Paxos has been ordered to stop issuing Binance’s BUSD stablecoin, and the crypto market has already picked its big winner. Tether’s USDT has garnered $1 billion in capitalization since yesterday, thanks to investor flight. The king of stablecoins has just further consolidated its position.

Investors flee from BUSD to Tether’s USDT

Although Changpeng Zhao, the CEO of Binance, was reassuring, the news that fell earlier this week put a stop to the BUSD. Binance’s stablecoin, which dreamed of being a serious competitor to Tether’s USDT, is in trouble. We explained it to you yesterday, the exchange platform saw more than a billion dollars of stablecoins leaving its coffers yesterday, in a great movement of panic among users.

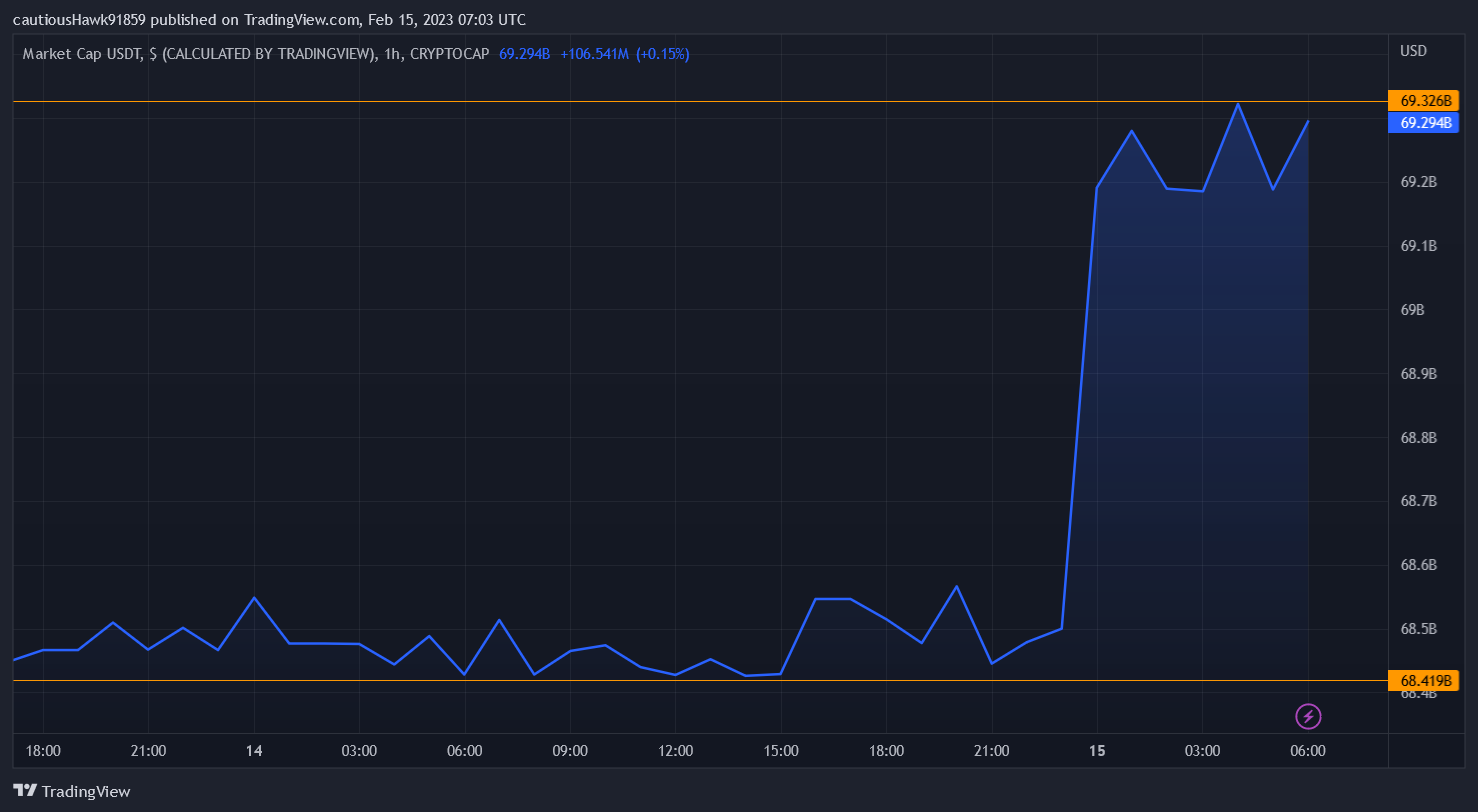

And the winner is… Tether. The capitalization of USDT has indeed taken more than a billion dollars since yesterdaya sign that the ex-BUSD supporters have taken refuge in the arms of the largest stablecoin of the moment:

USDT Capitalization Explodes Since Binance’s BUSD Struggles Started

The capitalization of BUSD shows the opposite movement. While it reached 16 billion dollars on February 12, it has shrunk to $15 billion This morning.

👉 To go further – Stablecoin, all about this type of cryptocurrency

The best way to secure your cryptocurrencies 🔒

🔥 The world leader in crypto security

Tether (USDT), undisputed king of stablecoins

If there is one constant in the world of cryptocurrencies, it is the almost supernatural ability of Tether to continue to exist and bring investors together, despite the scandals and doubts that have marred its existence. His USDT stablecoin just proved he was king again, and its market dominance of “stable” cryptos now exceeds 50%.

The trend is not found as much in the USDC of Circle, the second largest stablecoin at the moment. It has actually also lost momentum: its market cap exceeded 41 billion dollars on February 12, but it fell to 40 billion dollars this morning.

Why this investor favor for Tether? The reason seems partly geographical. Paxos and Circle (the issuer of USDC) are both located in the United States, where the SEC prowls. As for Tether, it is located in Hong Kong, and is therefore not reachable by the American financial policeman. Something to remind us that despite the ideals of decentralization carried by cryptocurrencies, geographical location plays a significant role.

👉 Listen to this article and all other crypto news on Spotify

🎁 Cryptoast Research Launch Offer

1st Newsletter Free with the code TOASTNL

Sources: TradingView, CoinGecko

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.