The code of crvUSD, the future algorithmic stablecoin of the decentralized finance (DeFi) protocol Curve, has just been published on the GitHub platform. According to the whitepaper written by the founder of Curve himself, the stablecoin will be over-collateralized by different cryptocurrencies and can be minted by users when they deposit liquidity.

Curve publishes the code of its stablecoin

Timidly announced last July by the founder of Curve Michael Egorovthe algorithmic stablecoin of the popular decentralized finance (DeFi) protocol saw his code as well as his white paper publicly published on the GitHub platform.

As we reported last August, “crvUSD” will effectively be a decentralized stablecoin over-collateralized by different cryptocurrencies in a manner similar to Maker’s DAI.

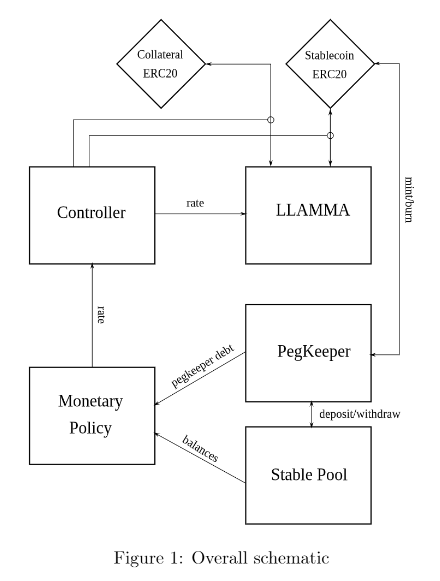

According to the whitepaper written by Michael Egorov himself, users will be able to mint the crvUSD by participating in the over-collateralization of the latter by depositing cryptocurrencies on Curve, all structured by a unique mechanism called Lending-Liquidating AMM Algorithm, or more simply LLAMA.

Schematization of the structure of the crvUSD

In his conclusion, the founder of Curve explains that these different mechanisms could solve the various problems inherent in algorithmic stablecoins :

“The mechanisms presented can hopefully resolve the risk of liquidations for making and borrowing stablecoins. In addition, stabilization and automatic monetary policy mechanisms can help maintain the peg without the need to maintain an SMP. [Peg Stability Module, NDLR] excessive. »

Indeed, unlike stablecoins like USDC or USDT which are over-collateralized with “real” money, algorithmic stablecoins are backed by different cryptocurrencies. Often, in order to cope with market volatility, algorithmic stablecoins are over-collateralized to some degree with USDC or USDT.

Although the crvUSD code has been publicly revealed, no date has been issued for the official release of the stablecoin.

The crvUSD will thus join the CRV token of Curve, which is distributed as a reward on the decentralized finance platform for users depositing cash there. Also in the interest of decentralization, the CRV token also acts as Curve’s governance token.

👉 Also read – The advent of decentralization? Uniswap overtakes Coinbase in volume traded

Trade on the leading DEX

⛓️ A platform at the heart of DeFi

Source: GitHub

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.