After adding Bitcoin ETF to its pension fund last summer, Michigan State is now turning its attention to Ethereum (ETH). This time, it was Grayscale's products that caught the attention.

Michigan adds Ethereum (ETH) ETFs to its pension fund

Despite the launch of spot Ethereum (ETH) ETFs this summer in the United States, they are having a harder time convincing their counterparts backed by Bitcoin (BTC). Despite everything, this does not seem to discourage the state of Michigan, which invested heavily in Grayscale's Ethereum ETFs.

Indeed, it was first Matthew Sigel, head of digital assets research at VanEck, who spotted the new feature on X.

💡 How to invest in an Ethereum spot ETF in France?

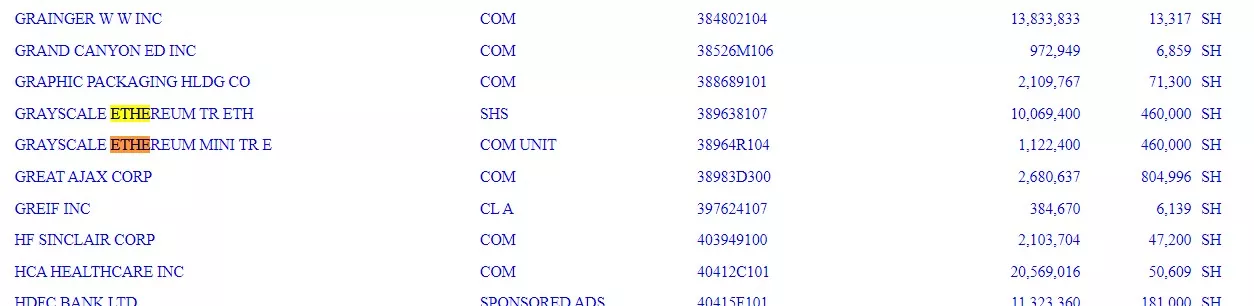

Looking at the form 13F sent to the Securities and Exchange Commission (SEC), we see that the pension fund not only holds ETHE, Grayscale's main Ethereum ETH, but also the “mini” version of this funds. At the current price, all of these shares worth approximately $10.4 million :

Excerpt from Michigan State Pension Fund Investments

Thus, these investments are a continuation of those already made last July. And for good reason, the State then added 110,000 shares of the Bitcoin spot ETF from Ark Invest and 21Shares, the equivalent of nearly $7.4 million today.

👉 Also in the news — The Ethereum (ETH) white paper celebrates its 11th anniversary – What future for the blockchain co-founded by Vitalik Buterin?

For its part, ETH is trading at $2,460, stable over 24 hours amid a wait-and-see attitude before the results of the American presidential election. As for Ethereum ETFs, they experienced another day of net outflows on Monday, to the tune of $63.2 million.

Coinhouse: the most famous French crypto platform

Sources: XDRY

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.