The US Department of Justice plans to force Google to sell Chrome, for an amount of $20 billion, in order to limit its monopoly and promote competition. This historic decision marks a turning point in the regulation of tech giants.

Google Chrome at the heart of the debates: a monopoly under pressure

In a historic decision, the US Department of Justice plans to force Alphabet, Google's parent company, to sell its Chrome web browser.

With more than 3 billion monthly users and an estimated value of $20 billion, Chrome dominates 61% of the U.S. browser market, according to StatCounter. This dominance gives Google a strategic advantage in collecting data, targeting its ads and promoting its innovations such as its Gemini artificial intelligence (AI).

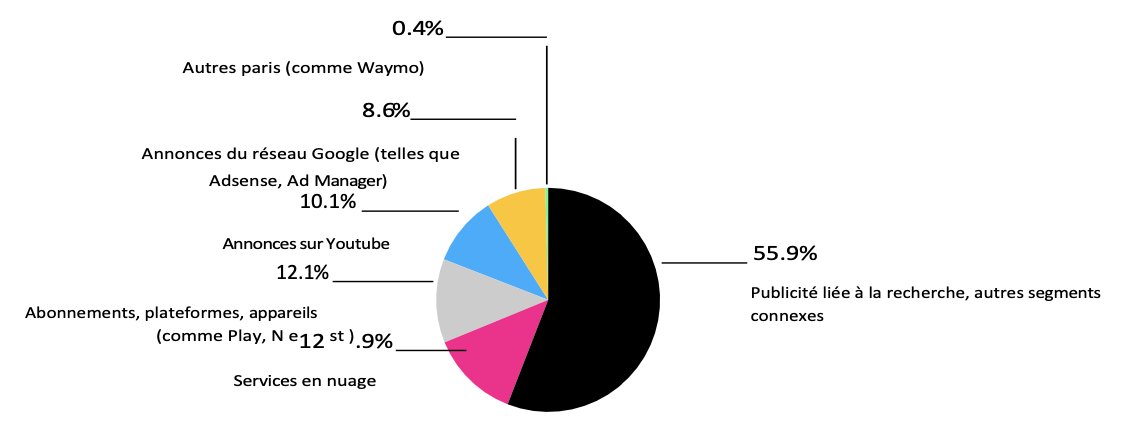

Very lucrative activities since the advertising sector alone generates nearly $300 million in annual revenue for the company.

Financial data compiled by Bloomberg based on Google Chrome Q3 2024 financial statements

Financial data compiled by Bloomberg based on Google Chrome Q3 2024 financial statements

On these facts, the antitrust regulator believes that this influence stifles competition, particularly in key areas such as online search and AI. Indeed, Google has recently been displaying AI-based answers at the top of its search pages, called “ AI Overviews “.

While websites can opt out of having their information used by the search engine, they can't opt out of previews or risk falling behind in SEO. A feature that provokes reactions since, by reducing traffic on the source page, advertising revenue is also affected.

Black Friday: – 75% on Cryptoast Academy, don't miss the bullrun, join our experts

A technological restructuring in sight for Google

The ruling last August that Google violated antitrust laws in online marketplaces and text ads followed a 10-week trial last year.

Judge Amit Mehta scheduled a 2-week hearing in April to determine what changes Google must make to address this illegal behavior. Over the past 3 months, government lawyers have met with dozens of companies to prepare their recommendations. A final decision is expected to be made by August 2025.

During the trial, the judge insisted that Google relied on anticompetitive payments to ensure that its search engine was enabled by default on most smartphones. A sum which represents 26.3 billion dollars in 2021, from companies like Apple and Samsung.

[le ministère de la Justice] continues to promote a radical agenda that goes well beyond the legal issues raised in this case.

Beyond Chrome, regulators also want to decouple the Android system from other Google products, such as the Google Play app store, in order to stimulate competition.

The firm warns of the potentially negative effects of these measures on consumers and American technological leadership, particularly crucial in the race for AI innovation.

Google also said in a blog post that if other companies were to acquire Chrome, they likely wouldn't have as much incentive to invest or keep it free. This case symbolizes the growing desire of American authorities to regulate technology giants.

In the event of a sale, the digital landscape could be completely reshaped, allowing emerging players to assert themselves as an alternative and thereby making the market more competitive.

€20 offered when you register on Bitvavo

Source: Bloomberg

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital