Every month, many companies, emerging or already well established in the crypto ecosystem, manage to attract the interest of investors and obtain financing. The month of December 2024 was no exception to the rule, since more than 1.8 billion dollars were raised by high-potential companies, of which more than 1.2 billion were raised by only 5 of them .

The main fundraisings in December: more than $1.8 billion invested in crypto companies

Every month, numerous rounds of tables, also called fundraising roundsare organized and carried out so that companies with promising projects raise money and can develop.

In December 2024, crypto projects that organized funding rounds managed to raise $1.84 billion, of which more than $1.2 billion was raised by only 5 of them.

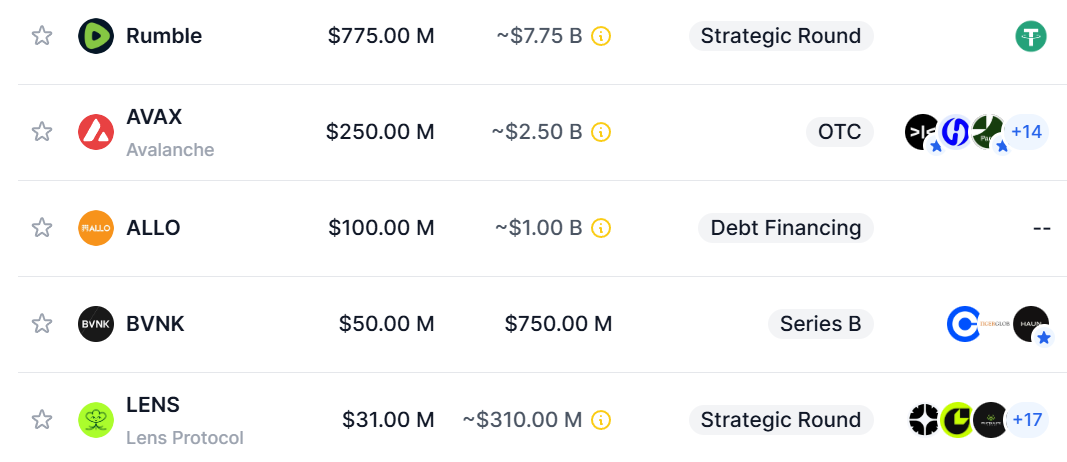

According to data from the DropsTab site, here are the 5 main fundraisings carried out by Web3 companies during the month of December 2024:

The 5 biggest fundraisers of December 2024 in the crypto sector

Buy cryptos on eToro

5 – Lens Protocol

- Funding series: Strategic Round;

- Launch date of the company and/or project: February 2022

- Amount raised: $31 million.

Lens Protocol is a decentralized platform built on the Polygon blockchain, which allows creating and managing Web3 social networks, an approach called SocialFi.

The platform is designed to “ return control to users » and offers digital profiles in the form of NFTs, where each interaction (posts, comments, shares) is recorded on-chain, thus offering real ownership and portability of social data.

Lens Protocol was created by Stani Kulechov, a well-known Web3 player as he is also the founder of the decentralized finance (DeFi) protocol Aave.

The Strategic Round led by Lightspeed Faction ended on December 18 with 31 million dollars raised. In total, these are more than 15 venture capital funds and 9 business angels who participated in this fundraising including: Avail, Circle, Consensys, DFG, Fabric Ventures, Illia Polosukhin (co-founder of Near) and many others.

We're excited to announce a $31 million strategic raise led by @FactionVC to fuel the rise of SocialFi. pic.twitter.com/NiGAc91d44

— Lens (@LensProtocol) December 18, 2024

Lens Protocol had already raised $15 million in June 2023, bringing the total funds raised to $46 million.

The latest funds raised by Lens Protocol will be used to “ the expansion of its infrastructure “.

4 – BVNK

- Funding series: Series B;

- Launch date of the company and/or project: May 2021;

- Amount raised: 50 million dollars.

BVNK is a startup from the United Kingdom, specializing in infrastructure around stablecoins.

The Series B fundraising which closed on December 17 with $50 million raisedarises in a favorable context for investments in this type of company.

Indeed, while Bridge was bought in October by Stripe for the gigantic sum of $1.1 billion, many players from traditional finance (TradFi) are paying particular attention to developments around stablecoins and their infrastructures.

BVNK had already raised $40 million as of May 2022, bringing the total amount of funds raised to $90 million.

The Series B funding round was led by Haun Ventures and saw the participation of Coinbase Ventures and Tiger Global Managementthe latter having led BVNK’s first fundraising.

According to our colleagues at Fortune Crypto, the $50 million was entirely raised in exchange for shares in the company BVNK.

This latest fundraising aims to expand BVNK's activities, particularly in the United States, where it has just opened offices in San Francisco and New York.

Don't miss the bullrun, join our experts on Cryptoast Academy

Advertisement

3 – ALLO

- Funding series: Debt Financing and Seed Round;

- Launch date of the company and/or project: December 2024;

- Amount raised: $102 million.

ALLO is a DeFi platform specializing in tokenization and lending of real-world tokenized assets (RWA).

The startup claims to have staked over 544 BTC via the Babylon protocol, bringing the total value locked (TVL) of the project to $52 million according to DeFiLlama. The staked BTCs are represented by the alloBTC token.

In December, ALLO will have carried out 2 distinct fundraising events: one of 2 million dollars in Seed Round and the 2nd of 100 million dollars which is a “ line of credit » so that ALLO can carry out its activities.

The seed round saw the participation of Morningstar Ventures, NGC Ventures and Gate Labs.

According to our colleagues at Cointelegraph, the credit line was financed by a consortium of lenders, including Greengage and a long-standing American institution »without the identity of the latter being revealed.

Prior to these fundraising rounds, ALLO had secured an investment of $750,000 as part of its participation in the Binance Labs accelerator program.

Open an account on Binance, the world's #1 crypto platform

2 – Avalanche (AVAX)

- Funding series: Over The Counter (OTC);

- Launch date of the company and/or project: September 2020;

- Amount raised: 250 million dollars.

Avalanche is an ecosystem, created to offer fast, secure and scalable transactions. Launched in September 2020 by Ava Labs, Avalanche stands out for its unique consensus, making it possible to process thousands of transactions per second with low latency.

Avalanche is designed to be compatible with the Ethereum Virtual Machine (EVM) by offering great flexibility, and allows developers to create decentralized applications (dApps), custom tokens and layer 1 blockchains, previously called “subnet”.

On December 12, Avalanche closed an Over The Counter (OTC) fundraising round led by Dragonfly Capital, raised to $250 million. This fundraising saw the participation of 17 venture capital funds including Hypersphere Ventures, ParaFi Capital, Galaxy and many others.

In exchange for their invested funds, venture capital funds will obtain AVAX tokens, which must go through a vesting period before being released.

👉 Our guide to buying AVAX tokens

The funds raised by Avalanche will be used to support the “Avalanche6900” update which aims to reduce transaction costs on the C-Chain and the costs of deploying layer 1 blockchains based on Avalanche technology.

These funds will also be used to participate in the “Retro9000” program, which must retroactively subsidize, to the tune of $40 million, developers who build on Avalanche and finance a sponsorship campaign, to the tune of $2 million.

At the time of writing, the price of the AVAX token is trading near $44, an increase of 19% over the last 14 days.

1 – Rumble

- Funding series: Strategic Round;

- Launch date of the company and/or project: March 2013

- Amount raised: $775 million.

Rumble is an online video sharing platform that stands out for its approach to freedom of expression, offering an alternative to YouTube. Founded in 2013, Rumble allows users to post, view and share videos without excessive censorship.

The platform emphasizes monetization for its content creators and attracts a user base that is rather critical of censorship policies on other social platforms.

Although Rumble is literally not a crypto company as of today, the huge investment from $775 million by the sole investor that is the stablecoin giant Tether (USDT) could suggest its future involvement in the sector.

Many people may not realize the incredibly strong connection between cryptocurrency and free speech communities, which is rooted in a passion for freedom, transparency, and decentralization.

Of the $775 million raised by Rumble, $250 million will be dedicated to “ strengthening the company's financial foundations and accelerating its growth initiatives “.

Create an account on Gemini: the American exchange launching in France

Source: DropsTab

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital