This Monday morning should be placed under the sign of consolidation for Bitcoin. The US open should be monitored to seek to glean information on upcoming developments in price action. Can we restart upwards now or does BTC require a correction before regaining upward momentum?

Is consolidation continuing on Bitcoin?

It is Monday, December 9, 2024 and the price of Bitcoin is moving around $98,000.

Last Thursday's flash crash drastically cleaned up long positions on derivatives markets. Since that day, we have seen a timid recovery from speculators, who seem stunned by the movement in a context where Bitcoin has been sliding around $100,000 for 2 weeks.

With Bitcoin remaining in a strong uptrend, short positions do not appear to be manifesting in an exaggerated manner, indicating that the psychological bias in the market remains very positive overall.

Trade crypto on Binance, the #1 exchange in the world

As often, the opening of the market in the United States will probably be the conductor of this day which begins in the consolidation for the crypto market. The major event of this week on the macro side is due to inflation since on Wednesday December 11 at 2:30 p.m. the CPI figures for the month of November will be published which are expected to be equivalent to the previous month.

The market has taken into account the resilience of inflation but continues to anticipate a rate cut at 80% at the next Fed meeting. The macro surprise and the bearish catalyst could therefore come from a surprise in the inflation figure which could appear greater than expected. The opposite is also possible with a market which, in the event of good news on inflation, could finally project itself towards further declines in 2025.

👉 Discover our selection of the best sites for trading Bitcoin

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin/USDT | -0.80% | +3.50% | +28.40% |

| ETH/Bitcoin | -1.30% | +3.80% | -0.60% |

📈 Surf the bull run by surrounding yourself with experts! Join us now at Cryptoast Academy

Can consolidation continue?

The price of BTC has been working at $100,000 since November 22. In 2020, before crossing the psychological level of $20,000, Bitcoin had worked this zone from November 25 to December 16 to cross it very impulsively, only going back much later.

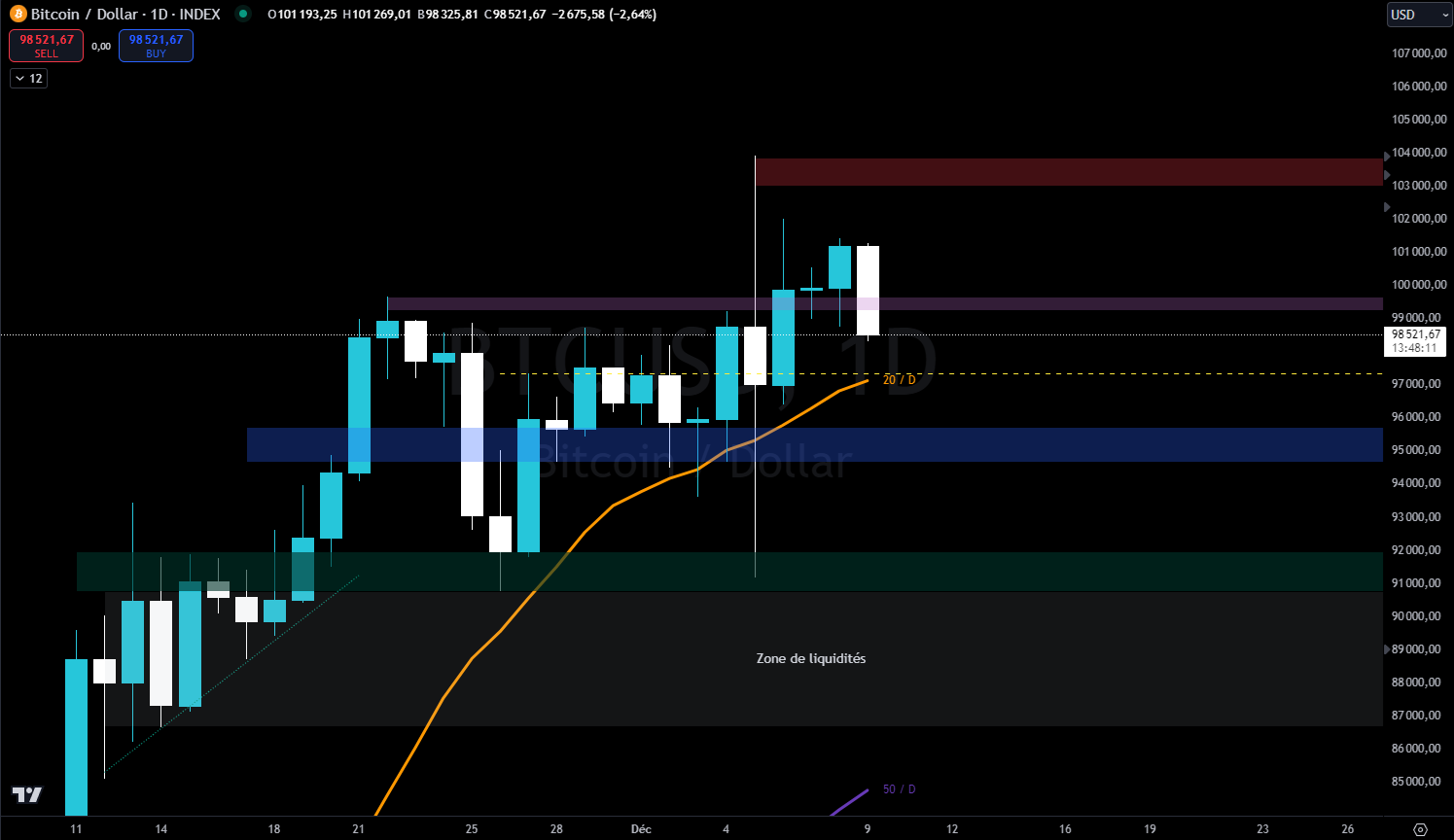

Of course, there is no guarantee that things will turn out the same way, and it is very likely that this will not be the case. Still, this past behavior allows us to set a framework for current consolidation. This could continue with a potential revisit below the 20-day moving average. In the event of a more violent bearish impulse, it is possible to work below the lower limit of the range.

Trade crypto on Binance, the #1 exchange in the world

In addition, the scenario of a decline towards $95,000 seems, at this stage, the most likely. This level has already been worked on several times, which could imply, before restarting upwards, an excess around $93,000. This scenario would leave the December 5, 2024 low unrevisited.

A second scenario envisions a deeper correction, where Bitcoin could revisit not only the December 5 low, but also the November 26 low, seeking liquidity near $87,000 before re-entering the range to continue its uptrend.

These scenarios remain bullish, because the underlying trend of Bitcoin is also bullish. At this point, it seems premature to me to consider a cycle peak around $100,000.

Finally, the asset has recently shown some signs of heaviness, which leads me to think that a correction is necessary to regain good upward momentum.

In the short term, we can see price compression through the alignment of downward H4 highs and upward lows. The decision for the next move could then depend on the breakout of this short-term triangle. A break to the north would indicate a bullish continuation, while a break to the south, confirmed by a move below the 20-day moving average, would suggest a deeper correction.

Daily Bitcoin price graph

👉 Would you like to discover more technical analyzes on Bitcoin or altcoins? Join our premium Cryptoast Academy group where we share altcoin analysis charts every week!

In summaryBitcoin has been working at the $100,000 level for several days. The range between $90,000 and $100,000 is the current price framework that may have achieved an excess above before entering a correction in search of the opposite boundary.

So, do you think BTC can cross $110,000? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new analysis of Bitcoin.

Trade crypto on Binance, the #1 exchange in the world

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital