Every month, many emerging or already well-established companies in the crypto ecosystem manage to attract investor interest and obtain funding. The month of September 2024 was no exception to the rule, since several hundred million dollars were raised by companies with strong potential.

The main fundraisings in September: almost $600 million invested in crypto companies

Every month, numerous table rounds, also called fundraising roundsare organized and carried out so that companies with promising projects raise money and can develop.

In total, during the month of September 2024, nearly $600 million has been raised for crypto projects, including over $258 million by 5 projects alone.

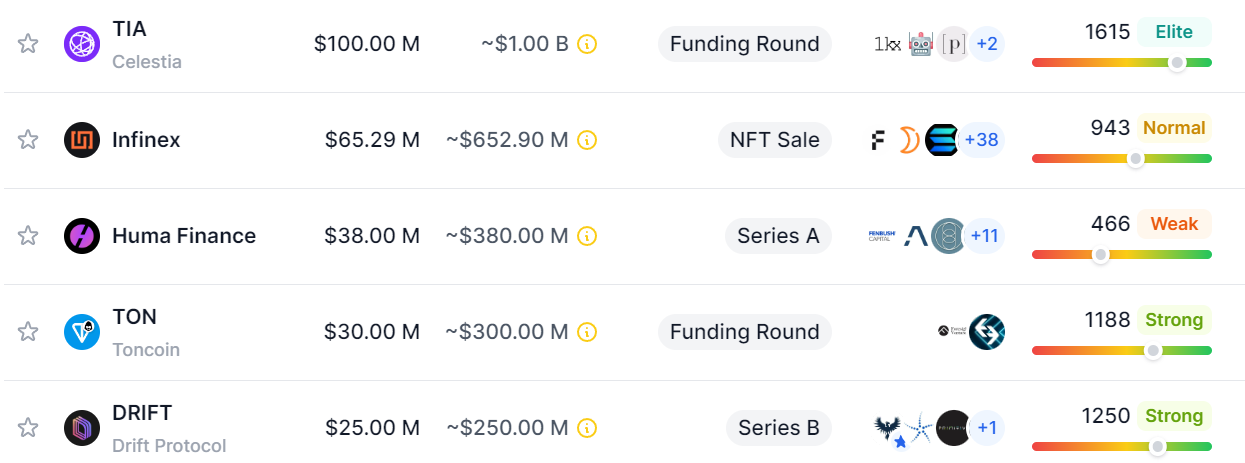

According to data from the DropsTab site, here are the 5 main fundraisers carried out by Web3 entities during the month of September 2024 :

The 5 biggest fundraisers of September 2024 in the crypto sector

The 5 biggest fundraisers of September 2024 in the crypto sector

Buy cryptos on eToro

5 – Drift Protocol (DRIFT)

- Funding Series : Series B

- Launch date of the business and/or project : November 2021

- Amount raised : $25 million

Drift Protocol presents itself as a decentralized exchange (DEX) for cryptocurrencies built on the Solana blockchain, specialized in perpetual futures trading. It allows users to speculate on different cryptos with leverage of up to x10.

The protocol uses a Dynamic Automated Market Maker (DAMM) to optimize liquidity and reduce price gaps. Drift also supports activities related to decentralized finance (DeFi) such as lending/borrowing, liquidity pools, digital vaults, etc.

The Series B funding round led by Multicoin Capital closed on September 19 with 25 million dollars raised. In total, between the 2021 seed round, the January 2024 series A and the series B, Drift Protocol will have raised more than $52 million.

This last round of discussion saw the participation of Blockchain Capital, Primitive Ventures and Folius Ventures. Thanks to these funds raised, Drift Labs, the company behind the development of the protocol, intends to double its workforce from 25 to 50 people over the next year. The co-founder of Drift Labs, Cindy Leow, said her goal was to make Drift the “ Crypto Robinhood “.

Drift Labs is also working to offer a prediction market, like the Polymarket platform which has seen a meteoric rise, particularly with betting on the 2024 American presidential elections..

Ledger: the best solution to protect your cryptocurrencies

4 – The Open Network (Toncoin)

- Funding Series : Funding round

- Launch date of the business and/or project : May 2020

- Amount raised : $30 million

The Open Network is a Proof of Stake (PoS) type blockchain, initially developed by the team behind the messaging application Telegram and then gradually became governed by its community following attacks by the American Securities and Exchanges Commission (SEC).

Although Telegram has officially distanced itself from the TON blockchain, its founder, Pavel Durov, remains symbolically linked to this blockchain in the eyes of the community. Thus, when the latter was arrested by the French authorities on August 24, 2024, the price of Toncoin suffered greatly.

Despite this event, investors such as the cryptocurrency exchange Bitget and Foresight Ventures have allocated $30 million to the TON project during the fundraising which closed on September 18.

Foresight Ventures is a venture capital firm created and led by Forest Bai, also president of the media outlet The Block. He declared that “ TON's rise represents the biggest growth opportunity in the cryptocurrency market this year “.

Investment from Foresight Ventures and Bitget aims to improve the development of TON-based projects, focusing on tap-to-earn games such as Hamster Kombat and Notcoin. It also aims for these 2 entities to get involved “ deeper into the governance of TON “.

3 – Huma Finance

- Funding Series : Series A

- Launch date of the business and/or project : February 2023

- Amount raised : $38 million

Huma Finance is a decentralized finance (DeFi) protocol focused on cross-border payments that recently merged with Arfa platform acting on the same vertical. The merger which took place in April 2024 aims to create a robust decentralized financing network, called PayFi.

During the Series A financing round which closed on September 11, Huma Finance raised $38 million with many actors such as Fenbushi Capital, ParaFi Capital, Distributed Global among others.

In February 2023 Huma Finance had raised more than 8 million dollars during its seed round, notably with the participation of Circle Ventures.

2 – Infinex

- Funding Series : Financing through the sale of non-fungible tokens (NFT)

- Launch date of the business and/or project : May 2024

- Amount raised : $65 million

Infinex is a DEX aimed at simplifying access to decentralized applications (dApps) for a rather Web2 native audience.

Its main asset is the Infinex Accounta cross-blockchain account that allows users to easily navigate the decentralized finance (DeFi) ecosystem without having to manage complex portfolios or gas fees.

Infinex's objective is to make DeFi products accessible to everyonewith a familiar interface, similar to that of centralized exchange platforms (CEX), all by preserving the advantages of decentralization such as transparency and non-custodial custody of cryptocurrencies.

The fundraising carried out by Infinex is rather original because it took the form of an NFT sale. Despite its unconventional form, the fundraising was still a success since more than $65 million has been raised.

“Patron” NFT for Infinex fundraising

The sale took place in 4 stages, from the most private, by invitation only, to the finally completely public. An NFT “ Boss ”, which can be literally translated as “ patron », can have 3 different levels:

- Liquid Patrons : With an entry ticket to $5,000Liquid Patrons will be immediately transferable after the distribution date (October 24);

- Linear Patterns : By investing $3,000the Linear Patrons will, as their name indicates, be released linearly, 1 year after the distribution date;

- Locked Patrons : And finally, to 1250 dollarsLocked Patrons also have a linear release system, but with a lower release which will lead to a greater delay.

This fundraising saw the participation of numerous venture capital funds such as Wintermute Ventures, Framework Ventures, Moonrock Capital, Solana Venturesand many others.

Crypto ecosystems have also gotten involved like Wormhole, Synthetix, Near Foundation or even Pyth. In addition, renowned business angels such as Stani Kulechovfounder of the DeFi platform Aave or Anatoly Yakovenkofounder of Solana also participated in the fundraising.

Although the reason for the fundraising is not clearly displayed on the Infinex website, the latter's roadmap announces new features coming from October 2024.

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

1 – Celestia (TIA)

- Funding Series : Funding Round

- Launch date of the business and/or project : October 2023

- Amount raised : 100 million dollars

Celestia defines herself as a modular blockchain network. In opposition to the classic monolithic architecture used by blockchains like Bitcoin, Ethereum or others, Celestia offers a paradigm shift by moving towards modularity in separating its blockchain into several independent layers.

Celestia is particularly popular for having performed a massive airdrop of its crypto, TIA in 2023. On September 23, the Celestia Foundation, the team behind the development of the eponymous blockchain, closed a fundraising amounting to 100 million dollars.

Led by Bain Capital Crypto, the fundraising saw the participation of 1kx, Robot Ventures, Placeholder and Syncracy Capital. Celestia's last fundraising (2022), led by the same entity, amounted to $55 million.

Although the Celestia Foundation did not clearly express the objective of this significant fundraising, it specified that the developers are currently focusing on their new roadmapunveiled in September.

Remember that Celestia will carry out the largest token unlock in the entire crypto sector this month, representing $970 million, or nearly 82% of its circulating supply.

Train with Alyra to integrate the blockchain ecosystem

Source: DropsTab

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

What you need to know about affiliate links. This page may feature assets, products or services relating to investments. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.