Ethena, a protocol specializing in decentralized stablecoins, plans to launch a new stablecoin called “UStb” via BlackRock and Securitize. This stablecoin will be backed by BlackRock's BUIDL tokenized fund, consisting mainly of US Treasury bills and repurchase agreements.

Soon a new stablecoin from Ethena thanks to BlackRock's BUIDL fund

The Ethena protocol, which offers decentralized stablecoins, is preparing to launch a stablecoin collateralized by BUIDL, the tokenized fund of finance giant BlackRock in partnership with Securitize.

We are excited to announce Ethena's newest product offering: UStb

UStb will be fully backed by @Blackrock BUIDL in partnership with @Securitizeenabling a separate fiat stablecoin product alongside USDe

Details below on why this is important: pic.twitter.com/jOIoMef7W3

— Ethena Labs (@ethena_labs) September 26, 2024

The stablecoin, which will be called “UStb”should “function like a normal stablecoin” and its reserves will therefore be supported by the tokenized fund BUIDL. The latter consists of investments in the US dollar, short-term Treasury bills and repurchase agreements (repo).

📩 Cryptoast becomes the first crypto media to tokenize the advertising space with SiBorg Ads

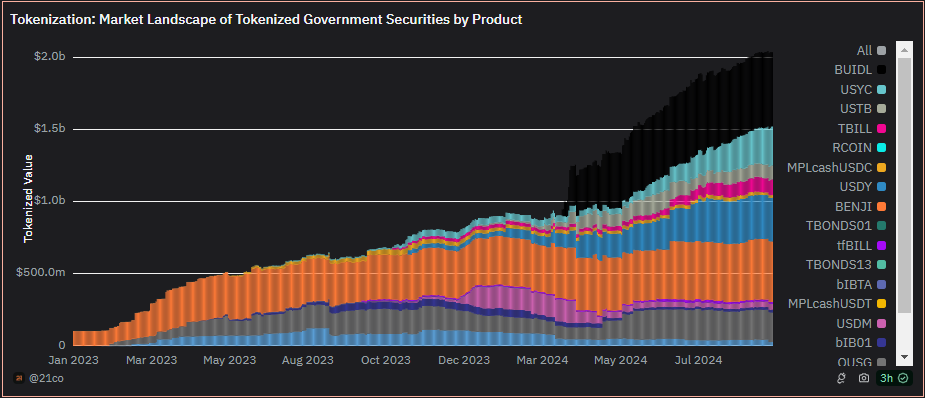

BlackRock's BUIDL fund, tokenized by Securitize, which launched in March 2023, quickly became the largest tokenized U.S. government securities fund, with over $522 million in assets under management.

By investing in U.S. Treasury bills and other money market instruments, BUIDL offers a low risk profile and high liquidity, 2 essential attributes to maintain the stability of UStb.

RealT: invest in real estate from $50

Today, BlackRock's BUIDL fund is the most capitalized in its category, despite its late launch. It is followed by BENJI, the tokenized fund of Franklin Templeton.

Financial landscape of different tokenized government securities (by 21Shares)

Note that Ethena Labs also plans to use UStb as collateral on the main centralized exchange platforms with which it is already in partnership, such as Bybit and Bitget. These platforms, which already accept USDe as margin guarantee, could thus offer users 2 distinct options in terms of risk and return.

🔎 RWAs and investment accessible to all: realistic or utopian promise?

UStb will exist as a completely independent product from the other stablecoin developed by Ethena, USDelaunched last February. USDe is distinguished by a different approach to UStb, using derivative-based hedging strategies rather than directly backing fiat or asset reserves.

The team has already announced that it will provide more details on the official launch date as well as new integrations with exchange platforms in the coming weeks.

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

Sources: Dune, press release

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.