Inflation disappoints, the traditional markets sink, and on April 2 approach, carrying possible adjustments to American customs tariffs. Everything suggests that risk markets are preparing to capitulate, Bitcoin on the front line. What if, against all odds, things were going well? How would Bitcoin do?

Inflation disappoints, the concerns of the Fed is confirmed

We are Tuesday April 1, 2025, and the price of Bitcoin closes the week at 82,404 dollars, down 2.38 %. However, this withdrawal does not reflect the intensity of the powerful rejection observed from the 88,000 dollars support area, which we had identified last week as an polarity zone.

This movement was partly catalyzed by the publication, Friday, of the figure of inflation PCE, deemed disappointing. Indeed, superior to expectations, this data corroborates the concerns of the American federal reserve, which had a few days earlier revised its macroeconomic projections: slowdown in growth, increase in inflation and unemployment rate.

The new perspectives established by the Fed draw a worrying scenario for the United States, where inflation persists in an economic context in deterioration. Ultimately, this could lead the country to a recession, or even to a stagflation phase.

In the event of a recession, the Fed still has tools to relaunch the economy. On the other hand, a stagflation scenario would be much more difficult to manage.

The economic policy led by President Trump proves to be in this particularly penalizing context for the markets, which could now favor a pessimistic scenario, thus breaking with optimistic bias that has been predominated since early 2023.

Trade cryptos on binance, exchange n ° 1 in the world

On the derivative market side, financing costs regularly pass into negative territory, a sign that the lower bias has progressed sufficiently to restore a certain balance between buyers and sellers.

However, the current configuration is similar to a range phase, with a reactive open open around a major pivot observed over the past year.

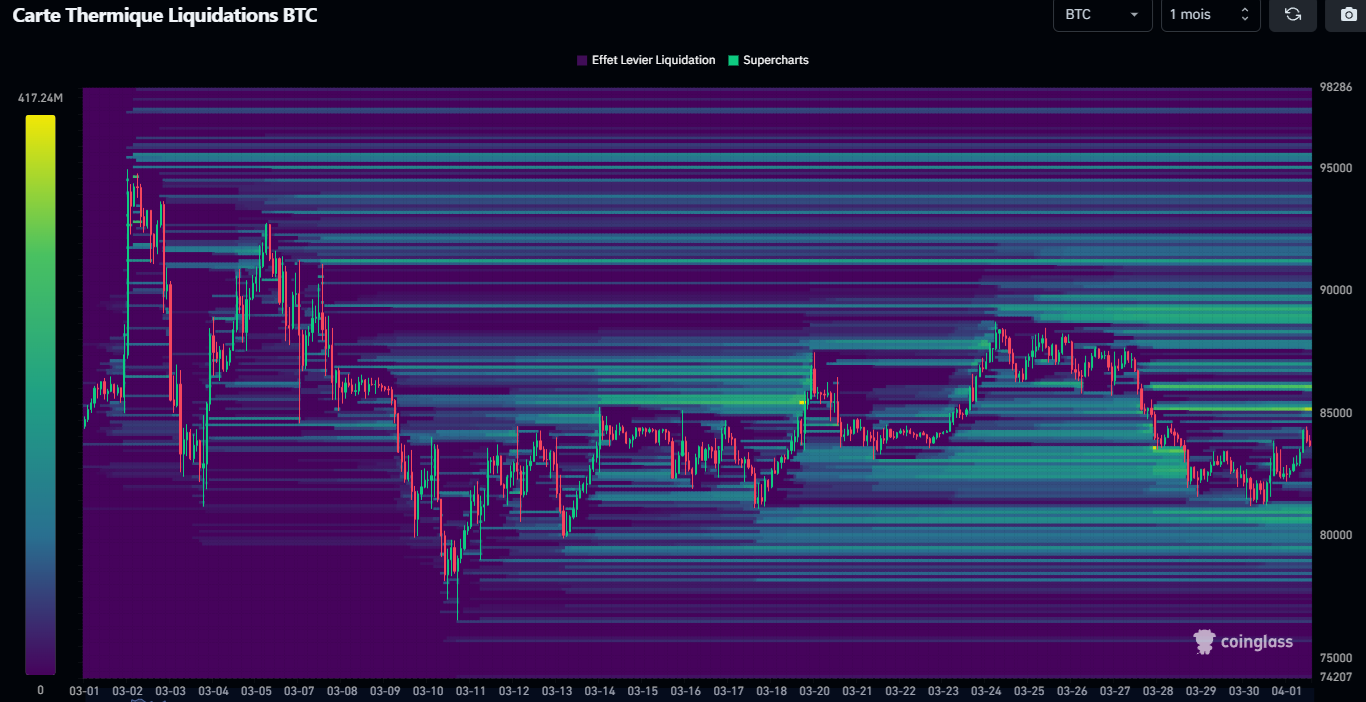

The liquidity pockets remain generally unchanged, with an area to explore under prices up to $ 78,000. Unsurprisingly, the last summit reaches $ 88,000 is the main area of attraction in the north in the event of hunting hitchhiking.

Bitcoin liquidity graphics in the last month

In terms of capitalization, Bitcoin remains, without surprise, the undisputed leader of the crypto ecosystem, retaining first place in the classification with a capitalization of $ 1,660 billion, a drop of 47 billion since our last analysis.

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin / USDT | +1.10 % | -4.20 % | -2.60 % |

| Eth / bitcoin | +0.60 % | -6.00 % | -14.40 % |

📈 Surf the Bull Run by surrounding you with experts! Join us now on Cryptoast Academy

Transform crypto crashes into opportunities 🚀 Receive 7 exclusive tips to succeed where 90% fail!

Bitcoin, in the between two

Now solidly installed below the threshold of $ 90,000, the BTC is evolving in a downward trend on the weekly scale. An unreasing configuration, reinforced by poorly encouraging quarterly and monthly fences: the first is in negative polarity, the second is positioned under the previous fence.

The most worrying element remains the loss of the mobile average at 7 months, paving the way for a return scenario to the mobile average at 20 months, now located around $ 65,000. However, the monthly trend remains upwards, with a last hollow observed around 49,200 dollars, and a summit scored at $ 109,000.

The polarity of the last monthly bullish movement is at 79,200 dollars, a key technical level that Bitcoin will imperatively have to preserve during the next monthly fences to keep a return to its ATH. The asset thus evolves in an area of uncertainty, halfway between correction and consolidation.

Trade crypto volatility decentralized with Dydx

Bitcoin is currently evolving between a mobile average at 20 weeks, the slope of which is now down (94,000 dollars), and a mobile average at 50 weeks ($ 76,000), still ascending, which constitutes a solid technical support. The latter is reinforced by the lower band of the Bollinger.

It is precisely this area that the asset seems to want to work, with a view to lateral consolidation. This is the scenario that we have favored for several weeks: a phase of lateralization under the old Range 2025, the latter having today become a significant supply zone.

Even if a temporary deviation under the mobile average at 50 weeks, in the direction of the request zone represented by the 2024 range, remains possible, a weekly fence below could lead to validating all the lower signals and triggering the objectives that we have already mentioned.

Long or shorts over 100 cryptos with hyperliquid

In a daily time unit, the rejection operated since the $ 88,000 is clear. Bitcoin is struggling to question the downward dynamics started from $ 100,000. If he tries, when these lines are written, to rekindle the rebound movement, the double fence under the 82,700 dollars suggests that a deeper retirement could impose itself before any attempt to resume up bullish.

In this context, the views of the market could naturally turn to the $ 79,000 area, corresponding to the 0.786 retrace from the last Haussier movement – an interesting technical confluence with the polarity of the previous monthly movement.

Graphic of the Bitcoin Daily course

👉 Do you want to discover more technical analyzes on Bitcoin or on Altcoins?

Join our Premium Cryptoast Academy group in which we share altcoin analysis graphics every week!

In summary, Although the current monthly trend continues to support the hypothesis of an upward resumption in the medium term, the realization of this scenario will depend on the capacity of Bitcoin to rebuild an upward structure on the unity of weekly time – a slow process, requiring time and patience. In the shorter term, a withdrawal to the $ 79,000 zone seems to be logically part of the current price evolution.

So, do you think the BTC can reintegrate its $ 91,000 range? Do not hesitate to give us your opinion in the comments.

Have a nice day and we meet next week for a new Bitcoin analysis.

Trade cryptos on binance, exchange n ° 1 in the world

Sources: tradingview, quince, glassnod

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital