This week, Coinbase released its Q2 2024 results. Despite a decline from Q1, the company saw its revenue double compared to last year. What are the key stocks to remember?

Coinbase Releases Q2 2024 Figures

Due to its listing on NASDAQ, Coinbase is required to report its results every quarterthus making it possible to judge the company's performance.

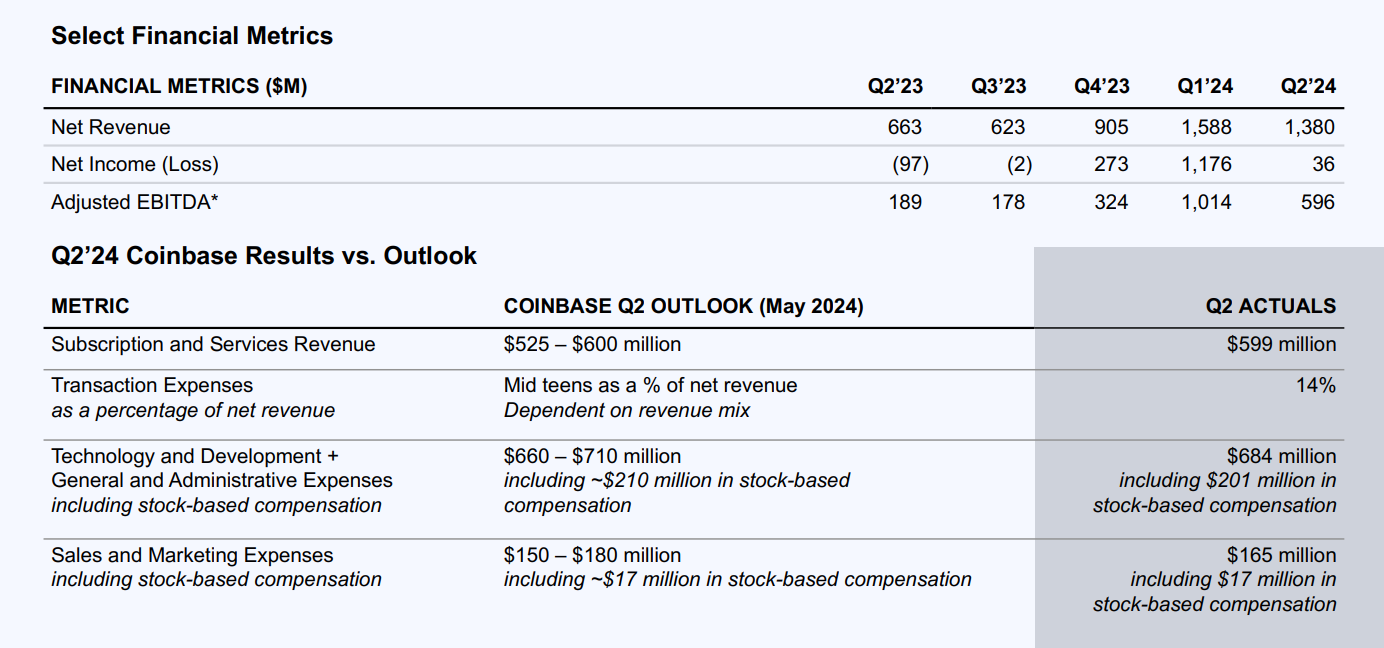

This week, the famous cryptocurrency platform shared its figures for the second quarter, whose $1.38 billion in revenue shows an increase of more than 100% compared to the $663 million in the second quarter of 2023. Despite everything, this still represents a decrease of around 11% compared to the previous quarteras a direct result of a market slowdown:

Figure 1 — Coinbase Results for the Last 5 Quarters

Despite a slight decline in turnover this quarter, The company, however, draws positive conclusions from this.particularly at the global ecosystem level with better regulatory prospects in the United States:

Q2 was a strong quarter for Coinbase and the crypto industry. In addition to strong financial results and continued efforts to build trusted products to drive crypto adoption, Coinbase and the crypto industry made significant strides toward regulatory clarity in the U.S., which we believe will be a major driver of innovation in the industry.

Thus, Coinbase calls this change in polarity in the United States a “vital unlocking“.

Coinbase: Sign up for the world's most reputable crypto exchange

A major role in ETFs

One of the highlights of 2024 for Coinbase is its role in spot ETFsboth for Bitcoin (BTC) and Ethereum (ETH). And for good reason, the company acts as a trusted custodian for almost all of them:

“In Q2, Coinbase won custody mandates with 8 of 9 ETH ETFs, building on our foundation as the trusted primary custodian for 9 of 11 U.S. BTC ETF products.”

Thus, these missions participate in “to a lesser extent” has provide an additional source of revenue for Coinbase. This remains, however, marginal compared to the entire balance sheet, with the company's total custody activities representing 35 million dollars.

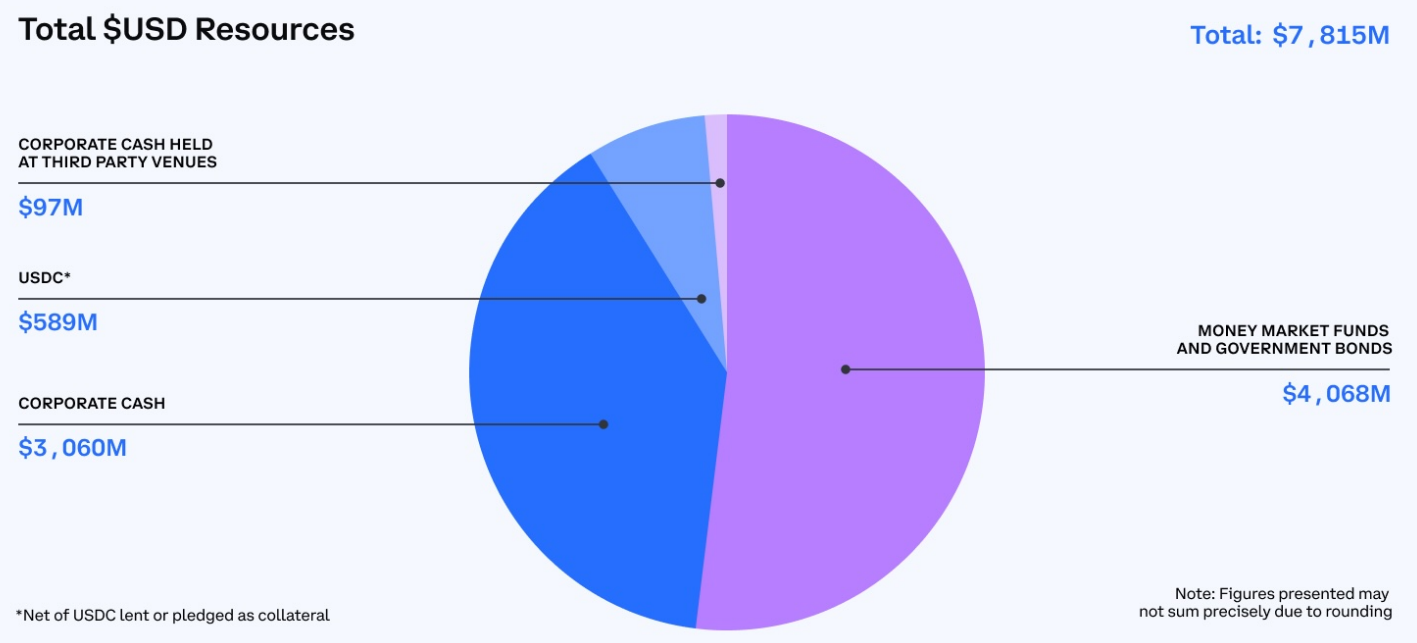

Another notable point in these quarterly figures is the total cash held by Coinbase for its own account. It amounts to $7.8 billion, mainly placed in bonds:

Figure 2 — Liquidity held by Coinbase

As I write these lines, Coinbase stock was trading at nearly $214 in pre-market tradingup 1.54%, all for a market capitalization of more than $52 billion. In addition, the platform would total $77.5 billion in assets under management, according to Arkham data.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Source: Coinbase

The #1 Crypto Newsletter

Receive a daily crypto news recap by email

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.