Every month, many companies, emerging or already well established in the crypto ecosystem, manage to attract the interest of investors and obtain financing. The month of November 2024 was no exception to the rule, since nearly $880 million was raised by companies with high potential.

The main fundraisings in November: nearly $880 million invested in crypto companies

Every month, numerous rounds of tables, also called fundraising roundsare organized and carried out so that companies with promising projects raise money and can develop.

In November 2024, crypto projects having organized funding rounds managed to raise nearly $880 million, of which $405 million was raised by only 5 of them.

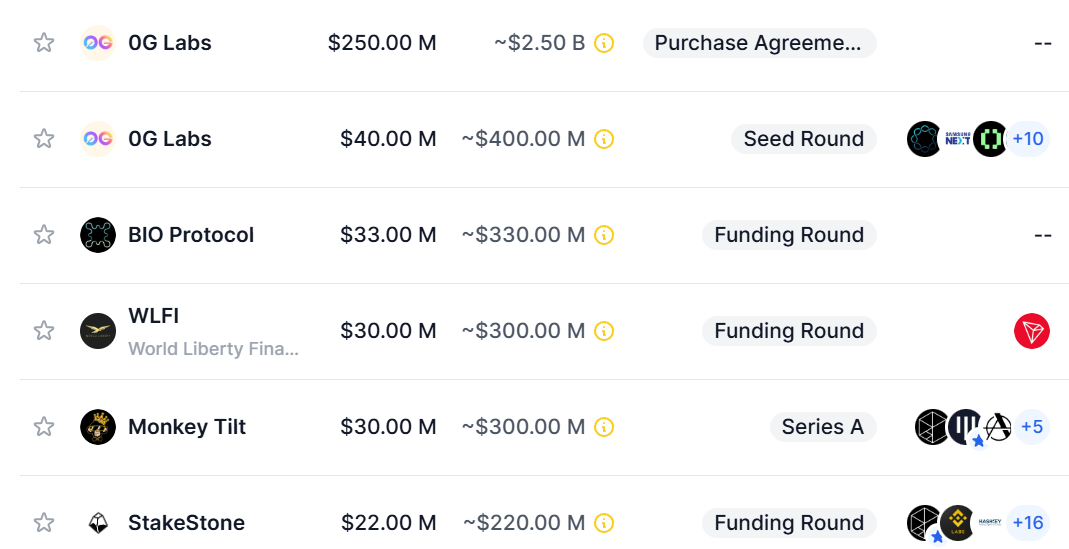

According to data from the DropsTab site, here are the 5 main fundraisings carried out by Web3 companies during the month of November 2024:

The 5 biggest fundraisers of November 2024 in the crypto sector

Buy cryptos on eToro

5 – StakeStone

- Funding series: Funding Round

- Launch date of the company and/or project: March 2023

- Amount raised: $22 million

StakeStone presents itself as a “ multi-chain liquidity distribution network “. Its main function to date is to offer returns, in particular via restaking of Ether or BTC through Babylon.

The Hong Kong-native company is also preparing to launch its payments product, which will include features such as flexible savings accounts offering Buy-Now-Pay-Later (BNPL) capability.

💰 Invest in Bitcoin effortlessly with Bitstack

The Funding Round led by Polychain Capital closed on November 11 with 22 million dollars raised. In total, these are more than 17 venture capital funds and 2 exchanges who participated in this fundraising including: Binance Labs, OKX Ventures, HashKey Capital, SevenX Venturesand many others.

Binance Labs also participated in the project's first fundraising, in March 2024. The amount of this participation, however, was not disclosed.

The funds raised by StakeStone will be used to accelerate its growth, expand its product offering and strengthen its presence in key markets.

4 – Monkey Tilt

- Funding series: Series A

- Launch date of the company and/or project: March 2024

- Amount raised: $30 million

Monkey Tilt is an online casino crypto platform. This project quickly gained attention with its innovative approach combining traditional casino experiences with a social aspect.

During the fundraising which ended on November 20, led by Pantera Capital, $30 million were collected by the project. This Series A fundraising saw the participation of Polychain Capital, Hack VC and Accomplice among others. Since its launch, Monkey Tilt has raised a total of $51 million through its various fundraising efforts.

👉Our opinion on the 10 best wallets to secure your cryptos

The funds raised will be used to finance a marketing campaign and to set up a technical team responsible for maintaining the platform.

3 – World Liberty Financial (WLFI)

- Funding series: Funding Round

- Launch date of the company and/or project: September 2024

- Amount raised: $30 million

The World Liberty Financial (WLFI) project was officially launched on September 16, 2024 by Donald Trump Jr. and Eric Trump, 2 of the sons of the future president of the United States.

This project, which has generated a lot of ink in our columns, aims to democratize access to decentralized financial services (DeFi) while positioning itself on anti-traditional financial system values.

Although the project experienced difficulties at its launch in convincing investors, and this even after the results giving Donald Trump the victory for the presidency of the United States fell, 30 million dollars were raised from a single investor: Justin Sun or to be exact, Tron the blockchain that the latter founded.

We are excited to invest $30 million in World Liberty Financial @worldlibertyfi as its largest investor. The US is becoming the blockchain hub, and Bitcoin owes it to @realDonaldTrump! TRON is committed to making America great again and leading innovation. Let's go! pic.twitter.com/cISTsVYP1f

— HE Justin Sun 🍌 (@justinsuntron) November 25, 2024

This investment, which is reminiscent of the sulfurous natures shared by Justin Sun and Donald Trump, remains relatively anecdotal for the Asian giant. Indeed, according to Artemis Terminal, the Tron blockchain has generated over $538 million in revenue in the last 365 days.

Black Friday: – 75% on Cryptoast Academy, don't miss the bullrun, join our experts

2 – BIO Protocol

- Funding series: Funding Round

- Launch date of the company and/or project: November 2024

- Amount raised: $33 million

The BIO Protocol project is defined as a decentralized platform aiming to revolutionize the financing of scientific projects (DeSci), particularly in the fields of biotechnology and medicine.

💡 Everything you need to know about decentralized science (DeSci)

The protocol allows communities of scientists, patients and investors to collaborate to fund and co-develop research and products in areas such as longevity, rare diseases and mental health.

BIO Protocol operates through a network of biotechnology decentralized autonomous organizations (DAOs) named “ BioDAO “. Each of these BioDAOs specializes in a specific area, such as cryopreservation or mental health care through the use of psychedelic substances.

During its fundraising which ended on November 13, the project raised more than $33 million.

Although the investors in the latest fundraising round are not known, Binance Labs showed interest in the project by investing an undisclosed amount in the previous round. This is all the more remarkable because this is the very first time that Binance Labs has invested in a project affiliated with the DeSci narrative.

With this new capital, the protocol plans to further expand its ecosystem, providing seed funding for new BioDAOs. BIO Protocol also plans to strengthen its current team by recruiting 11 people.

1 – OG Labs

- Funding series: Purchase Agreements (SAFT Fundraising)/Seed Round

- Launch date of the company and/or project: March 2024

- Amount raised: $290 million

OG Labs presents itself as a crypto startup using artificial intelligence (AI), having made a shift away from its initial objective which was to develop a modular blockchain solution.

The project is building what it calls a decentralized AI operating system (dAIOS) that aims to enable the development of AI applications on the blockchain.

During the month of November, OG Labs raised $290 million which places this project at the top of our monthly ranking. To be more precise, fundraising is divided into 2 stages: a seed round of $40 million and a SAFT Fundraising of $250 million.

A SAFT Fundraising for “ Simple Agreement for Future Tokens » is a somewhat special financing method. In fact, the funds concerned by this fundraising will only be available for the project upon completion of the Token Generation Event (TGE).

In other words, if the project closes down before the TGE, it will never receive these funds.

As for the seed round, many venture capital funds and business angels have put their hands in the portfolio. Among the most notable we can cite: Delphi Labs, Samsung NEXT, Hack VC, Animoca Brands and Polygon.

According to the founder and CEO of the OG Labs project, Michael Heinrich, the funds raised will be used to double its workforce and stimulate the growth of the ecosystem through several incentive programs.

€20 offered when you register on Bitvavo

Source: DropsTab

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital