Little by little, as good fundamental news continues, the crypto market's eyes seem to be turning towards Ethereum. Could the coming weeks allow ETH, unloved at the start of the cycle, to regain its reputation?

It is Wednesday June 19, 2024 and the price of ETH is moving around $3,500.

The crypto market has known for several weeks a correction that pushes many altcoins towards the last supports of their medium-term uptrend. The weakest have sometimes even crossed the latter, at the risk of validating the start of a medium-term downward trend at the weekly close.

Over this period, I note a very pronounced technical gap between strong projects, which demonstrate resilience, and weak ones, on which capitulation is underway. This is a period that provides us with a lot of information on the probabilities of outperformance inherent to each token for the weeks and months to come.

In this context, in which category does Ethereum Ether fall?

| Pairs with Ethereum | 24 hours | 7 days | 1 month |

| Ethereum/USDT | +3.2% | -4.3% | +22.4% |

| Ethereum/Bitcoin | +0.19% | -3.63% | +9.23% |

👉 How to easily buy Ethereum (ETH) in 2024?

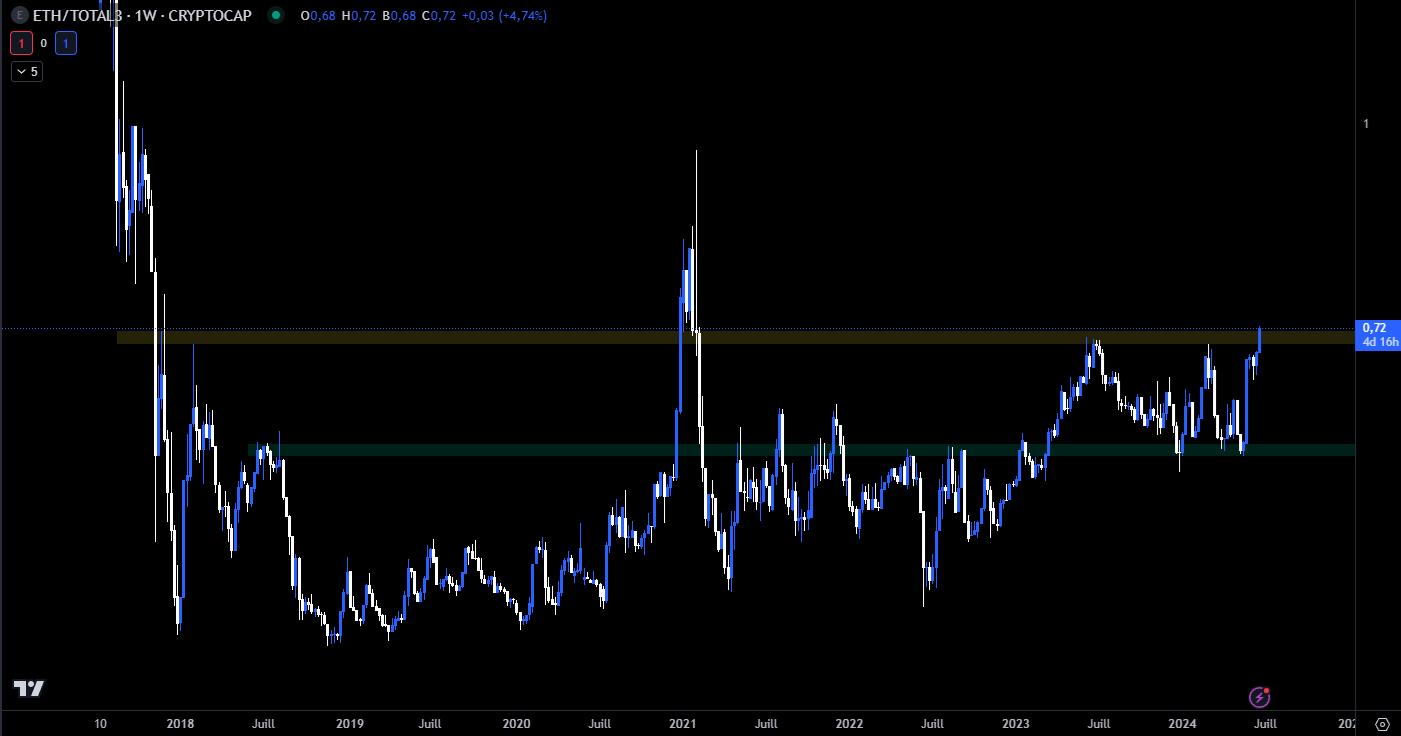

The chart below represents the relative strength of Ethereum against all altcoins. We are currently working through historic resistance. In fact, this was only crossed during the first hours of the 2021 bullmarket.

Currently, it is particularly interesting to see ETH able to drain capital from the altcoin market.

This is a sign of renewed confidence in ETH, which until now had come under strong criticism. If the launch of spot ETFs in the United States is a success, the external capital that will be added to the market could allow Ethereum to experience a phase of major outperformance by settling beyond the zone drawn in yellow below. below.

ETH price chart against the altcoin market

Cryptoast Research: Don't waste this bull run, surround yourself with experts

A bullish consolidation for Ether

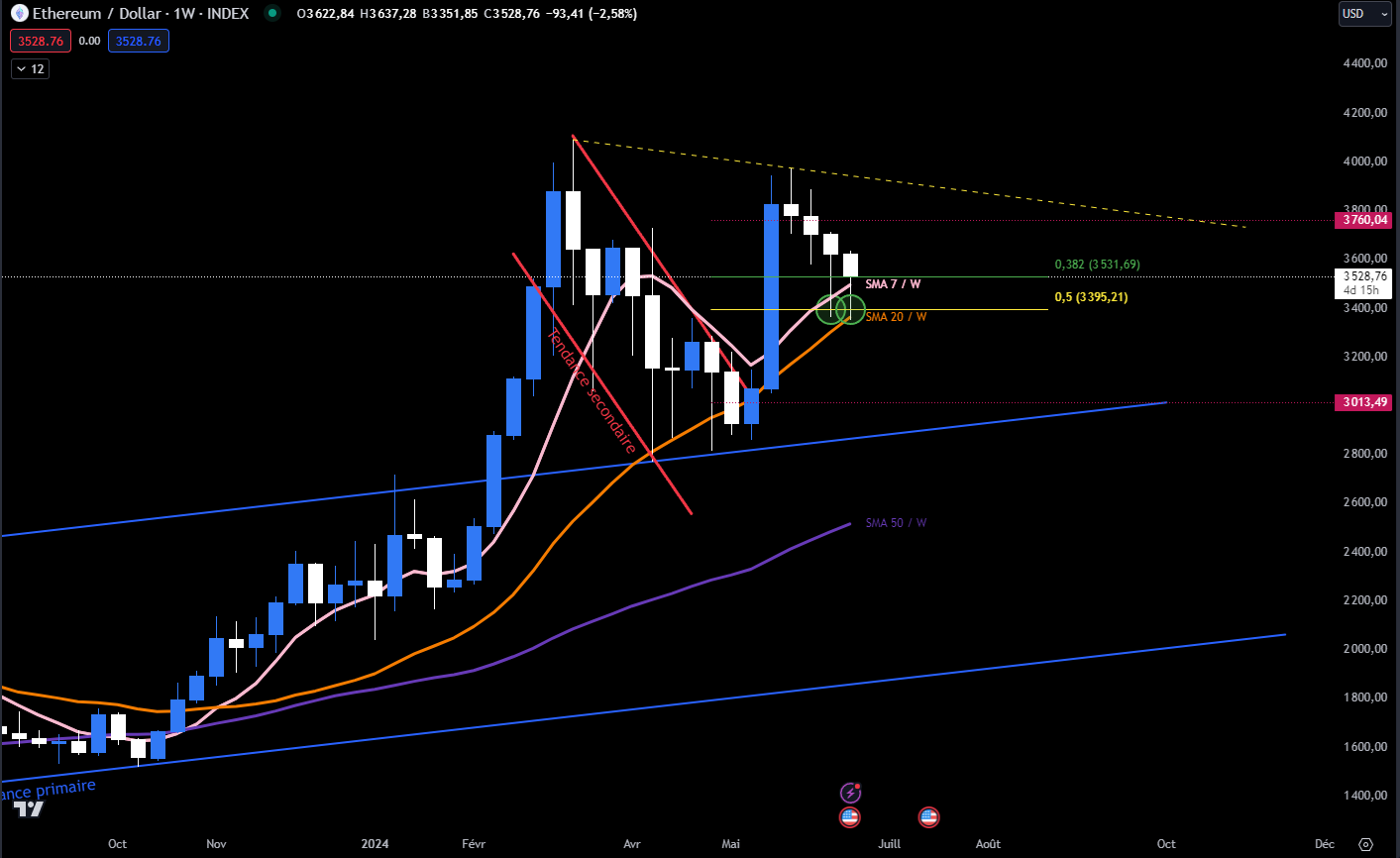

Ethereum demonstrates a lot of resilience against the dollar in this correction phase which affects the entire crypto market. The situation has changed little over the last 7 days: ETH has still been in an underlying upward trend for several months.

The asset maintains its consolidation in a compression triangle between the yellow dotted line and the top of the bullish channel drawn in blue in which its primary upward trend was in 2022 and 2023.

The price action at this point shows an upward-oriented consolidation as prices maintain:

- a 7-week moving average confluence with 0.382 fibonnacci retracement of the bullish leg « ETF » ;

- a 20-week moving average in confluence with the range equilibrium.

These levels must be maintained at the close on Sunday for this analysis to remain valid.

Buy cryptos on eToro

Maintaining the $3,400 to $3,500 zone close is therefore essential for Ethereum. It would thus maintain a positive polarity. The current compression zone nevertheless offers it a significant margin of volatility.

Prices could thus continue to work between $2,800 and $4,000, with the bullish camp seeking to defend or reconquer $3,400, and the bearish camp to settle below. However, we can already observe the majority of buyers at $3,400 given the strong reactions generated upon contact. For the moment, the latter have control over this asset.

If, however, the bullish camp were to fail to maintain this level, the polarity on Ethereum would shift into the negative. The bearish objective would initially be at 3200 then around 2800 dollars with a zone of excess materialized by the 50-week moving average close to 2600 dollars.

Weekly ETH price chart

Join the Cryptoast community on Discord

End clap for ETH's bearish oblique resistance?

The bearish oblique resistance which will have contained the ETH/BTC pair in its slow descent since “The merge” event seems to be gradually losing its relevance. Indeed, its traction force is facing the bottom of the range and prices are now moving above it, without making a clear break.

From now on, the main thing is to focus on the green support zone which must continue to keep ETH in its range against Bitcoin in order to envisage outperformance in the medium term. In addition, to promote renewed strength against BTC, it will be appropriate to produce a trough higher than the previous one.

Some will see this scenario as constructing an inverted “shoulder head shoulder” with a 0.06 neck line. Others will simply look for a higher high beyond this level, in order to establish the start of a medium-term uptrend according to the DOW law. Any outperformance scenario would be invalidated by crossing the lows achieved in May 2024.

Weekly price chart of Ethereum against BTC

Cryptoast Research: Don't waste this bull run, surround yourself with experts

In summary, Ethereum ETH is well entrenched in its uptrend. The consolidation continues, marking great resilience and preserving key price levels with a view to bullish continuation in the coming weeks.

The major polarity zone at $3,400 is the level that will need to be defended to avoid any degradation.

Against Bitcoin, Ethereum is still at the bottom of its range. A positive signal was given when spot ETFs were announced, but the chart does not currently show a bullish structure. It will be necessary to cross 0.06 to validate a potential reversal while preserving the lows of May.

So, do you think ETH can outperform the crypto market again? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.