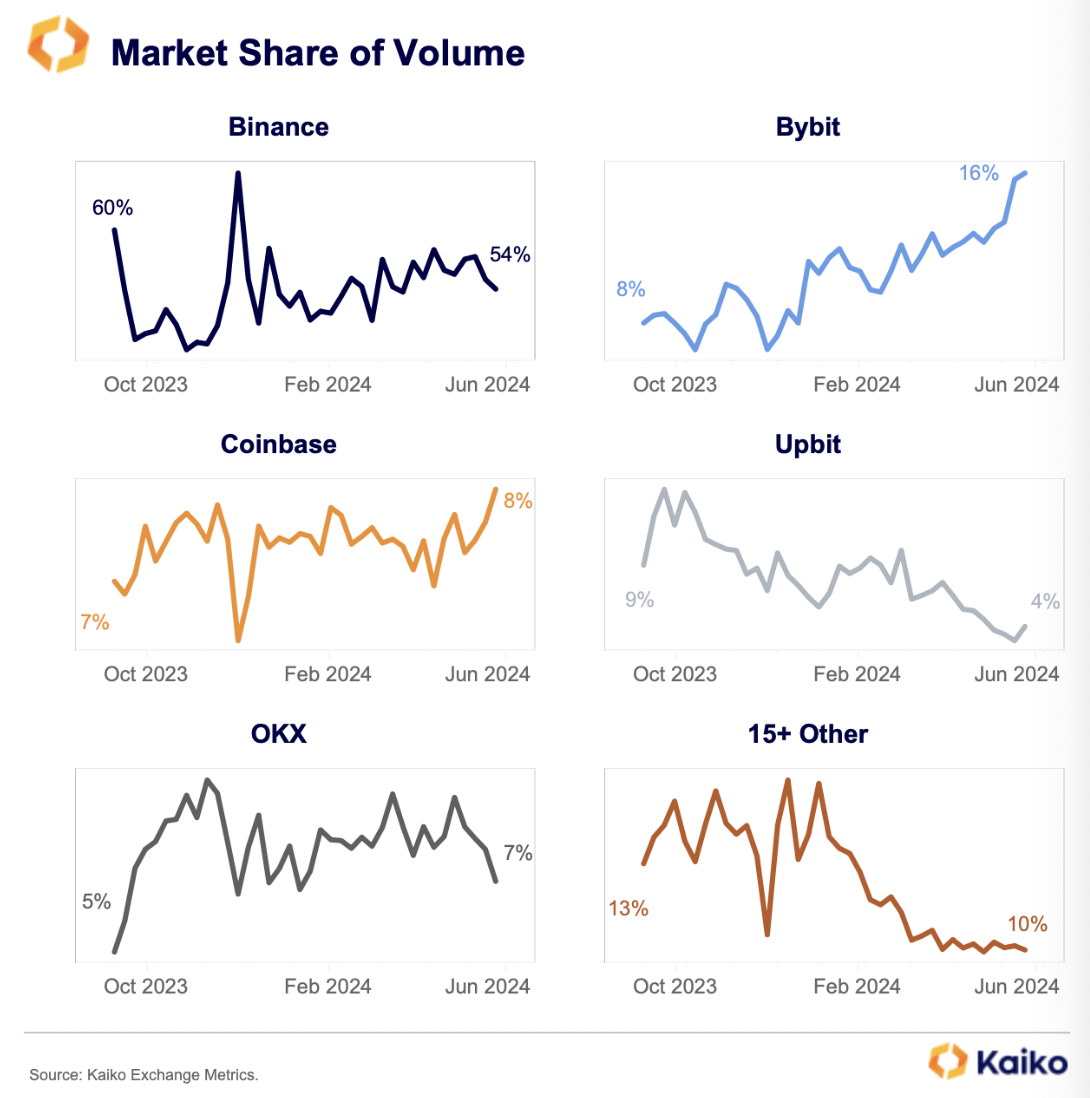

Since October, Bybit's market share increased from 8% to 16%, while Coinbase's market share increased by only 1% over the same period. Even more surprising, despite a reassuring agreement concluded by Binance with the SEC at the end of 2023, the latter declined, thus losing 6 points of market share.

This seems to indicate that the number 1 exchange has lost significant capital of trust in its setbacks with the American regulatory authorities.

👉 Find ourTop 5 best platforms for buying cryptocurrencies in 2024

Figure 1 – Evolution of market shares of the main cryptocurrency exchanges

€20 offered when you register on Bitvavo

An attractive strategic position and competitive advantages

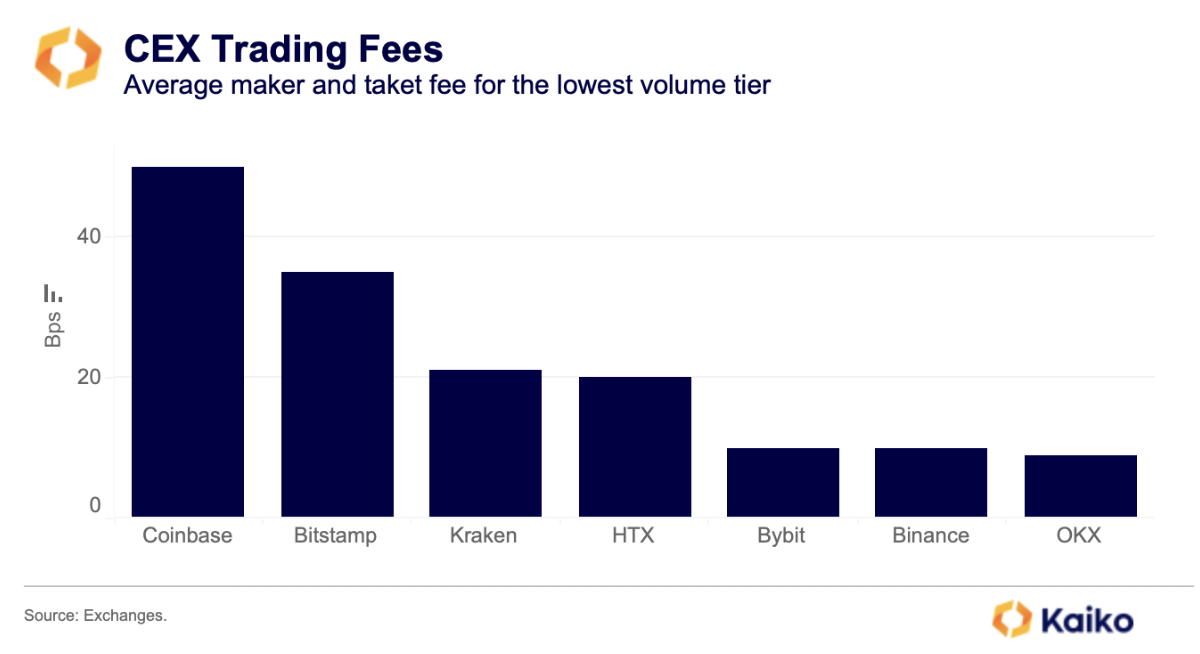

Kaiko explains this trend by Bybit's competitive fees, which are among the lowest in the industry. However, this statement needs to be qualified since other exchanges like Binance and OKX also offer attractive fees and implement reward or promotion policies on fees.

Bybit's competitive advantage is therefore not only based on its attractive fees.

Bybit launched zero fees for USDC trading in February 2023, while Binance has been promoting TUSD and FDUSD over the past year

.

👉In the news – Binance unveils its “HODLer Airdrops” program to support its ecosystem

Figure 2 – Top CEX Trading Fees

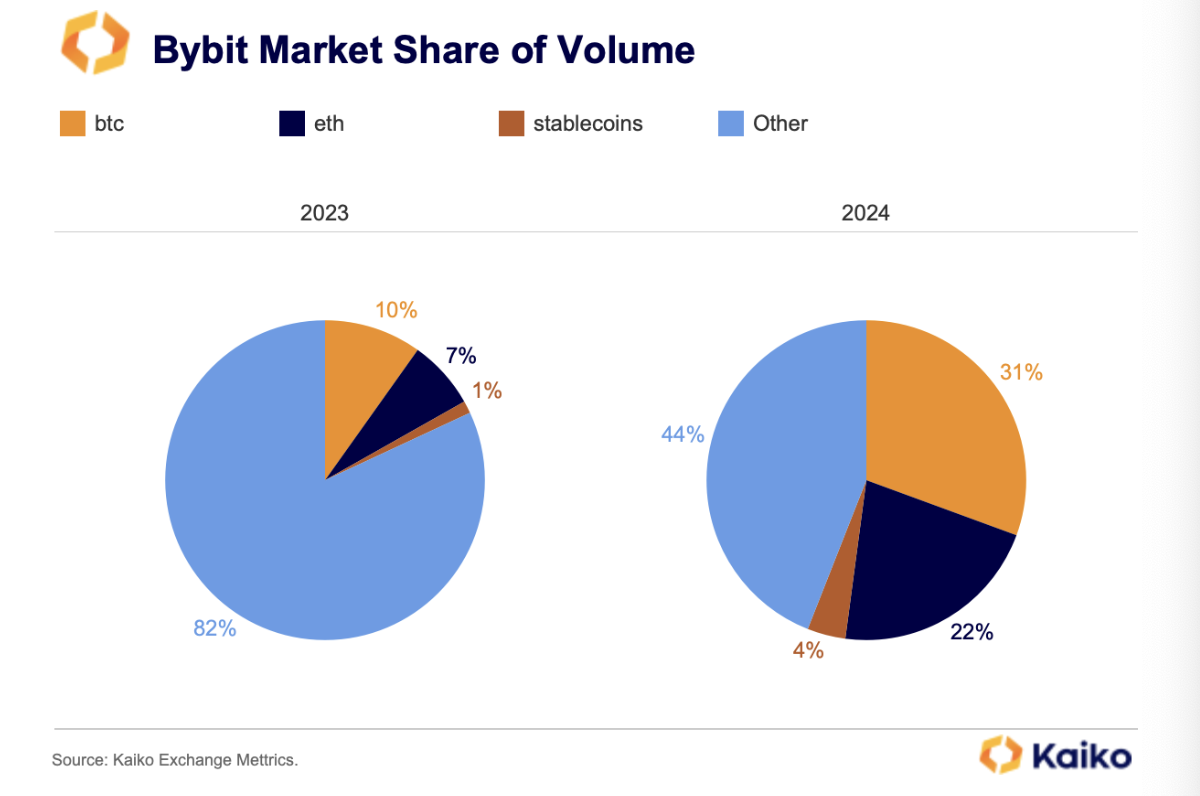

With the analysis of spot trading volumes by asset, it becomes evident that Bybit was driven up mainly by 2 cryptocurrencies: Bitcoin and Ethereum. Indeed, unlike Binance which has seen a volume decrease of 16% since last year, Bybit's market share has exploded by 36% since 2023 on the 2 major cryptos.

Figure 3 – Evolution of Bybit's market shares from 2023 to 2024 on the main cryptocurrencies

This trend is rather good news for the second in title, since altcoins are often more sensitive to market sentiment and therefore more likely to decline during bear markets, according to Kaiko. Bybit also strengthens its second place in the derivatives market, supporting strong and constant growth.

Download Bitstack and earn €5 in Bitcoin with code CRYPTOAST5*

* After activating a savings plan and accumulating at least €100 in BTC purchases

What you need to know about affiliate links. This page may feature assets, products or services relating to investments. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.