Several analysts remain optimistic about Ethereum’s long-term prospects. A study by Kaiko suggests that ETH could outperform Bitcoin following the launch of Ethereum spot ETFs, which could happen as early as next Tuesday.

Could ETH Overtake BTC After Next ETFs Arrive?

Since the approval of Ethereum spot ETFs by the United States Securities and Exchange Commission (SEC) in May, enthusiasm seems to have given way to impatience in the cryptocurrency market. Nearly 2 months have passed without these new financial products having deigned to see the light of day, and the price of Ether (ETH) has lost almost 20% of its value over the period.

Despite this correction, A study by Kaiko suggests that ETH could outperform Bitcoin following the potential launch of Ethereum spot ETFs next Tuesday.

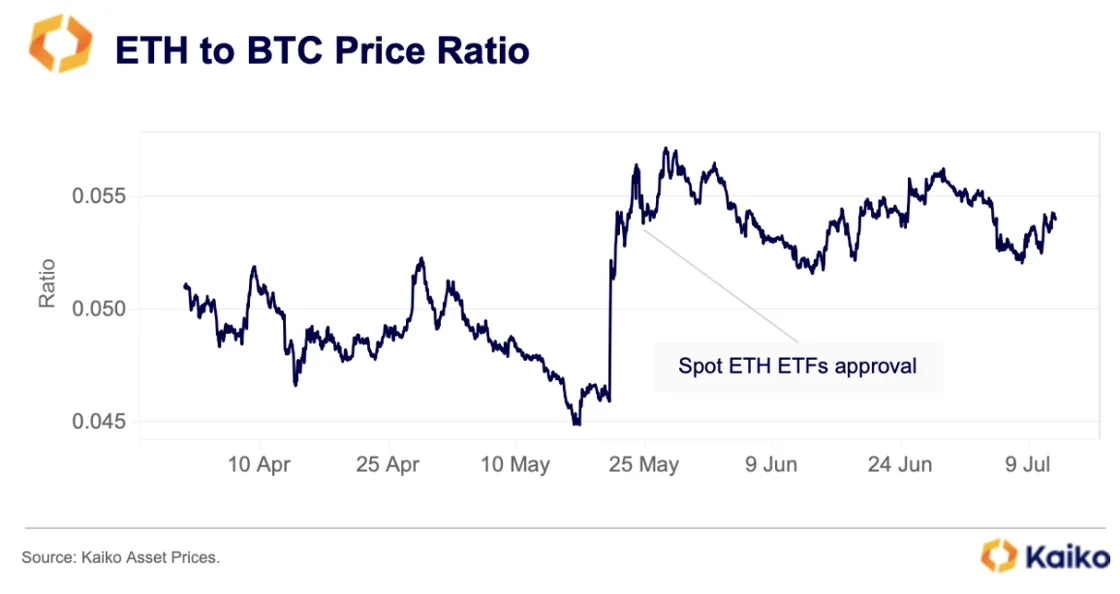

Indeed, the ETH/BTC ratio, which measures the relative performance of the 2 cryptocurrencies, remains high at around 0.05, a level significantly higher than before the approval (0.045). This trend suggests that ETH could continue to outperform Bitcoin after the launch of the Ethereum spot ETFs.

Figure 1 – Evolution of the ETH / BTC ratio

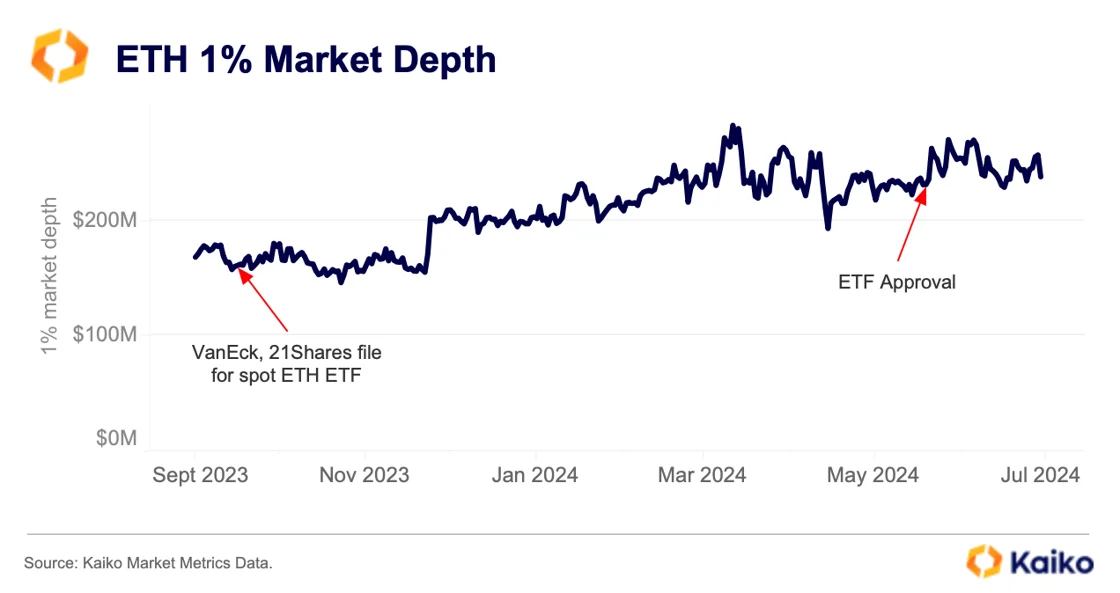

Moreover, Market liquidity remains at a solid level. ETH's 1% Market Depth, an indicator of the amount of available buy and sell orders, has remained around $230 million since May.

👉 Learn more about ETFs – Bitcoin Spot ETFs Explained: Everything You Need to Know

This figure is promising, especially since trading volumes tend to be lower during the summer months. The arrival of spot ETFs could further improve ETH's liquidity, as was the case for Bitcoin after the launch of Bitcoin spot ETFs in January.

Figure 2 – Evolution of Ether market depth

Get your €50 bonus with Bitpanda!

Liquidity still present on Ethereum

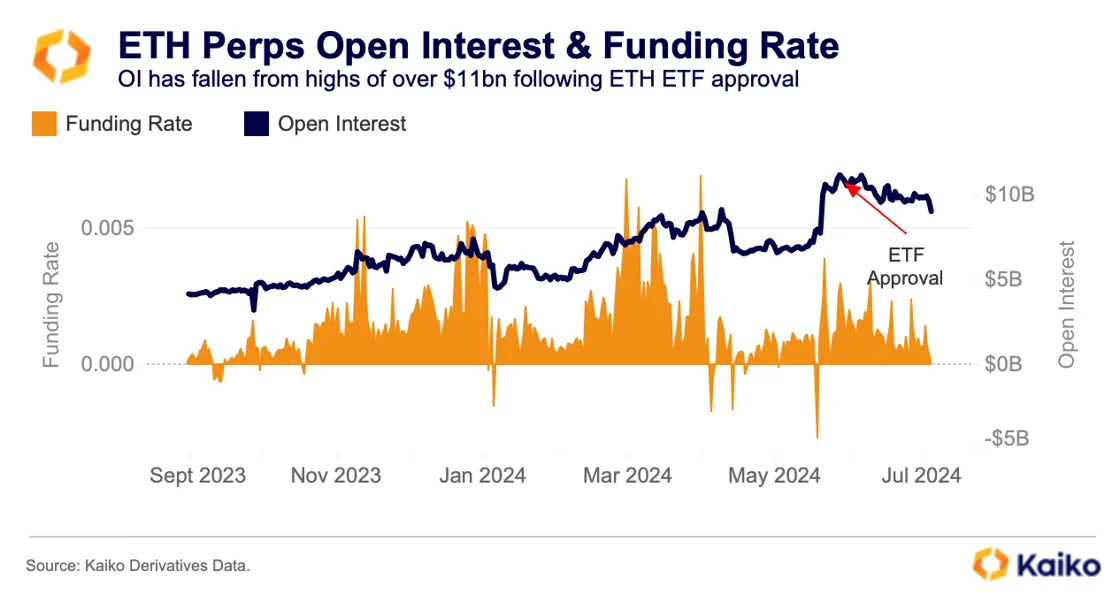

While spot markets have shown some resilience in the face of the June correction, Perpetual futures contracts, on the other hand, have seen a sharp decline.

Financing rates, which compensate longs for the risk taken by short sellers, have halved since May, according to Kaiko’s report. The trend shows a decline in conviction among traders, who are less willing to pay high premiums to hold long positions.

👉 Also in the news – Bitcoin and Ethereum increase by 20% in 1 week: towards new historical highs?

Uncertainty over the exact launch date of Ethereum spot ETFs could explain this change in mood. Open interest in ETH perpetual futures contracts has also declined by about $11 billion from June highs seen after the SEC approval.

Figure 3 – Evolution of open interest on Ethereum perpetual contracts

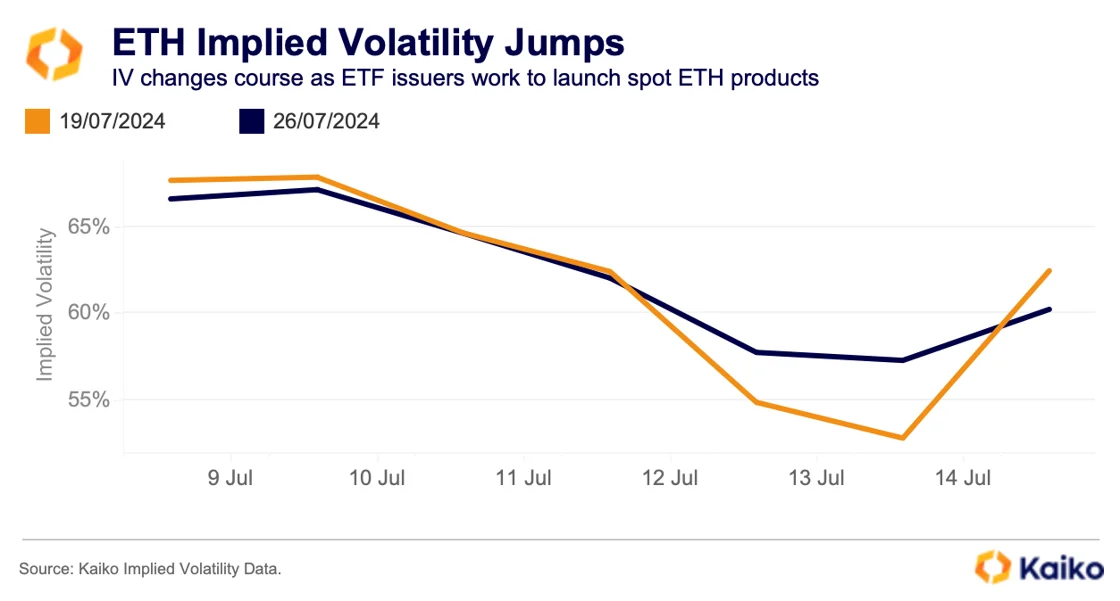

On another side, Implied volatility observed on short-term options contracts increased sharply last week. This means that traders are willing to pay more to hedge against volatile price movements, especially as the launch date of the Ethereum spot ETF approaches.

Figure 4 – Evolution of Ether implied volatility

From the chart above, the spike in implied volatility suggests some level of uncertainty among traders, but could also reflect anticipation of further price increase on ETH once Ethereum spot ETFs are launched.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Source: Kaiko Research

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.