In a context where Bitcoin achieves a new weekly high by crossing $65,000, Ether is struggling to regain the appeal of its youth. However, 2024 was off to a good start, with price action revisiting $4,000 in March. These last few weeks have nevertheless allowed a major cleansing of all the frustration accumulated by the detractors of the project. Could this deeply negative sentiment displayed on the networks, combined with the crossing of significant resistance, revive price action?

It is Friday September 27, 2024 and the price of ETH is moving around $2,650.

Ether, the cryptocurrency of the Ethereum blockchain, suffers from particularly negative market psychology. Investors no longer have confidence in its ability to outperform! Still, Ethereum is a blockchain industry staple with high-value fundamentals.

The unit price of ETH does not change the intrinsic qualities of the project, and the psychology of the market could very quickly switch back to optimism from the moment the charts show strength again. Furthermore, once sentiment changes, the recapitalization of Ether could be very rapid.

After several weeks of FUD around Ether and the omnipresence of sellers on the market, what would be the pivot that would allow investors to shift towards a more positive bias?

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

Ethereum: what to say about relative strength?

| Pairs with Ethereum | 24 hours | 7 days | 1 month |

| Ethereum/USDT | +0.70% | +4.00% | +4.80% |

| Ethereum/Bitcoin | -1.00% | +0.80% | -4.30% |

👉 How to easily buy Ethereum (ETH) in 2024?

We can see, on a weekly basis, a first reaction in the relative strength of ETH against the rest of the altcoins. Although it is too early to draw any conclusions, this movement should be monitored since it occurs in a major area of interest: the middle of an ETH/TOTAL3 range in development since 2017.

This movement is also confirmed by the RSI which also rebounds from the bottom of its neutral zone. Flipping below could cause further bearish acceleration. On the contrary, maintaining the last low of the RSI or building a divergence on this zone could be a harbinger of recovery.

Chart of Ethereum against TOTAL3 weekly

Buy cryptos on eToro

Against Bitcoinprice action is now working historical levels not revisited since 2021. The RSI zone in which ETH/BTC operates has only been crossed 3 times:

- in October 2023,

- in August 2019,

- in December 2018.

It is therefore very rare to observe such momentum on the ETH/BTC pair. The probability of seeing the construction of a reversal structure appear at current levels is relatively high.

While it is possible to continue falling towards the pivot of the 2021 bull run, the level at which we will look for RSI divergence, re-entry above the January 2021 close could mark a first positive signal that could gain momentum if it managed to cross the middle of the bearish channel, then the green zone and the top of the channel.

Ethereum vs. Bitcoin Weekly Chart

Buy cryptos on eToro

ETH, crosses the $2,850 to $3,000 zone

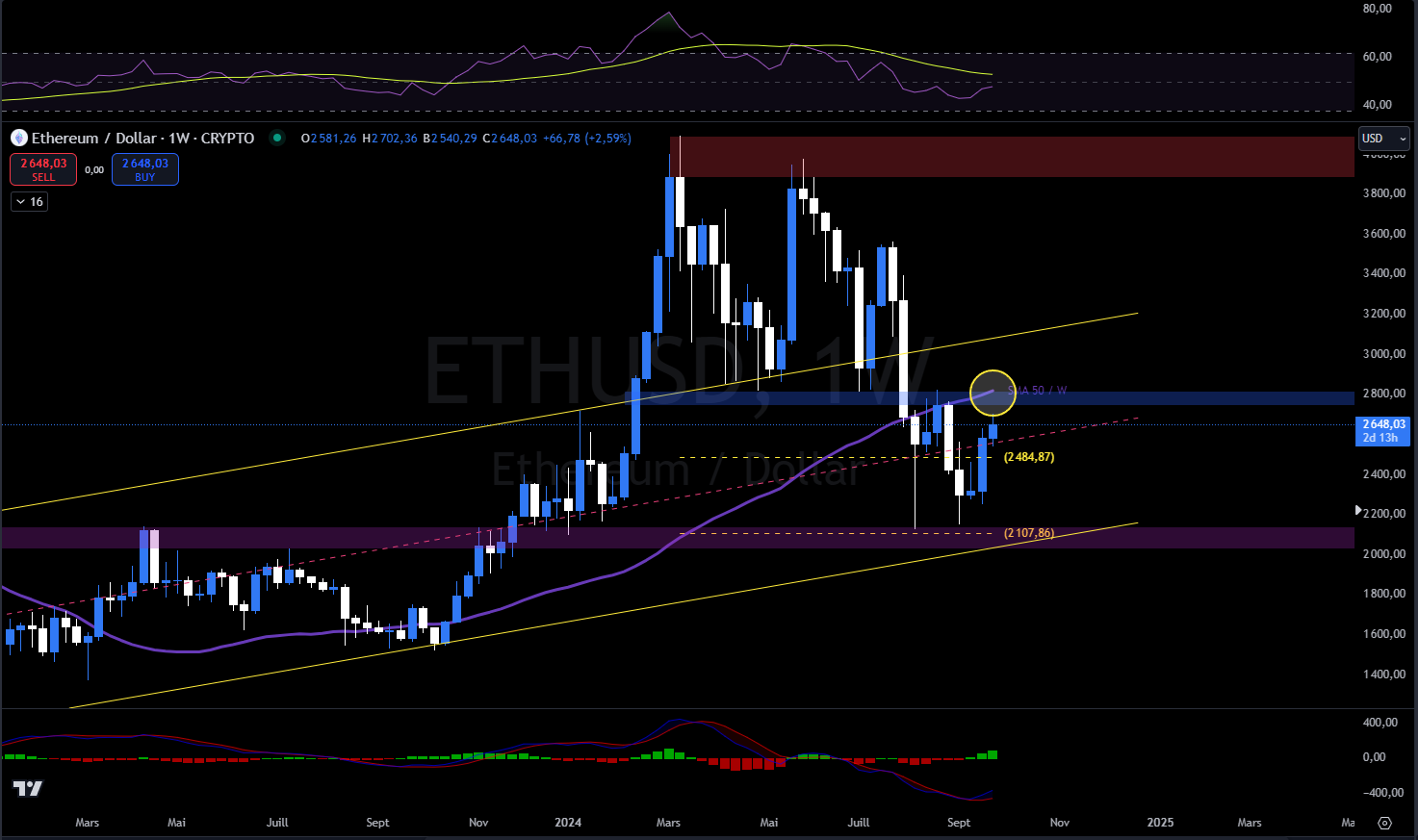

To change the psychology of the market, Ether must cross the $2,800 to $3,000 level. This level is the pivot for the year 2024. We crossed it at the start of the year before visiting $4,000. It was also the crossing and then the retest of this zone which caused the two falls towards 2,100 dollars.

Over the month of September, the price action has built a configuration of 3 Japanese candlesticks which allows us to envisage a low point at $2,100. Elements are missing to confirm this since the structure according to the DOW law does not show any change in trend.

This could nevertheless build above $2,850 in the case of price action that settles there. However, the most likely scenario lies in the construction of a new low higher than the previous one before preparing to cross $2,850 to establish a new high point higher than the previous one.

The most favorable zone for the construction of this trough is between $2,400 and $2,500, although a final wick close to $2,100 remains a possibility in the event of a hunt for liquidity.

However, any bullish scenario would be abolished in the event of a close below $2,000!

Weekly ETH price chart

In summary, the Ethereum cryptocurrency suffers from the negative psychological state of market participants. However, the fundamentals remain solid and a change in bias only depends on crossing $3,000! In this case, Ether could very quickly recapitalize and revisit $3,800.

So, do you think ETH can outperform the crypto market again? Don't hesitate to give us your opinion in the comments.

Have a nice day and we'll see you next week for a new technical analysis of Ethereum.

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: TradingView, Coinglass, GlassnodeETF

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.