The sun is back on the crypto markets. After going through 8 months of turbulence, we could experience a calm phase which could lead Bitcoin to develop the last phase of its bullish cycle. Be wary however, this new movement could well be a final bullish trap!

It's official: Donald Trump is elected president of the United States

It is Wednesday, November 6, 2024 and the price of Bitcoin is moving around $74,000.

It's done ! The event that we have been waiting for for several months finally reveals its results. The Republican Party wins this 2024 election which will see the installation of Donald Trump for a second and final term as president.

The markets reacted very positively last night, as Trump's victory took shape. The S&P 500 in particular could open with a bullish gap this afternoon, with futures contracts having reached a new historic high overnight.

Bitcoin is following in the footsteps of traditional markets, reaching a new high of more than $75,000 early this morning in France. BTC made the market wait 238 days before achieving this feat.

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin/USDT | +8.10% | +2.90% | +18.70% |

| ETH/Bitcoin | -0.10% | -4.30% | -9.00% |

📈 Surf the bull run by surrounding yourself with experts! Join us now at Cryptoast Academy

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

Massive short liquidations on Bitcoin derivatives

What is striking this morning when observing the derivatives markets is neither the open interest, which remains in an excess zone, nor the financing costs, which are just as high, but rather the short liquidations recorded between 1 a.m. and 5 a.m.

Indeed, yesterday we noted an excessive fall in funding while, at the same time, prices continued to rise. This information guided us towards the hypothesis of an accumulation of short positions in anticipation of a further decline in Bitcoin, with a failure to $70,000.

In just 4 hours, $171 million of these bearish positions were liquidated, mechanically sending funding rates back towards excess zones. As I write these lines, the day has just begun, but we have to go back to December 2021 to find an equivalent level of daily short liquidations!

The squeeze could also continue since the same mechanism seems to be happening again: falling financing rates, a volatile price, but this time open interest is increasing. It is therefore likely that volatility will not calm down.

Bitcoin Derivatives Markets in 4 Hours

Buy cryptos on eToro

Bitcoin: avoid reintegration to restart the bull run

The title of this article may seem somewhat optimistic to you. That's an understatement to say the least. Yes, it is optimistic, but it is also the standard objective of a second bullish leg which would come to life today if we manage to launch and then maintain a phase of euphoria: the bullrun.

Aligned with the cycle and seasonality, it is reasonable to believe that the positive signals sent today could be the catalyst to trigger the terminal phase that many of us have been waiting for.

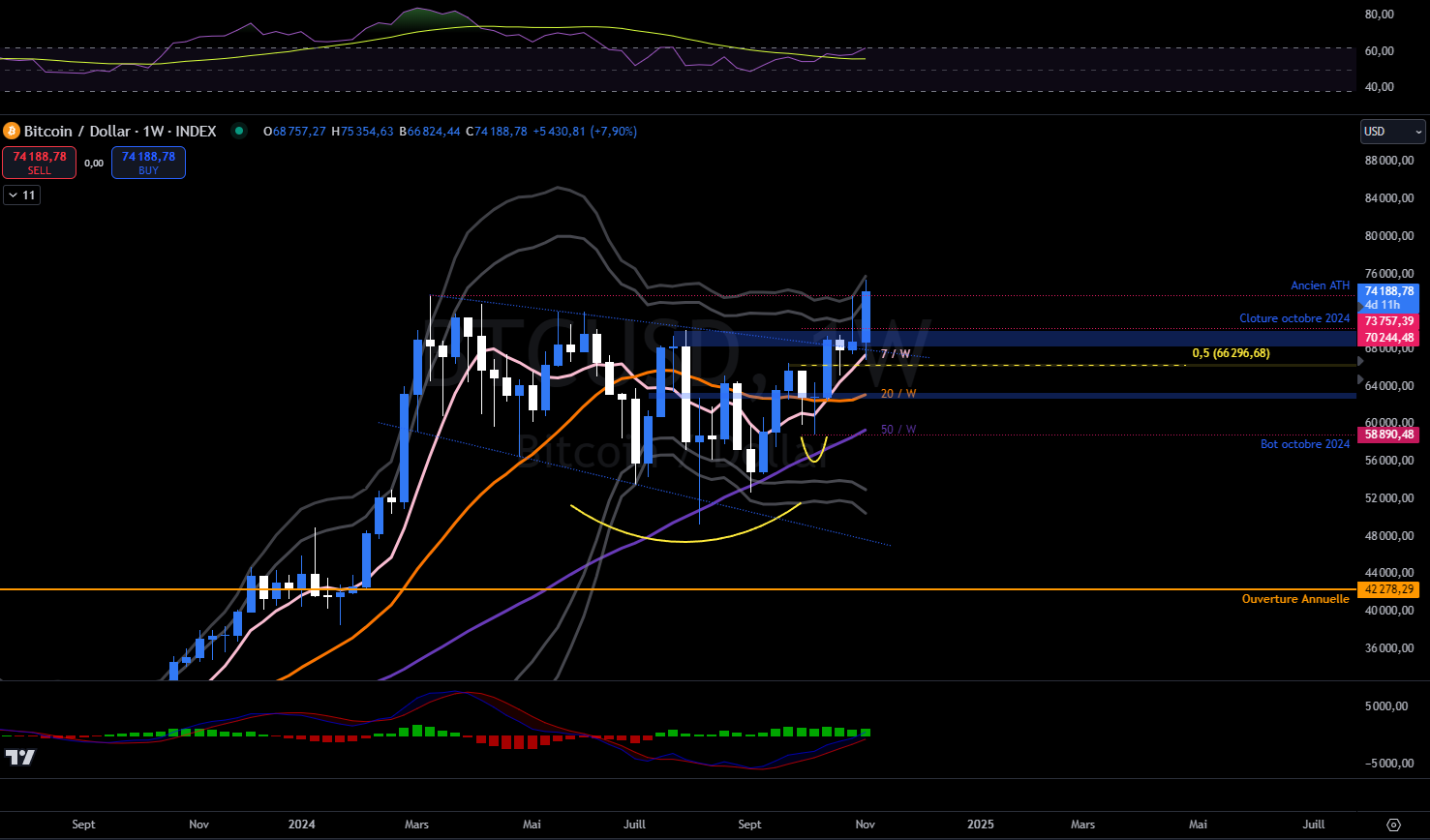

However, be careful, the crypto market, which is often contrarian, is very talented when it comes to trapping operators. So be wary: a re-entry into the weekly close below the historic peak of March 2024 could send a first negative signal to the market.

👉 Our guide to easily buying Bitcoin

All planets seem to be aligning for a scenario in which Bitcoin continues in an upward trend after having reaccumulated for 8 months. To keep this scenario at a high probability level, price action must not re-enter below the old ATH and then settle sustainably below $70,000.

If price action were to consolidate and then close weekly below this level, it would re-enter the October candle, which would open up the likelihood of a deep correction towards a target of $61,000 to $63,000.

The good news lies in the configuration of the Bollinger bands, which favors a return of volatility with a dynamic realignment of supports upwards. For all practical purposes if a downward hunting movement were to be triggered, here are the support levels offered by these indicators on the Bitcoin Index:

- 7-week moving average: $67,319;

- 20-week moving average: $63,088;

- 50-week moving average: $59,322.

Weekly Bitcoin price chart

👉 Would you like to discover more technical analyzes on Bitcoin or altcoins? Join our premium Cryptoast Academy group where we share altcoin analysis charts every week!

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

In summaryBitcoin manages to achieve the feat of a new historic high point 8 months after the previous one. A very long wait for market observers, who expect the price of BTC to continue in an upward trend. Distrust, because the market rarely gives what the majority expects, and BTC could trap the most reckless. Initially, it will be appropriate to monitor the absence of reintegration below the March ATH at the weekly close.

So, do you think BTC can emerge from its 2024 consolidation? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new analysis of Bitcoin.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.