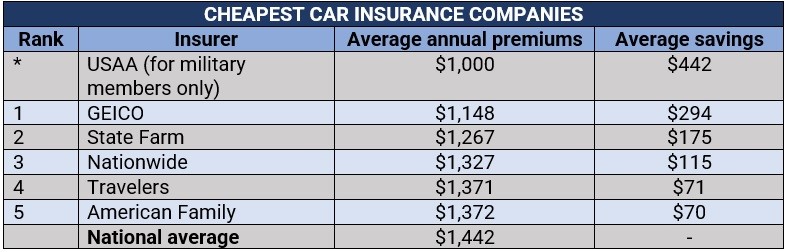

The average annual auto insurance premium across the country is $1,442, according to U.S. News’ analysis. Anything at that price point or below can be considered cheap car insurance. USAA offers the cheapest rate among all major car insurance providers at $1,000, almost a third lower than the national average. It also provides the least expensive premiums in almost every category. The insurer, however, has a restricted customer base, offering coverage only to active and former members of the US military and their families.

Among conventional insurers, GEICO has the cheapest car premiums, averaging $1,148 yearly. It is also the most affordable option for teens, seniors, safe drivers, and those with a poor credit history.

State Farm, meanwhile, ranks third on the list, with annual rates at $1,267. The country’s largest car insurer is also the cheapest choice for motorists with traffic violations, outside of USAA.

Here are the top five insurers offering the cheapest car insurance premiums based on U.S. News’ study.

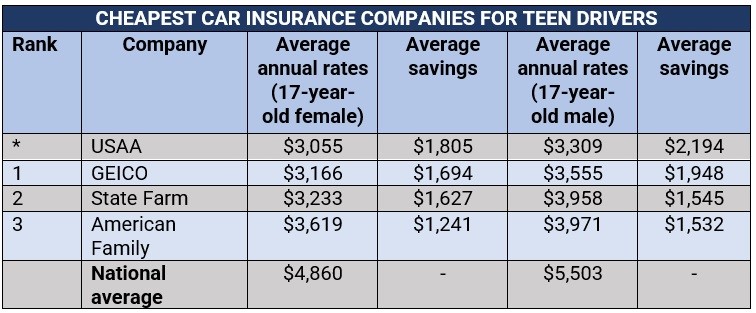

Cheap car insurance for teens

Car insurance premiums are higher for teen drivers than for any other age group. There is no way around it. Due to their inexperience, young drivers are more frequently involved in accidents than their adult counterparts. This puts them in a higher risk category, driving up their rates.

A 17-year-old female driver pays about $4,860 in car premiums annually, while males of the same age shell out $5,503. The figures are about three to four times higher than those for the average driver. Excluding USAA, the top three car insurers with the cheapest rates for teens, regardless of gender, are GEICO, State Farm, and American Family.

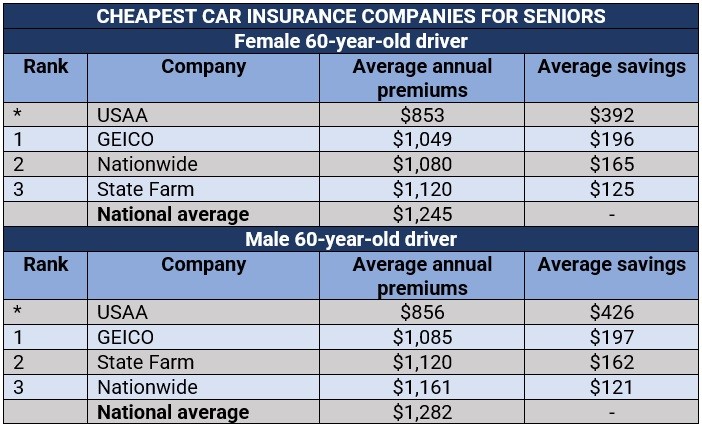

Cheap car insurance for seniors

Cheap car insurance for seniors

Senior drivers, or those in their 60s, are charged the lowest rates among all age groups, at $1,245 and $1,282 for females and males, respectively. Although the study did not reveal the reason for the cheap car insurance, it is widely known that many older people drive less and are, therefore, not likely to be involved in accidents. These are the insurers that offer the lowest rates for seniors.

Cheap car insurance for minimum coverage

Almost all states require drivers to have a bodily injury (BI) and property damage (PD) liability coverage, with the exception of Florida, where only PD is mandatory. Here are the cheapest auto insurance companies for minimum coverage based on the study.

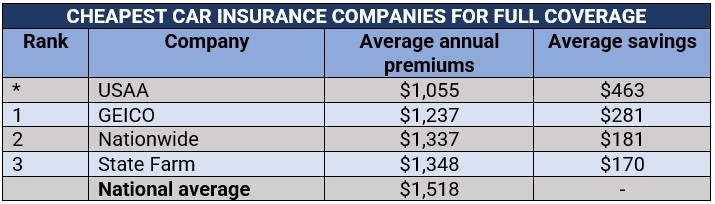

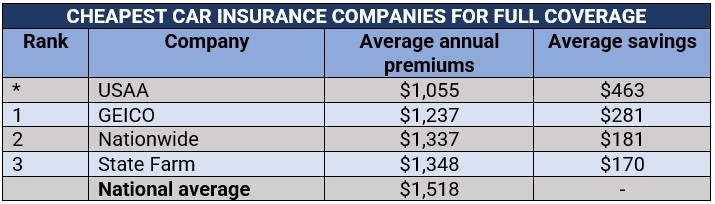

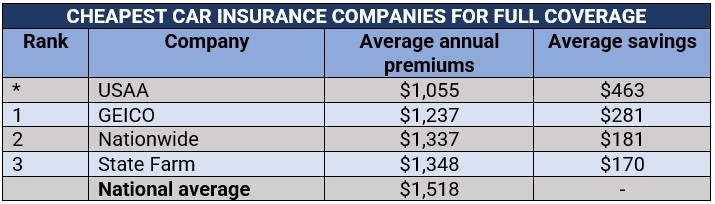

Cheap car insurance for full coverage

A full coverage car insurance policy combines liability (BI and PD), collision, and comprehensive coverage. Premiums for this type of coverage are typically higher as it provides more protection. These are the companies that offer drivers the most savings.

Cheap car insurance for drivers with poor credit

Insurance companies primarily use credit-based insurance scores to determine whether a motorist is eligible for coverage and how much premiums they will be charged. But according to many industry insiders, auto insurance scores also help prevent drivers with good credit standings from bearing some of the costs of higher-risk individuals.

These are the insurers that provide the cheapest rates for drivers with poor credit.

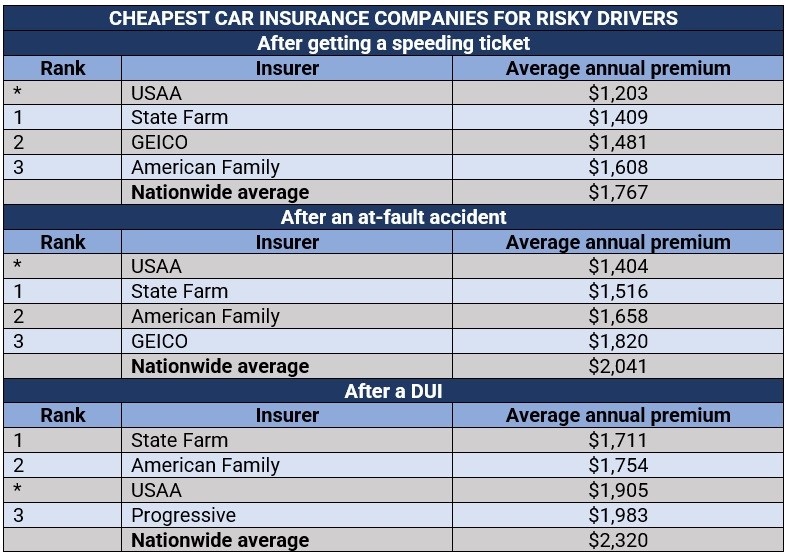

Cheap car insurance for risky drivers

Car insurers tend to view high-risk drivers as less of an asset and more of a liability, which is the main reason why premiums for this demographic are often significantly higher. it has been shown that a speeding ticket can raise insurance costs by more than 22%, an at-fault accident by almost 42%, and about 61% after a DUI.

For those who have experienced these traffic incidents, these are the insurers that offer the best rates.

Each driver comes with a unique set of risks. To calculate how much a motorist should pay in car premiums, insurers look at a range of factors, including those already mentioned above. However, different auto insurance providers use different metrics in determining how much risk a driver poses to them. Here are some common factors auto insurers take into consideration when determining insurance rates, according to Triple-I.

- Age: A person’s age correlates with driving experience and the risk of getting involved in an accident. Because of this, young drivers typically pay the highest auto insurance rates.

- Gender: Statistically, male drivers are more likely to get involved in accidents than female motorists, pushing up the premiums they need to pay.

- Address: Motorists who live in safer areas will likely pay cheaper premiums than those who reside in areas where vehicular accidents and car theft are common.

- Driving record: Auto insurers view a poor driving record as an indication that a motorist is more likely to file a claim in the future. As a result, at-fault accidents can drive up rates considerably.

- Mileage: The less a person drives, the lower the likelihood that they will get into an accident, which can reduce insurance premiums.

- Vehicle type: How much a car costs, how expensive it is to repair, how powerful the engine, its safety features, and how prone it is to theft are among the factors that have a major impact on car insurance rates.

- Credit rating: Insurers in most states use credit-based insurance scores to help determine premiums as these providers often believe that drivers with high ratings tend to file fewer claims than those with lower credit scores. Motorists with a good credit history, therefore, are given cheap car insurance rates.

- Level of coverage: Minimum coverage policies require lower premiums than comprehensive plans but offer limited protection.

Regardless of the factors listed above, drivers can employ an array of practical strategies to reduce auto insurance costs. Here are some of them:

1. Taking advantage of discounts

Car insurance providers offer a range of discounts, which motorists can take advantage of to reduce their annual premiums. Drivers can often avail of these through:

- Bundling of auto policies with homeowners’ or renters’ insurance

- Insuring multiple vehicles in a single policy

- Paying premiums in full instead of monthly instalments

- Installing security and safety features

- Taking defensive driving courses

- Maintaining good grades for students

2. Skipping coverage that you do not need

Auto insurance companies offer several coverage options that impact how much premiums will cost. To slash rates, experts advise motors to ditch unnecessary coverages.

3. Maintaining a clean driving record

Keeping one’s driving record spotless is among the best ways motorists can access affordable car insurance rates. Safe driver discounts vary between insurance providers but usually, motorists can access between 10% and 25% reduction in premiums for adopting safe driving practices.

4. Raising the deductible amount

A higher deductible means motorists will pay lower premiums. However, this also increases the amount they need to pay before their auto insurance picks the tab, so policyholders should make sure to keep the value at a level that they can afford. Sometimes cheap car insurance can lead to expensive one-off costs.

5. Checking out the insurance costs when buying a car

Some cars are more expensive to insure than others. For motorists looking to save on car insurance costs, experts recommend checking out sedans, vans, and other family-friendly vehicles as these often have the lowest premiums.

6. Switching to usage-based or pay-per-mile insurance

Enrolling in a usage-based insurance (UBI) program is beneficial for drivers who log fewer than 10,000 miles every year. This is often done with the insurer installing a telematics device in the vehicle. This device, also called a black box, tracks driving behavior, allowing motorists to access discounts based on when, how well, and how much they drive.

7. Using public transportation

Using mass transit reduces how much a person drives their vehicle, which may also have an impact on premium prices. Many car insurance providers charge based on your average yearly commuting, using public transportation more can help you get cheaper car insurance but talk to your provider about this.

8. Shopping around when it’s time to renew

Car insurance rates change often so that companies can stay competitive and get new customers. Because of this, it would be beneficial for motorists to review their policies every time it renews, so they can get the best coverage that fits their current needs at the cheapest price.

To operate a vehicle, motorists must carry auto insurance. It is mandated by the law in almost all states, except New Hampshire. Getting caught driving without one can result in hefty fines and affect future eligibility for obtaining coverage.

However, depending on where they live, drivers are required to secure different types of coverages. Here are the most common types of policies motorists need to take out, according to Triple-I.

- Bodily injury (BI) liability: Covers medical and legal costs associated with injuries or death for which the driver is at-fault.

- Property damage (PD) liability: Pays out if the policyholder’s vehicle damages another person’s property, as well as legal costs incurred in a lawsuit.

- Medical payments (Med Pay) or personal injury protection (PIP): Covers medical expenses for injuries the policyholder and their passengers sustain in an accident. Some policies also pay out for lost income.

- Uninsured/underinsured motorist coverage (UM/UIM): Pays out for injuries the policyholder and their passengers suffer if they are hit by an uninsured or underinsured driver.

You can check out the leading car insurance companies in the US in our special reports where we look at the best in insurance.

Which insurers do you think are the best options for affordable premiums? Do you have other rate-reduction tips to get cheap car insurance that you want to share? Share away in the comment box below.