The Pendle protocol is struggling to regain the TVL that it was able to capture at the beginning of 2024. However, the token attached to this platform seems, since August 2024, to regain attractiveness. It is probably in its fundamentals that the project draws the strength to attract speculation again. Let’s take stock of the chart of the PENDLE token.

Pendle in the race among the strongest?

It is Friday October 25, 2024, and the PENDLE price is around $4.70.

Decentralized finance (DeFi) has been at the heart of the development of blockchains since summer 2020, because this sector is considered one of the most promising. The transparency of blockchains, as well as their ability to interact with complex protocols without a trusted third party, are qualities that fit perfectly with the need for more accessible and fairer finance.

Pendle experienced massive adoption during the farming of the Eigenlayer protocol airdrop in early 2024. Indeed, the latter allowed the use of leverage to obtain many more points than the capital invested could normally allow. This functionality is just one example of the possibilities that Pendle offers, since it works in a rapidly developing sector: the tokenization of future returns.

👉 Find our selection of the best platforms for buying cryptocurrencies

Now in 107th position in the ranking of cryptocurrencies with $746 million in market capitalization, the project continues to attract the attention of investors. So, where are we technically on the PENDLE token?

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

| Pairs with Pendle | 24 hours | 7 days | 1 month |

| Pendle/USDT | -5.00% | +8.40% | +10.70% |

| Pendle/Bitcoin | -6.30% | +8.20% | +3.50% |

| Pendle/Ethereum | -5.60% | +12.10% | +14.10% |

Pendle, working on a major pivot!

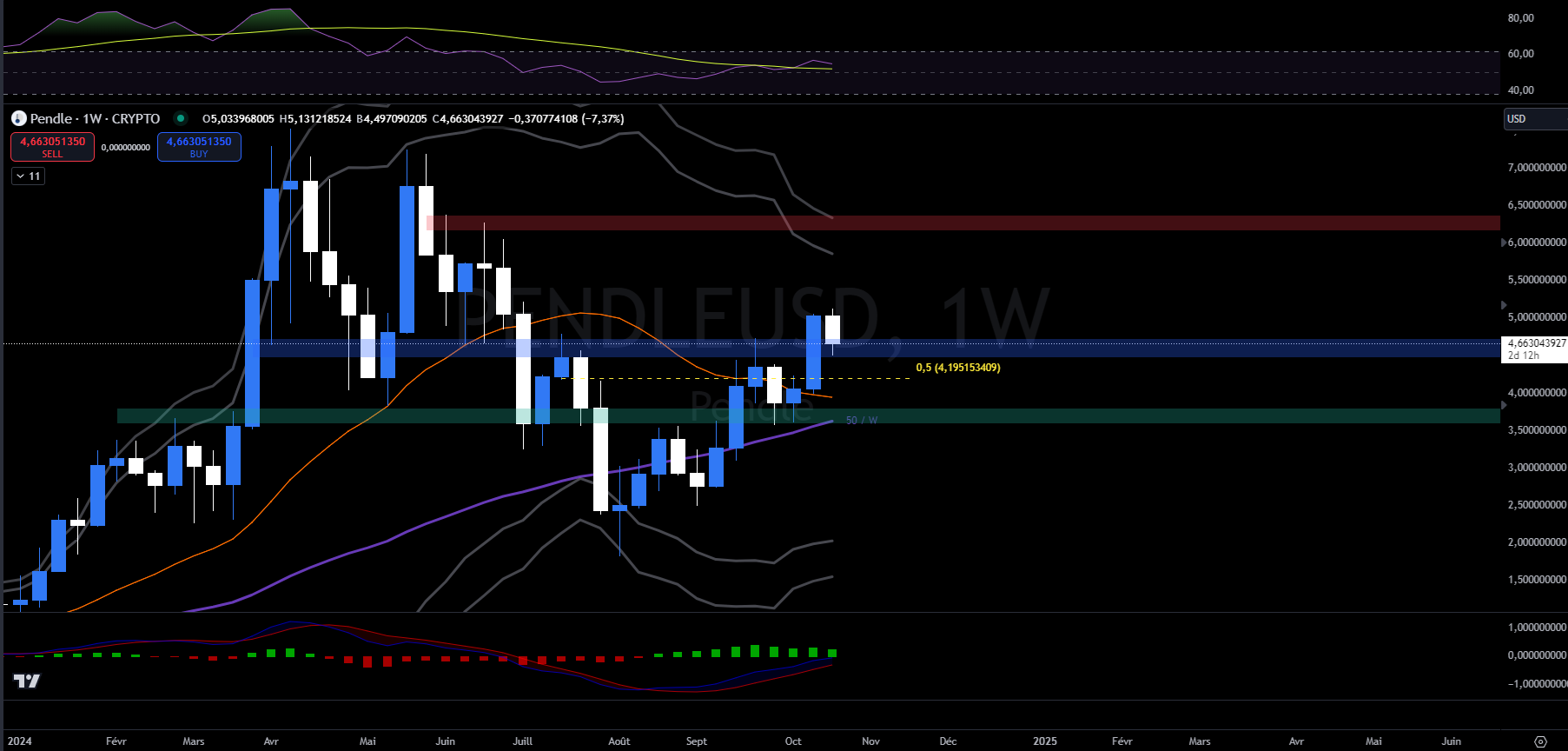

Pendle has shown interesting relative strength since the beginning of September, managing to validate a low point on August 5, 2024. The reconquest of the zone drawn in green between 3.60 and 3.80 dollars is a notable fact in the price action of these recent weeks.

The retest of this resistance which became support sent prices towards a new bullish leg, which managed to reconquer the upper level. The pivot of this level, located between 4.50 and 4.70 dollars, is currently in the middle of a retest phase.

Buy cryptos on eToro

The most likely scenario at the current stage of development is a bullish continuation in price action. The short, medium and long term trend is bullish, and the level which could call into question this good dynamic is located at $3.60.

The price of PENDLE therefore has a relative margin before calling into question the medium and long term bullish scenario. If the pivot zone in blue manages to prove its effectiveness as support, the next target after crossing $5.15 could be set around $6.

Conversely, a re-entry below $4.50 could send prices back towards the equilibrium at $4.20 before developing the next movement, either continuing towards the green zone, or towards a new attempt to cross the blue zone.

Weekly Pendle price graph

Buy cryptos on eToro

In summary, Pendle is well oriented to the upside, calmly working each of the levels he crosses. After surpassing an important first level around $3.70, the price action is currently working at $4.60. The most likely scenario remains the continuation of the upward trend, which would only be called into question in the event of a weekly close below $3.60.

So, do you think Pendle can achieve another bullish leg? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.