The cryptos market violently dropped last night: its capitalization lost 13 %, from 3,600 to 3,120 billion dollars. Bitcoin plunged under 91,500 dollars, Ether under $ 2,500, amplifying investors' concern. What to wait for the future? Is the Bull Run finished?

What happened on the Crypto market?

The alarm clock was painful for many this morning. The capitalization of the cryptocurrency market has dropped violently overnight, from around 3,600 billion to 3,120 billion dollars, a drop of 13 %. The Bitcoin course, after having already descended well throughout the weekend, fell by more than 3 % over the last 24 hours.

At more than $ 105,000 before the weekend, the king of cryptocurrencies attacks a new week at almost $ 91,500. Fortunately, the latter's price has since come back: A BTC is exchanged at 96,000 dollars at a time when we write these lines. The Ether, which is starting to seriously worry investors, went under the $ 2,500, losing around 20 %.

⌛ What is the best time to invest in Bitcoin?

Yes, the cryptocurrency market has already experienced similar declines. But he has also never been so capitalized. In other words, similar declines during the former historic ATH around 69,000 dollars could occur, but the masses of liquidity concerned were not the same.

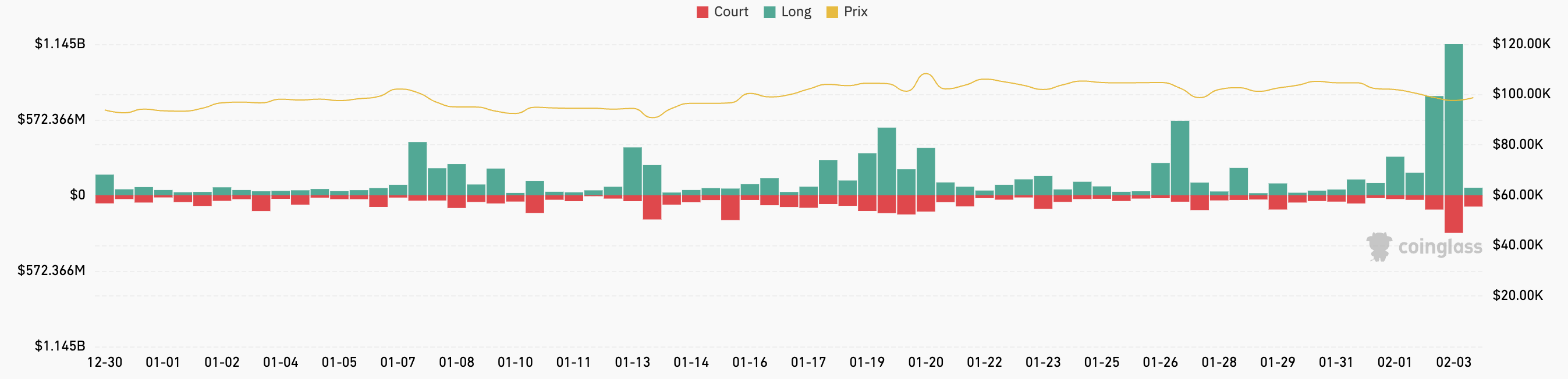

This morning, Correglass displayed a total liquidation on the Crypto market exceeding $ 2 billion, unheard of. And this, even during the painful episodes that were the fall of FTX or the COVVI-19.

History of liquidations on the Crypto market according to Coinglass

A record, then?

Not according to Ben Zhou, the CEO of Exchange Crypto Bybit. The latter pointed out on X that due to API -related limitations, Coinglass data were not closest to reality. According to him, liquidations on the Crypto market would rather be in a range from 8 to 10 billion dollars.

Buy cryptos on etoro

Donald Trump's announcements on the markets following the announcements

For many, this bloodbath is to be assigned to Donald Trump, who has announced a series of measures to participate in the recovery of the American economy. The latter include new customs taxes – the “Tariffs” – to the main border countries that are Canada and Mexico. The latter will have to pay customs taxes of 25 %.

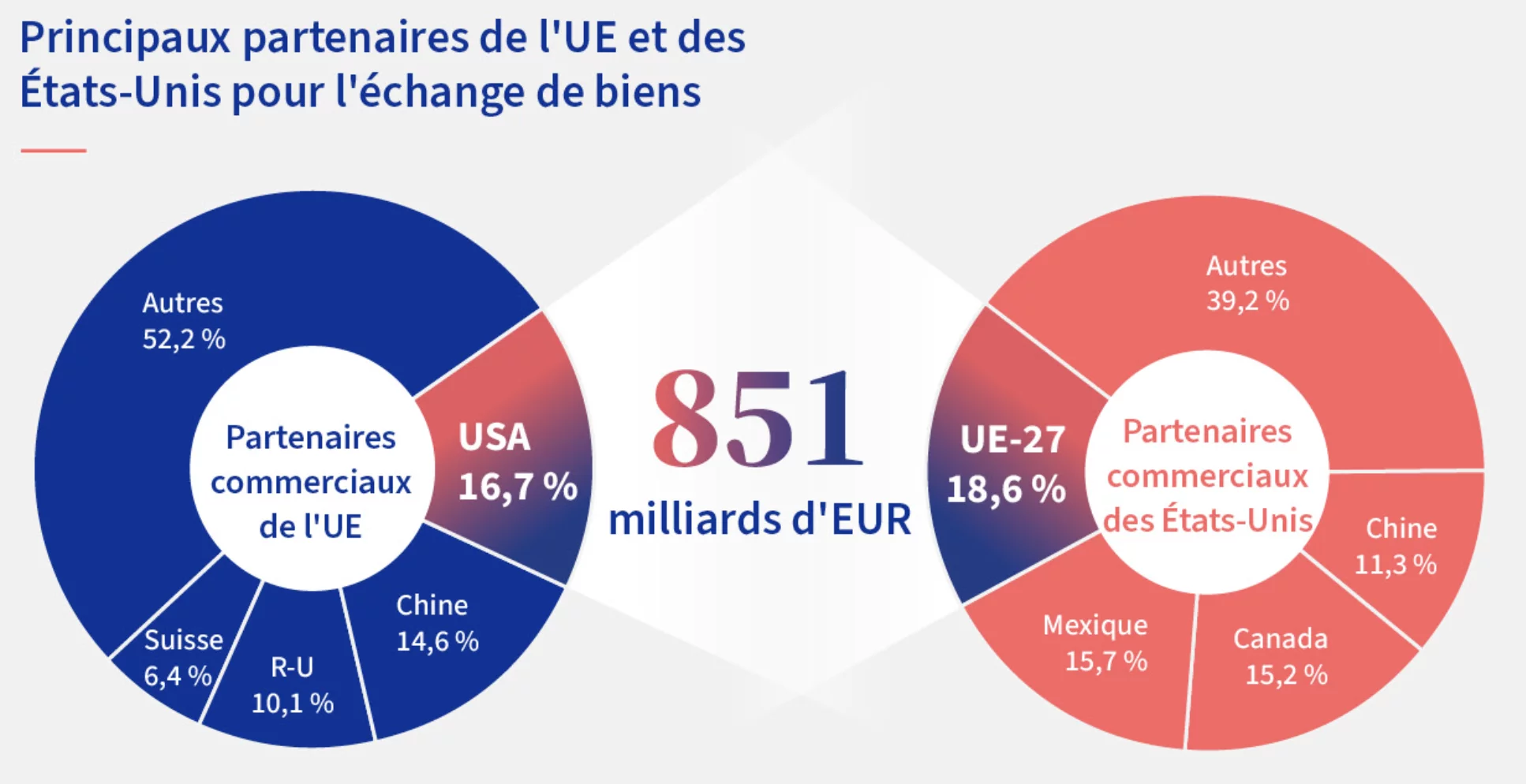

China, another world power, is inflicted an increase of 10 %what she intends to contest before the World Trade Organization. Finally, the new President of the United States also announced that the European Union would not be spared by similar measures.

📈 Diversify your investments with Trade Republic

France should therefore be affected. As Sylvain Bersinger, economist at Asteres, pointed out, in the columns of Europe 1 this morning, the sectors of aeronautics, luxury and cosmetics, pharmacy or even chemistry could suffer considerably if new customs taxes were to be truly implemented. Indeed, the United States is a very good customer of these different ranges of products.

Main Partners of the EU and the United States for the exchange of goods (2023)

The main European indices did not wait for the measures to be effective to react. The Stoxx Europe 600 and the FTSE 100 accuse a decrease of 1.4 %, the CAC 40 of 1.8, the aex displays a loss of 1.21 % and finally the Bel20 index is also in red with a loss 1.73 %. Similar losses are observable all around the world, especially in Asian markets (the Nikkei 225 is down 2.66 %) and even in the United States (S&P 500 down 1.91 % and the Dow Jones 1, 42 %).

The American gold and the dollar are for the moment the 2 large winners of these adventures which could also not stop there. Adventures, moreover, qualified as an act of protectionism the most important undertaken by an American president for almost a century “by Bloomberg analysts.

Gold avenue: Buy gold with ease

50 € reduction From 500 € of purchase with the code Cryptoast50

What to expect on the cryptocurrency market?

We observe that many investors have chosen to abandon part of their crypto positions to rebalance their portfolio. However, for Coban, analyst at Cryptoast Academy, this violent shock having struck the weakest assets underlines the apparent imbalance and excess market, without bringing a deadly blow to Bitcoin.

In the space of a few hours, the market saw $ 2.33 billion liquidated, in a downward and impregnible bearish movement. However, Bitcoin continues to evolve in its range, testing its low terminal, which currently serves it as a support. Despite the pressure, the assets seem to continue his work of lateralization, gradually eroding the psychology of market players. In 2024, the market spent long months in the denial of a same supercycle, but it is precisely when collective psychology changed in favor of this hypothesis – especially after a conference in Mourad at the end of 2024 – that the same started losing their appeal.

There is also no question of having reached a high point for Bitcoin. High point which will also determine the moment when altcoins will benefit – finally – from the Bull Run.

Many observers are today in a similar denial concerning a Bitcoin supercycle, often preferring to give their interest to altcoins, which however continue, for a large majority, to underform. When the collective conviction reaches its culmination, and the BTC will be fully recognized as the dominant active in the cycle, that it could mark a top. It is only at that time, if a total euphoria for Bitcoin manifests, that altcoins could finally find their salvation and trigger their own catch-up cycle. But this reversal potential remains conditioned on the massive return of capital to these assets.

👑 Find out how to buy bitcoin in a few minutes

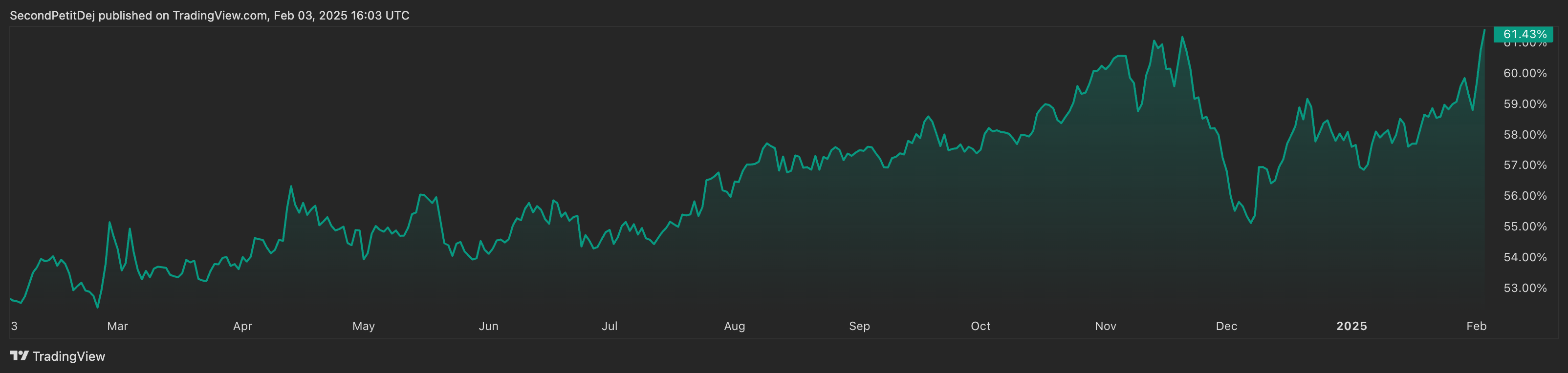

The dominance of bitcoin is at its climax during this Bull Run, and it has also remarkably illustrated during the episode of this weekend

Prof. Channel, our analyst specializing in on-chain data, underlines here the purchase opportunity offered by the $ 92,000:

Glassnod data indicates that large volumes of liquidations have been caused during the fall, with almost $ 50 million evaporated in less than an hour when the BTC affected the $ 92,000. These liquidation events, although impressive, often constitute excellent spot purchase opportunities, in particular in the event of a removal from the bottom of a range. Ultimately: more fear than harm. The markets have probably panicked under the covered of economic tension between the United States, Mexico and Canada, but the fall was quickly absorbed, which relieves the resilience of the current upward trend.

For our analyst Vincent Ganne, even a sound of bell. From a technical point of view, optimism is in order: ” Total Crypto market capitalization makes at a simple return and re-test of its former historic record, He underlines.

“” No predictive model at the end of Bull Market currently gives the signal of the market peak, whether it is the PI cycle Top Indicator, Stock to Flow, Puell Multiple, or even the MVRV Z-Score. All previous cycles ended at the end of the year following the Halving, at the end of 2025 for our current cycle, He concluded.

Find Coban, Vincent Ganne and Prof. Channel every week at Cryptoast Academy 👇

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Sources: Coringlass, European Council

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital