It is now official: Ethereum spot ETFs are landing on US stock exchanges after the famous S-1 forms were approved. Are we going to see the same scenario as for the Bitcoin spot ETFs launched last January?

The race for spot Ethereum ETFs begins in the United States

As predicted by most analysts, theEthereum spot ETFs have received regulatory approval to launch on U.S. exchanges on Tuesday, July 23. These are the long-awaited S-1 forms that have been approved, 2 months after the 19b-4 which signaled the imminent arrival of these ETFs based on Ether.

It's official: Spot Eth ETFs have been made effective by the SEC. The 424(b) forms are rolling in now, the last step = all systems go for tomorrow's 930am launch. Game on. pic.twitter.com/9MaBDBA8co

— Eric Balchunas (@EricBalchunas) July 22, 2024

Just as was the case for the launch of Bitcoin spot ETFs last January, We can expect a new battle from the various issuers in order to capture the maximum volume on these new investment vehicles..

💵 How to invest in an Ethereum spot ETF?

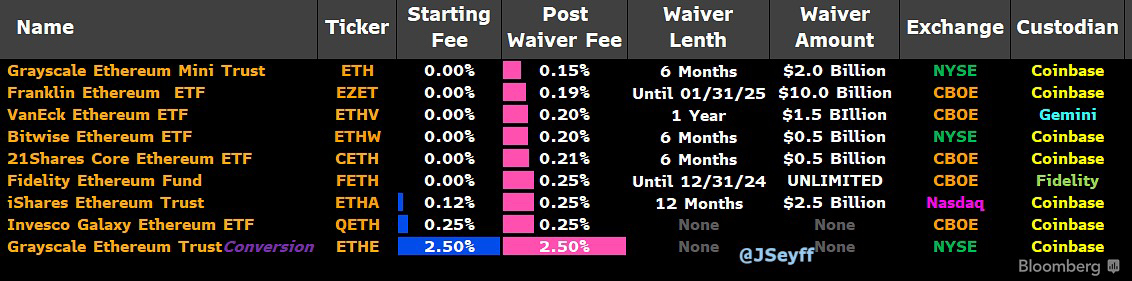

We find the same ETF issuers in the running, except for Ark Invest, Hashdex and Valkyrie which are absent. So, here are the Ethereum spot ETFs that are now available with their respective fees, exchanges and custodians:

Different Ethereum Spot ETFs Launched in the United States with Their Respective Specificities

Buy crypto on eToro

Thus, BlackRock's ETHA is launched on the Nasdaq, Grayscale's mini trust (ETH) as well as its ETHE and Bitwise's ETHW are launched on the New York Stock Exchange (NYSE), while the others land on the Chicago Board Options Exchange (CBOE).

Apart from BlackRock, Invesco and Grayscale, all issuers have decided to launch their spot Ethereum ETF without trading fees in order to capture maximum volume. At the same time, we can observe that Coinbase has been chosen as the depository for almost all ETFs, except Fidelity which will manage its own securities and VanEck's ETHV which will be at Gemini.

🗞️ In Ethereum News – Keplr Wallet to Become Compatible with Ethereum (ETH) Ecosystem

With Bitcoin and Ethereum spot ETFs now officially launched, The next countdown will be for possible ETFs based on Solana's SOL cryptocurrencyVanEck having opened hostilities at the end of last month.

The price of Ether reacted negatively to the news, posting a 2.30% drop over the last 24 hours. Ether is now trading at $3,450.

Buy Bitcoin and Cryptocurrencies ETN with XTB

Source: James Seyffart

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.