Could Stablecoins replace the idea of a central bank digital currency (MNBC)? While Donald Trump prohibited MNBC and the federal reserve wonders about their necessity, Christopher Waller, governor of the Fed, considers stablecoins as an asset for the dollar.

Stablecoins, new support from the US dollar

Why need a central bank digital currency (MNBC) when the growing market in Stablecoins is mainly based on the dollar? This is a question that can be asked on the one hand in front of Donald Trump's wish to simply ban MNBC, but also When listening to the governor of the United States Federal Reserve (Fed).

✏️ Are the Stablecoins the MNBC which does not say its name?

For a clear framework and suitable regulation, Christopher Waller actually declared that stablecoins constituted a means of strengthening the status of the dollar as a reserve currency. This, provided of course that the stablecoins emitted leaning against the dollar are indeed collateralized.

I consider stablecoins as a clear addition to our payment system. […] It is necessary to set up a regulatory framework to ensure that money is there and to ensure that it is completely covered.

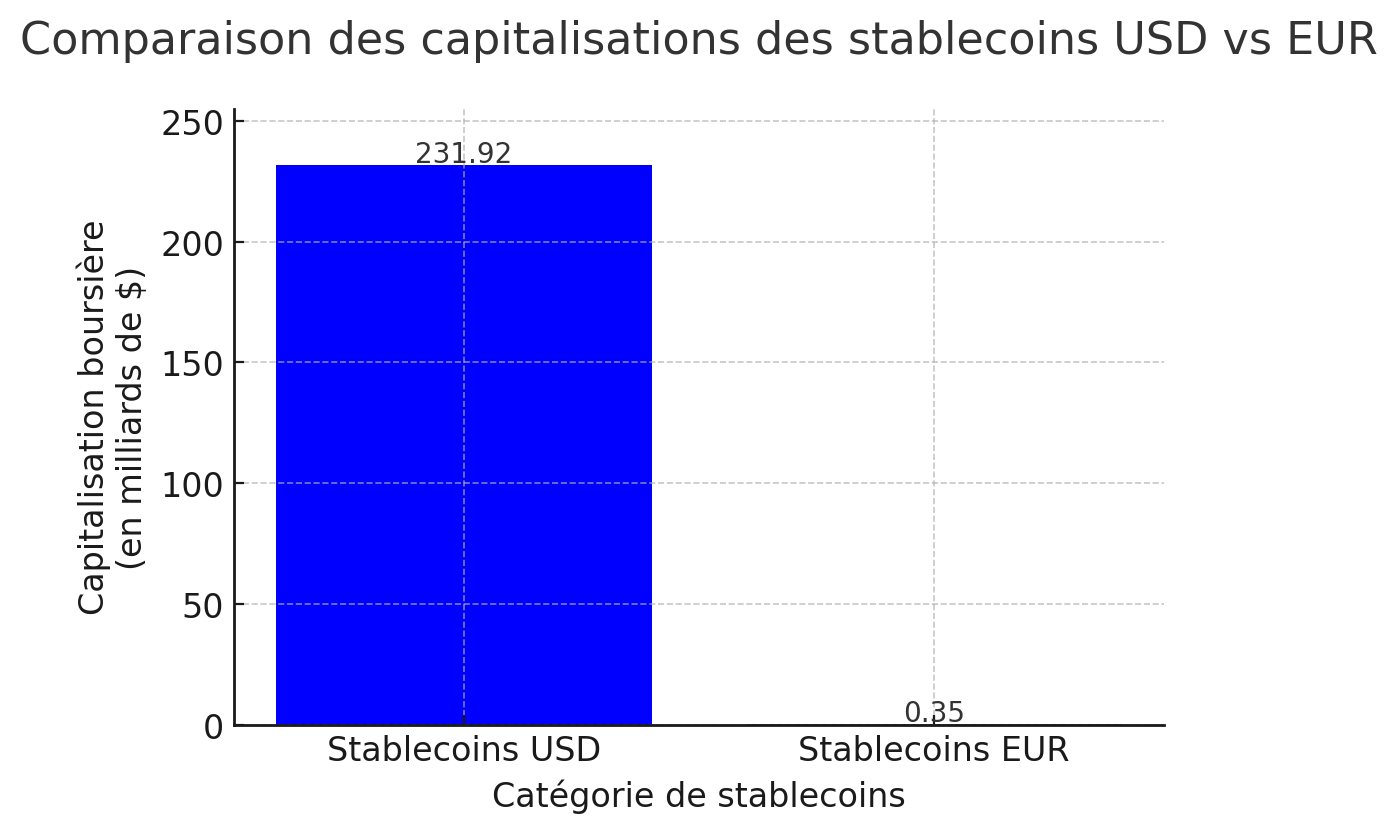

Currently, the stablecoins backed by the US dollar dominate this market segment by far, and those backed by the euro are pale in comparison:

The Governor of the Fed also said that the regulation of “digital currencies” was currently the priority of both the Republican Party and the Democratic Party. In this sense, A group of Bipartisian senators presented the “Genius Act”, a bill aiming precisely to strengthen the US dollar while guaranteeing innovation.

🗞️ For Arthur Hayes, a Bitcoin Strategic Reserve (BTC) could become a political weapon

If the bill were to be released as it stands, stable -co -emitters leaning against the dollar and exceeding $ 10 billion in capitalization must prove that their reserves are able to guarantee the coverage of their stablecoin. They will also be subject to the regulatory framework for the Federal Reserve and that of the Office of the Enteroller of the Currency (OCS)an independent agency attached to the Treasury which works to guarantee the solidity of the banking system.

Given the bipartisan nature of the project, It is likely that the bill will succeed.

Buy cryptos on etoro

Source: Bloomberg

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital