Conducted by JP Morgan, a study reveals that the number of cryptocurrency buyers in the United States has quadrupled since the Covid-19 crisis. During this period, the increased growth of household savings caused the number of new cryptocurrency insiders to explode.

Cryptocurrencies are democratizing

JP Morgan, the largest investment bank in the worldrecently published a report on the adoption and popularity of cryptocurrencies among US households.

In its study, the financial group estimates that the number of people who have invested in this type of asset has multiplied by 4 between 2020 and June 2022, increasing from 3% to 13% of the American population.

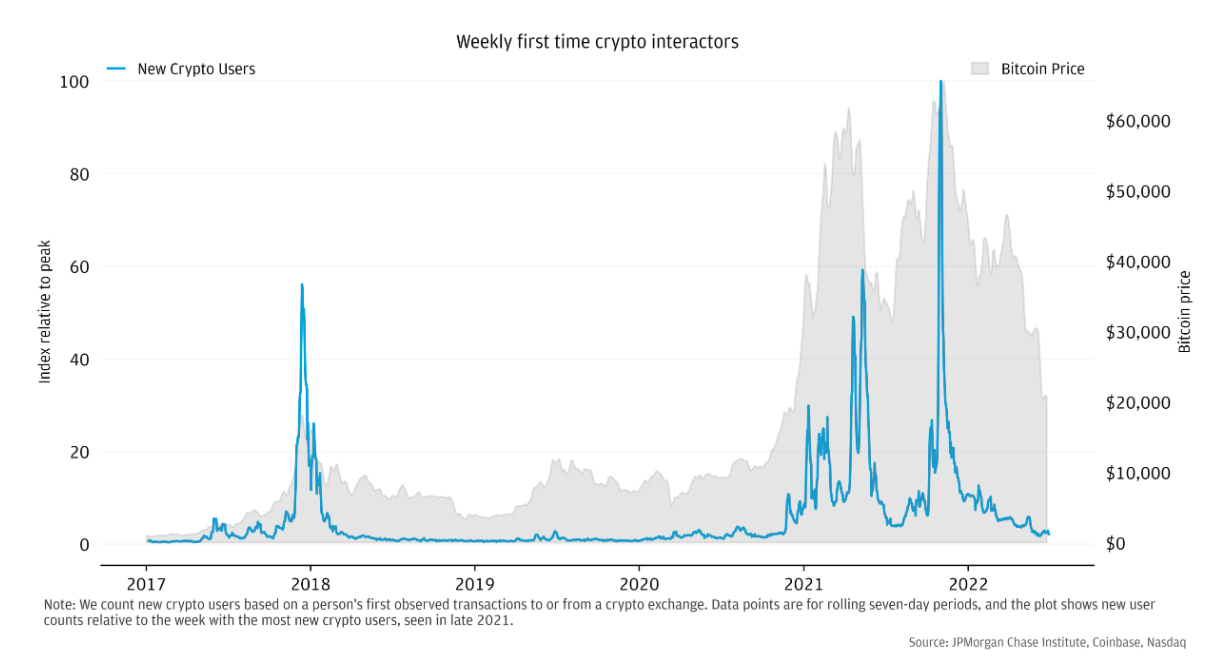

Additionally, the vast majority of newcomers to the cryptocurrency market started investing when Bitcoin (BTC) was at its all-time highs in the spring and fall of 2021:

Figure 1 – Graph representing a person’s first interaction with a cryptocurrency exchange, on a weekly scale.

Consequently, while these new entrants quickly found themselves at a lossthe most seasoned investors have been able to seize this opportunity to make a profit.

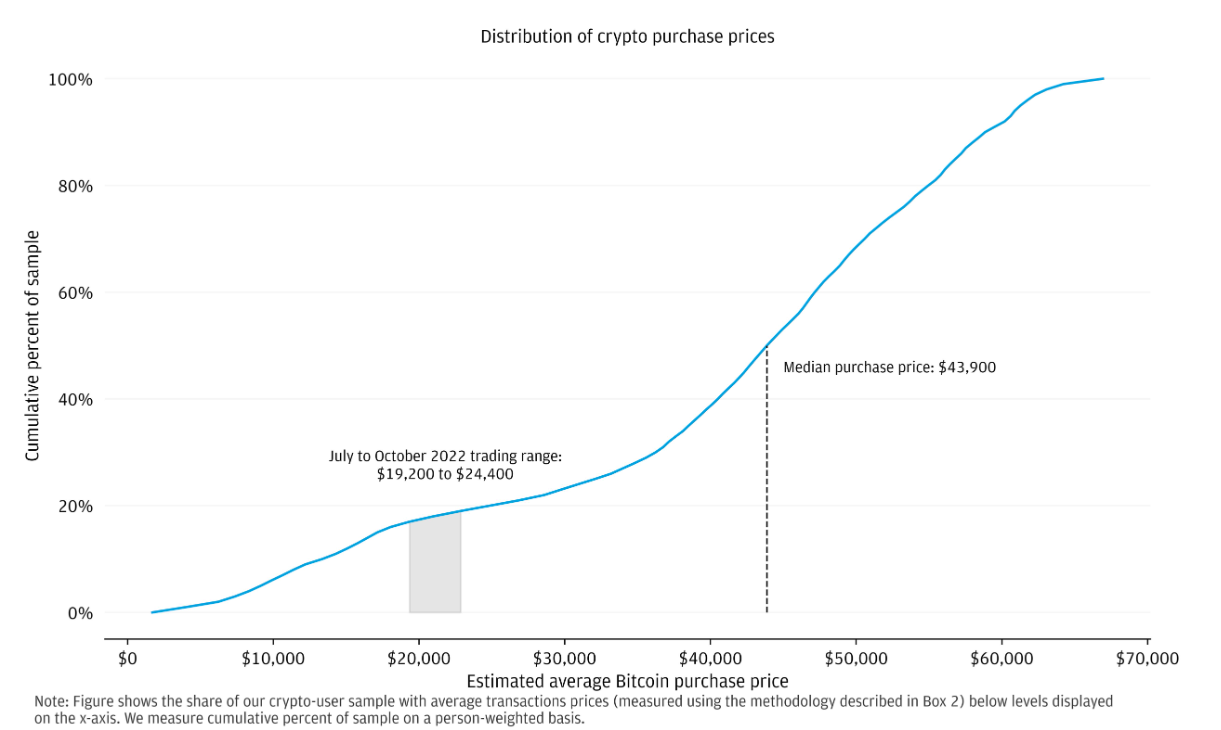

In its study, JP Morgan estimates that the average purchase price of Bitcoin is between $42,000 and $45,000. In addition, more than 80% of investors would currently be at a lossaccording to data released in conjunction with Coinbase and Nasdaq:

Figure 2 – Estimated average Bitcoin purchase price.

From the chart, with Bitcoin price currently stagnating around $17,000, we can estimate that 5 out of 6 people are at a loss on their investments.

To achieve this table, JP Morgan studied the date of various liquidity transfers from its Chase banking subsidiary to cryptocurrency exchanges, according to the closing price of BTC.

Nevertheless, these data should be considered as general tendencies : the methodology used by the study does not allow a high enough level of precision to ensure the accuracy of the information to the nearest percentage.

👉 How to buy Bitcoin in 2022? Get guided step by step

The No. 1 exchange in the world – Regulated in France

10% off your fees with code SVULQ98B 🔥

Why this craze for cryptocurrencies?

As critics of the sector cry speculative bubble, several tangible factors can explain this enthusiasm for investing in cryptocurrencies.

Firstly, the Covid-19 pandemic has created a significant savings surplus in a number of households. Caught between a brutal economic crisis and muddled future prospects, households have turned to cryptocurrencies, as the study points out:

“U.S. household engagement in cryptocurrencies has increased sharply during the COVID-19 pandemic, alongside a substantial increase in the overall personal savings rate. »

From a macroeconomic point of view, to support struggling industries, central banks around the world have massively created money. Before having the effect of the current inflation, these monetary flows fed the financial markets, creating prices decorrelated from any economic reality.

In this way, citizens and institutions have turned to cryptocurrencies with the idea of making a profit. According to a report by the Association for the Development of Digital Assets (ADAN)nearly half of investors see cryptocurrencies as an opportunity to grow their investments.

Today, in a context of global economic and financial crisis, the enthusiasm for cryptocurrencies seems to be weakening. However, the biggest players in traditional finance are stepping up their actions in this sectorstarting with JP Morgan which recently trademarked a future digital wallet.

👉 To learn more about the notion of digital wallet

The best way to secure your cryptocurrencies 🔒

🔥 The world leader in crypto security

Sources: JP Morgan, ADAN

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.