Each month, many companies, emerging or already well established of the crypto ecosystem, manage to attract the interest of investors and to obtain funding. The month of February 2025 did not deviate from the rule, since nearly $ 700 million was lifted by companies with high potential, more than 274 million of which were collected by only 5 of them.

The main fundraising in February: nearly $ 700 million invested in Crypto companies

Each month, many tables, also called Fundraising Roundsare organized and carried out so that companies carrying promising projects lift money and can develop.

In February 2025, Crypto projects that organized table towers managed to raise nearly $ 700 million, of which 274 million dollars were collected by only 5 of them.

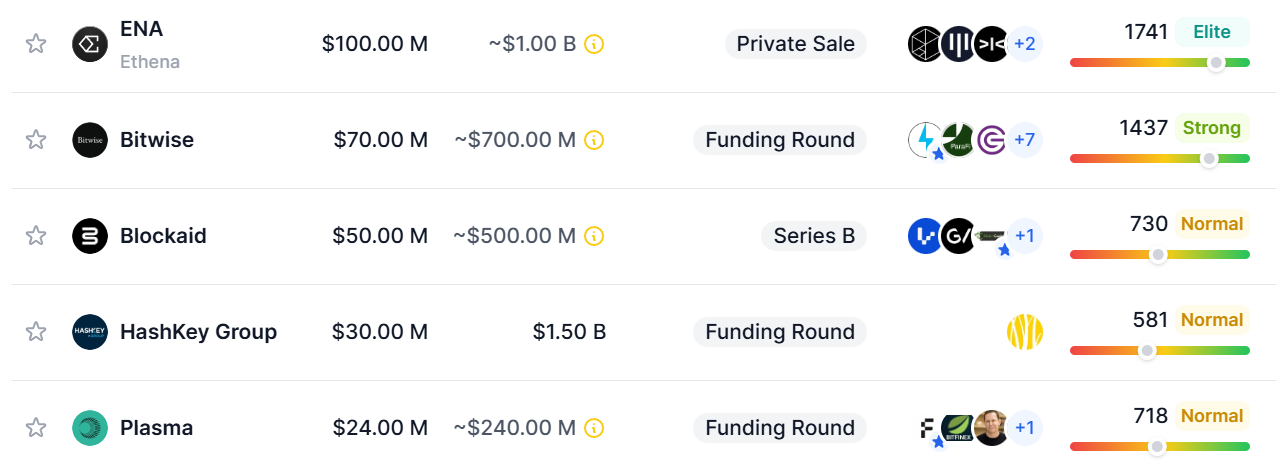

According to data from the Dropstab site, here is The 5 main fundraising made by web 3 companies during the month of February 2025 ::

The 5 largest fundraising of the month of February 2025 in the Crypto sector

The 5 largest fundraising of the month of February 2025 in the Crypto sector

Buy cryptos on etoro

5 – Plasma

- Financing series: Funding Round;

- Launch date of the company and/or the project: October 2024;

- Amount raised: $ 24 million.

Plasma is a blockchain specially designed to accelerate the adoption of stablecoins, in particular by offering solutions for the Bitcoin network.

This blockchain adopts an unusual technology: plasma is defined as a bitcoin sidechain, while allowing compatibility to Ethereum Virtual Machine (EVM).

One of the flagship features of the plasma blockchain is that it allows Stablecoins transfers, without paying any costs. According to the team behind the project, Plasma is able to support 2,000 transfers to the second.

💲 Discover our selection of stablecoins backed by the dollar

During the month of February, Plasma raised funds from $ 24 millionunder the aegis of Framework Ventures. This fundraising also saw the participation of the centralized exchange (CEX) Bitfinex and business angels like Paolo Ardoino (CEO of Tether) and Peter Thiel.

Last October, Plasma had already raised $ 3.5 million.

As evidenced by his comment, the CEO of Tether is optimistic about the solution that plasma develops:

With strong growth in supply and users, we are entering a new generalized adoption phase of stablecoins. To meet this challenge, it is more important than ever to have a secure, decentralized and scalable infrastructure. Plasma is designed to provide these essential rails by using Bitcoin as a safety layer.

Buy crypto on binance, exchange n ° 1 in the world

4 – Hashkey Group (HSK)

- Financing series: Funding Round;

- Launch date of the company and/or the project: 2018;

- Amount raised: $ 30 million.

Hashkey Group is a financial conglomerate based in Hong Kong, specializing in services related to cryptocurrencies and blockchain. It is mainly intended for professional institutions and investors by offering a wide range of solutions, going from trading to asset management, including technological development and venture capital.

Hashkey Group is notably one of the first players to have obtained a license from the Securities and Futures Commission (SFC) of Hong Kong, which allows him to propose Bitcoin and Ethereum Spot Etf on site.

📈 What is a Bitcoin ETF?

In December, Hashkey Group launched his own Layer 2 Blockchain on Ethereum using OP Stack, incorporating his native crypto, HSK.

On February 14, Hashkey Group raised $ 30 million with a Chinese investment fund, named Gaorong Ventures. Last January, the group had already lifted $ 100 millionwithout investors being revealed.

According to estimates by the media The Block, these fundraising leads to the valuation of Hashkey Group to $ 1.5 billion, thus confirming its unicorn status.

The HSK crypto price was not spared by correction of the Crypto market and records in the writing of these lines a negative performance of – 34.5 % in the last 30 days.

Try Dydx now: the favorite DEX of Crypto traders!

3 – Blockaid

- Financing series: Series B;

- Launch date of the company and/or the project: 2022;

- Amount raised: $ 50 million.

Blockaid is a security company specializing in the protection of cryptocurrencies and the fight against cybercrime in the blockchain ecosystem. Its mission is to secure users, companies and exchange platforms for hacking and theft of funds, while developing advanced technologies to detect and prevent attacks.

In addition to its technical solutions, Blockaid undertakes to educate users on best safety practices. The company offers personalized services adapted to the needs of its customers, as well as a support in the event of a hack to limit losses and restore security.

🔒 Our complete guide to secure your cryptocurrencies

Blockaid recently announced a fundraising $ 50 million during a series B financing round, led by Ribbit Capitalwith the participation of GV (formerly Google Ventures), varying and cyberstarts.

This investment echoes the recent Hack of Bybit, who saw the sad record of 1.46 billion Dollars stolen in his boxes.

The funds raised by Blockaid will allow him to finance its operational growth as well as research and development. The company also plans to increase its workforceaiming to more than double his current team of 70 people to better meet the growing demand for safety solutions in the crypto sector.

Zengo: the ultra-secure mobile wallet for your cryptos

2 – Bitwise

- Financing series: Funding Round;

- Launch date of the company and/or the project: 2017;

- Amount raised: $ 70 million.

Bitwise is a company founded in 2017, specializing in the investment and management of Crypto on behalf of third parties. It quickly established itself thanks to its platform which allows investors to access products based on different cryptocurrencies.

Among its flagship products, we can find the “Bitwise 10 Crypto index” index, which allows investors to expose themselves to a diversified basket of the 10 most capitalized cryptomonnaies. In addition, the company offers the possibility of exposing themselves to Bitcoin and Ethereum cryptos via its ETF Spot in the United States.

Bitwise raised $ 70 millionduring a lap of Funding Round led by Electric Capital in February. This funding saw the participation of Parafi Capital, General Catalyst and many other venture capital funds.

Since its launch, Bitwise has increased $ 154.5 million harvested.

Trade Republic: buy cryptos and actions in 5 minutes

1 – Ethena (ENA)

- Financing series: Private dirty/Strategic Round;

- Launch date of the company and/or the project: 2021;

- Amount raised: $ 116 million.

Ethena is a decentralized finance protocol (DEFI) deployed on blockchains Ethereum and Solana, which offers a stable algorithmic, named the USDE. The protocol also has its governance cryptocurrency, ENA.

During the month of February, Ethena revealed a private sale amounting to $ 100 million in tokenswhich took place last December. This private sale has seen the participation of Polychain Capital, Pantera Capital, Dragonfly Capital, Franklin Templeton and F-Prime Capital.

In addition, Ethena recently announced that she has lifted $ 16 million with the centralized Exchange investment fund Mexc.

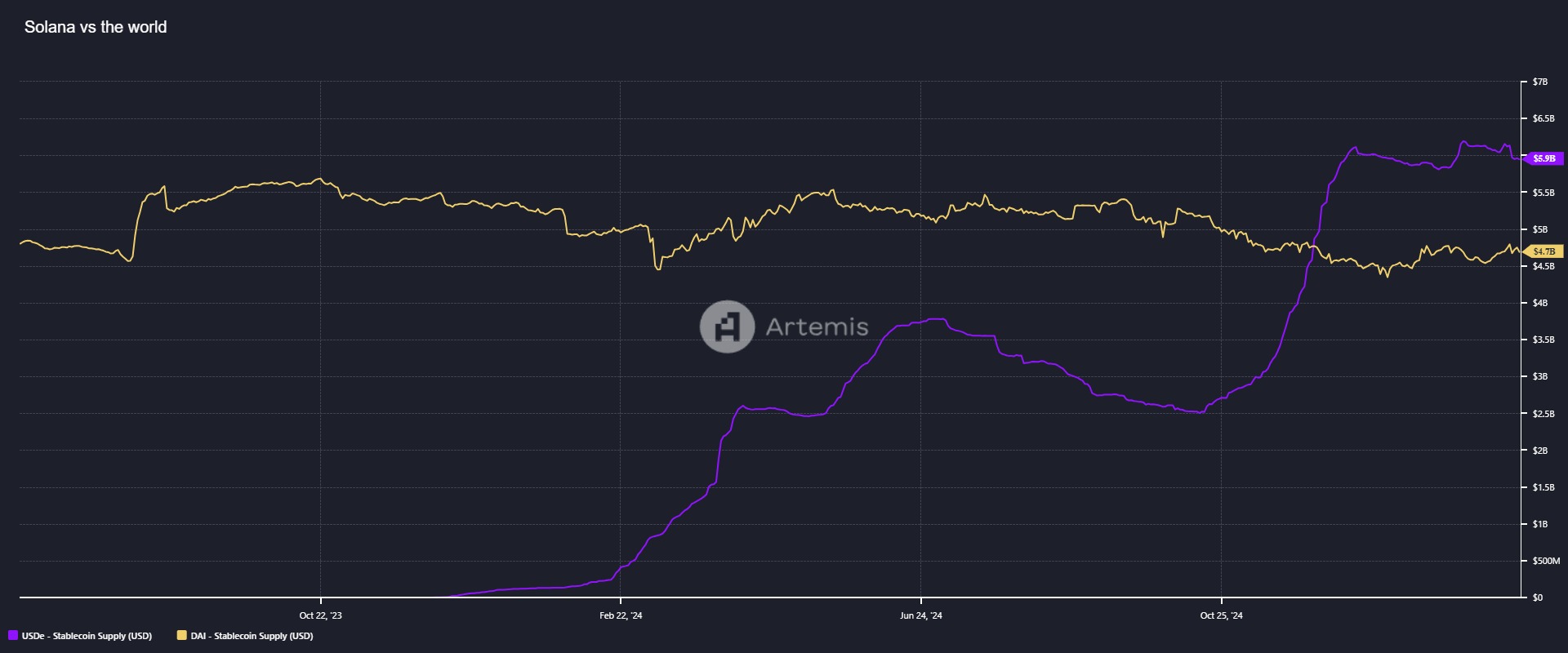

Graphic representing the Market Cap des Stablecoins Usde (in purple) and DAI (in yellow)

As we can see on the above graph, the Market Cap du Stablecoin d'Ethena, The USDE has experienced strong growth lately. In December, the USDE even exceeded the DAI in this metric, thus becoming The 3rd most capitalized Stablecoinbehind the USDC in 2nd place and the USDT in 1st place.

According to terminal artemic data, The USDE market cap therefore amounts to $ 5.9 billion. The Prix de l'Ena is gaining more mixed success since it records a negative performance of – 45 % in the last 30 days.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Sources: Dropstab, Terminal Artemis

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital