In recent days, the cryptocurrency market has suffered significant liquidations, due to the volatility caused by Donald Trump. What are the significant figures?

The cryptocurrency market is experiencing numerous liquidations

As we have seen, the cryptocurrency market was largely dominated by the TRUMP memecoin over the weekend, while optimism ahead of Donald Trump's inauguration allowed Bitcoin (BTC) to briefly exceed its previous all-time high.

With this ambient volatility, we observed the equivalent of $1.61 billion in liquidations on products derived from centralized platforms during the days of Saturday and Sunday. During the last 24 hours, said liquidations are still high, reaching $1.04 billion.

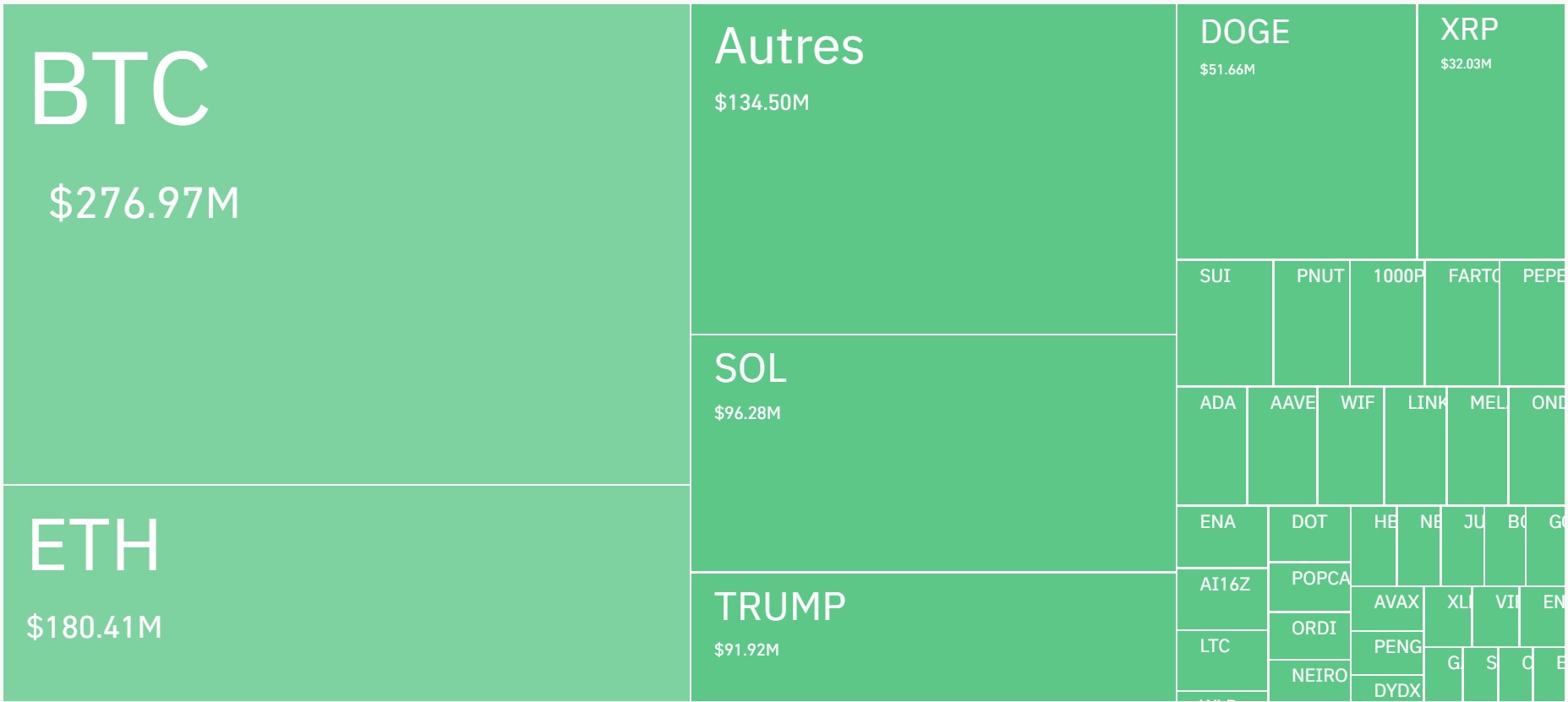

While BTC represents a little less than 27% of liquidations, note that TRUMP weighs 8.83%, which further supports the exceptional nature of the figures surrounding the asset, even though it was launched less than 72 hours ago:

Amounts liquidated by assets over 24 hours

In terms of distributions between long and short positions, it is the former that weigh the most in the balance, to the tune of almost 73%.

Buy and trade crypto on Solana’s top-performing DEX

Solana DEXs also benefit

To bounce back on the TRUMP, it should also be noted that in addition to the centralized platforms, Solana's decentralized exchanges (DEX) have seen their volumes soar, both on the spot side and on the perpetual side. To put it very simply, Saturday and Sunday are today the 2 most important days in terms of volumes for Raydium (RAY) and Jupiter (JUP).

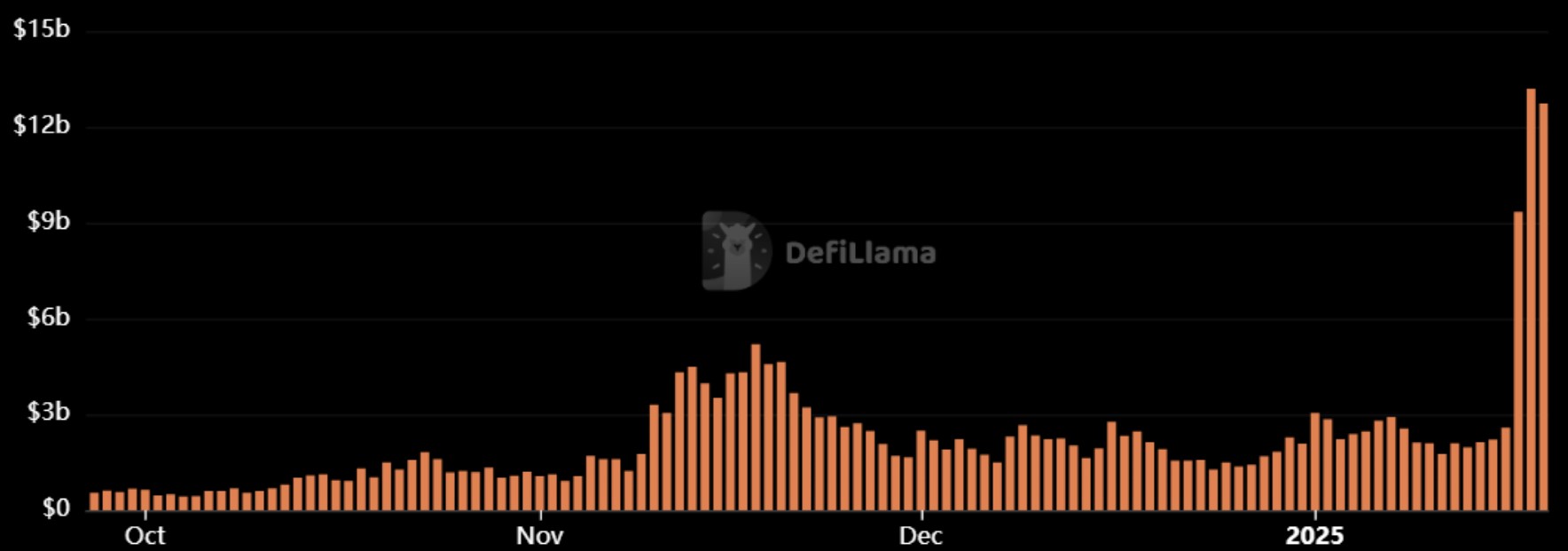

This weekend, Raydium achieved more than $25.92 billion in volume, which outperforms Uniswap (UNI) by 150% over the same period. Moreover, Saturday's record on Raydium also exceeds Uniswap's best day of volumes:

Daily volumes on the Raydium DEX

At the same time, RAY is trading at $7.31, up 7% in 24 hours.

Given this volatility and the ideas that the Trump family could give to other personalities regarding memecoins, it will be necessary to be particularly careful about risk management. If these tokens without any fundamental value can generate significant multiples, it is also worth remembering that the volatility they generate can also destabilize many traders.

Don't miss the bullrun, join our experts on Cryptoast Academy

Advertisement

Sources: Coinglass, DefiLlama

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital