Ark Invest, Cathie Wood’s investment fund, took advantage of GBTC’s 40% discount to Bitcoin to invest $2.8 million for its own ETF.

Ark Invest trusts Grayscale’s GBTC

While Grayscale’s GBTC investment product struggles to obtain Securities and Exchanges Commission (SEC) approval to be converted into an ETF, the investment fund Cathie Wood’s Ark Invest opted to take advantage of the decline. Indeed, the fund bought on Monday 315,000 GBTC shares for $2.8 million.

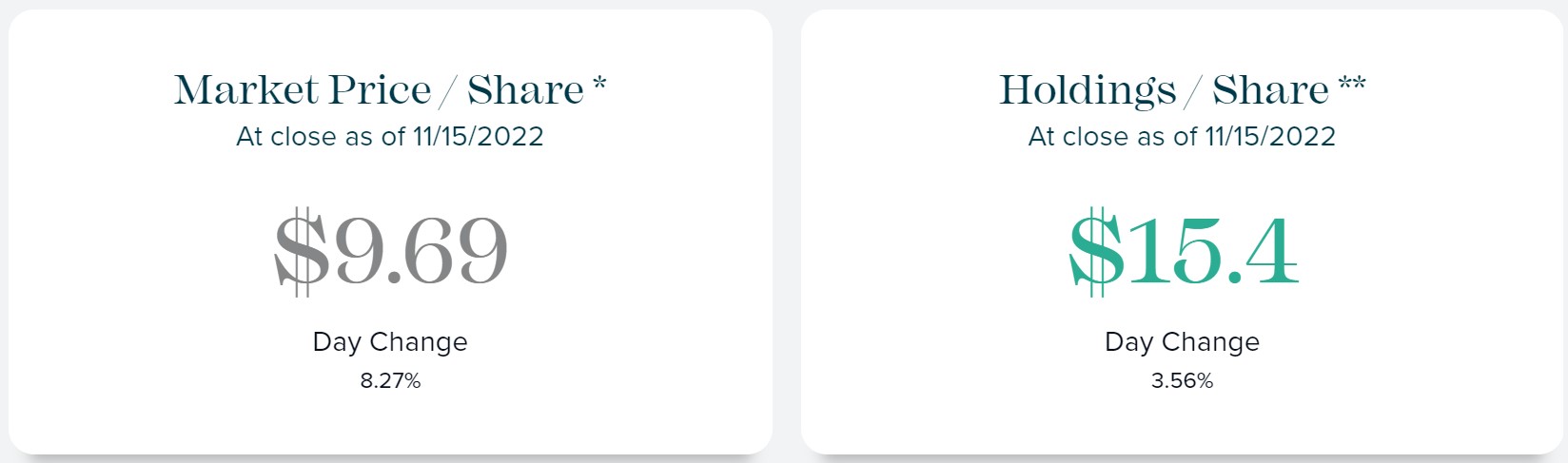

If Bitcoin is at historic lows, this is all the more true for GBTC. Indeed, the latter is currently traded on the market at a price of 37 to 40% less than its real valuenamely the price of CoinDesk Bitcoin Price Index (XBX) that it is supposed to follow:

Figure 1 – Difference between the real value of GBTC and its market price

This discrepancy comes from the very construction of the fund. When it was launched, institutional investors exchanged Bitcoin (BTC) for shares of GBTC. This was profitable at the time, as the spread was favorable before the trend reversed. The actors participating in this arbitration therefore relied on the promise of emerge a winner when the GBTC would be converted into an ETF.

However, this maneuver required a blocking period, and when the market price fell below the real value, several funds like Three Arrows Capital (3AC) found themselves in losses.

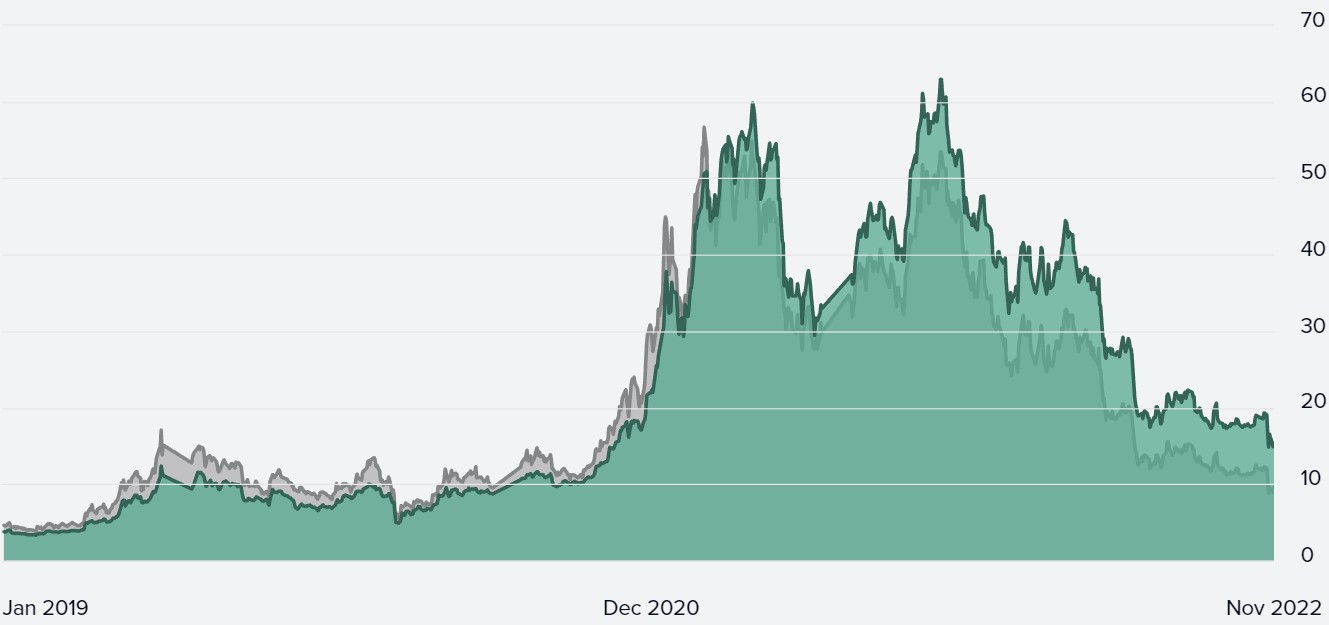

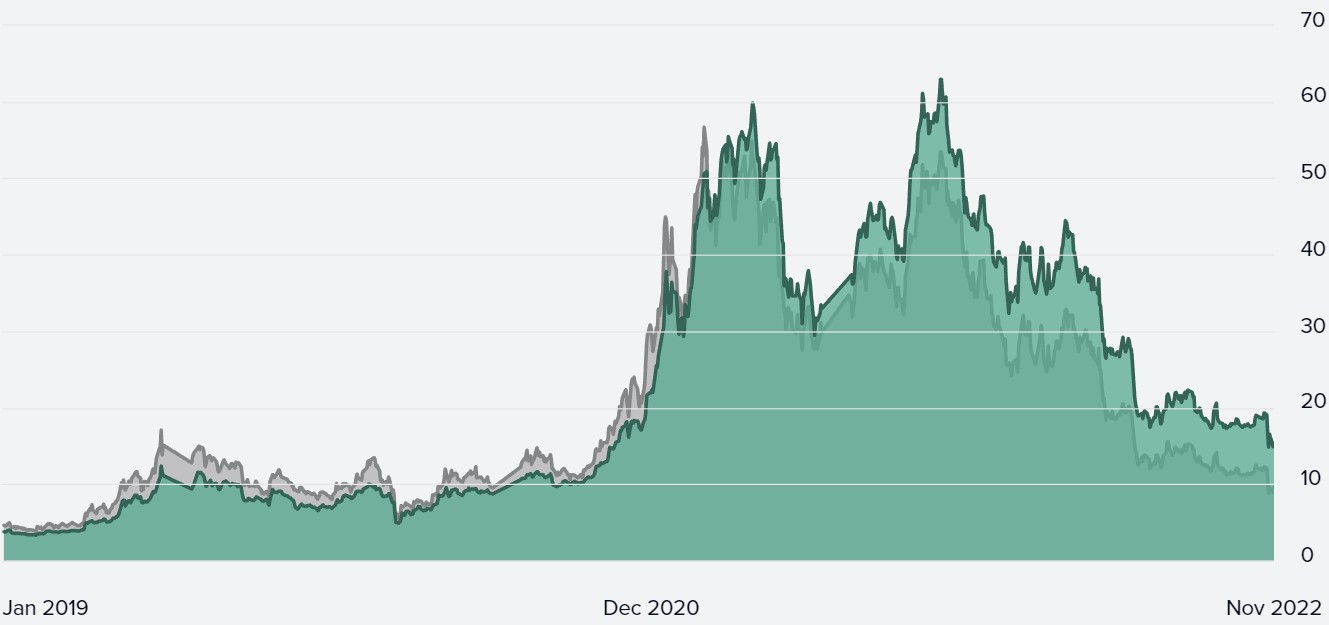

The two graphs overlaid below show the evolution of GBTC and its underlying XBC :

Figure 2 – Evolution of GBTC and XBX

👉 To go further – Take your first steps in cryptocurrencies with Binance

The No. 1 exchange in the world – Regulated in France

10% off your fees with code SVULQ98B 🔥

A risky bet, but potentially very lucrative

If and when the GBTC actually becomes an ETF, Ark Invest will have done very well in this operation. But SEC validation is a long time coming, and the gap between GBTC and XBX keeps growing as investors lose patience.

However, if we remember the famous adage ” buy to the sound of cannon “, the current market condition shows that we are at a long-term low point.

Additionally, a position of $2.8 million remains weak in comparison of the financial power of Ark Investwhich greatly limits the risk.

The shares purchased came to strengthen the ETFARK Next Generation Internet ETF(ARKW). The latter sees the GBTC representing 4.98% of its composition. In this basket of assets, we can also find Tesla, Zoom, Coinbase, Shopify or Block shares.

With such exposure to technology stocks, the ARKW is unsurprisingly displaying a devaluation of almost 75% since its all-time high in April 2021:

Figure 3 – ARKW ETF price

If the SEC eventually approves GBTC, it could become the first Bitcoin-backed Spot ETF recognized by the US financial policeman. It could then blow a wind of confidencein an ecosystem that pays for the mismanagement of Sam Bankman-Fried and his companies.

👉 Also in the news – Are there any murky ties between Sam Bankman-Fried and SEC Chairman Gary Gensler?

Join Experts and a Premium Community

PRO

Invest in your crypto knowledge for the next bullrun

Sources: Grayscale, Ark Invest, TradingView

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

;Resize=(1200,627)&impolicy=perceptual&quality=medium&hash=d618c6d43c7e31d91481b51581ec1150a117f4028795b6bc981163acdd4e8756)