f(x) Protocol enriches its DeFi offering with V2 which redefines the standards of leveraged trading in decentralized finance, by combining technical innovation and accessibility. Learn how f(x) Protocol is making liquidation-free crypto trading a reality with its latest update.

A protocol that stands out in the DeFi ecosystem

f(x) Protocol has established itself as an innovative solution in the decentralized finance (DeFi) ecosystem by responding to a major challenge: democratize leveraged trading while ensuring maximum security.

The particularity of f(x) Protocol lies in its ability to offer leveraged positions without liquidation risk, all managed and verifiable entirely on-chain for maximum transparency.

This approach differs from traditional platforms which often expose their users to significant risks of sudden losses. By prioritizing security and accessibility, f(x) Protocol has created an environment where even less experienced traders can explore the opportunities of leveraged trading while limiting the risks involved..

Be careful with leverage

Be careful, using leverage involves high risks and is mainly suitable for experienced traders. It is important to note that, while offering the possibility of making exponential profits, leverage can also lead to significant losses, potentially leading to a complete liquidation of the capital involved.

📈 What is leverage in the world of trading?

V1 of f(x) Protocol, despite its innovations, presented several limitations which slowed down its mass adoption.

Variable leverage, although flexible, made position management relatively complex. Indeed, institutional traders and new users struggled to maintain a coherent strategy in the face of fluctuations in their leverage.

Althoughcurrently, only Ether is available as collateral on V2other options will be integrated soon, such as Bitcoin.

👉 Enjoy 0.5% bonus on your deposits in the USDC-fxUSD pool or in the f(x) v2.0 Stability Pool with our affiliate link or indicate the cryptoast code

A V2 that pushes the limits of the protocol

The new version of f(x) Protocol brings major improvements that radically transform the user experience offered until now.

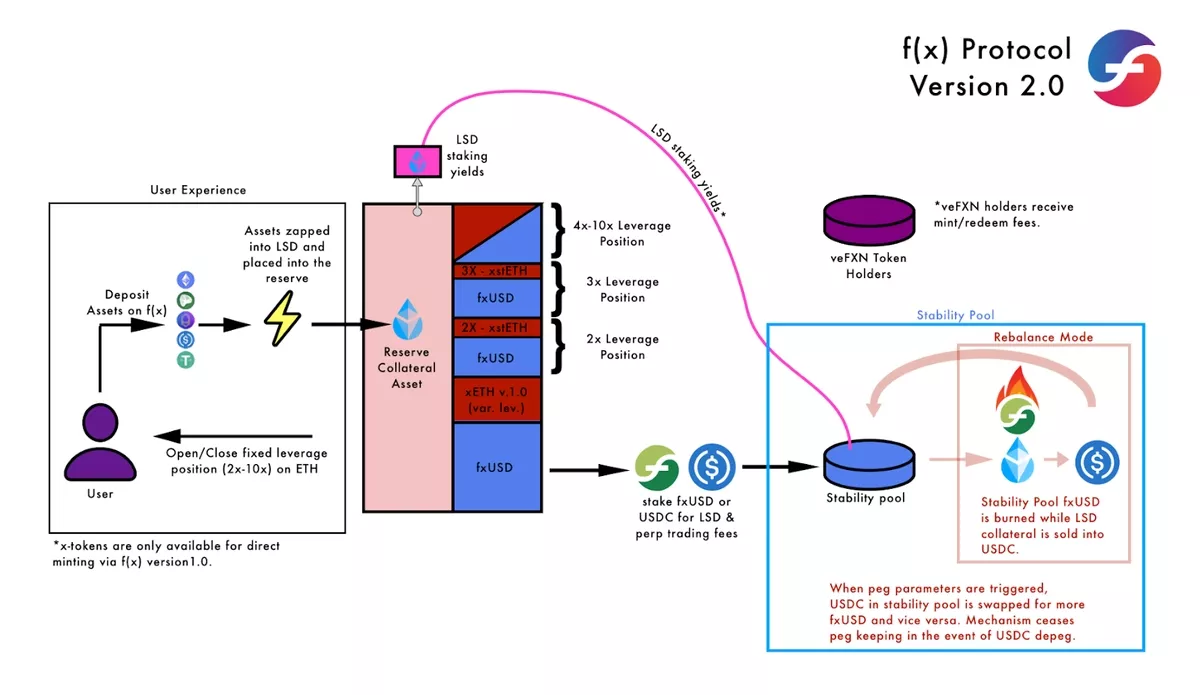

First, V2 of f(x) Protocol introduces fixed leverage, configurable up to a multiple of 7, and soon up to a multiple of 10which represents a significant advance in position management.

This innovation is accompanied by an automatic rebalancing mechanism which drastically reduces the risk of liquidationa first in the crypto industry according to the protocol.

This automation allows, among other things, to free traders from the constraint of constant monitoring of their positions and allows them to concentrate on their investment strategies.

❌ The 10 mistakes not to make in trading

Graphic representing the mechanisms of f(x) Protocol V2

Moreover, the integration of new collateral assetsnotably liquid derivative tokens (LST) such as stETH, opens up new optimization perspectives. In fact, the returns of the latter are redistributed to the “Stability Pool » and help create yield for users who deposit liquidity in the form of stablecoins.

This pool plays a fundamental role in ensuring efficient management of under-collateralized positions, thus avoiding sudden liquidations which could destabilize the market.

Concretely, users can deposit their funds, often in the form of stablecoins like USDC or others, specified by the protocol, into this collective pool. In the event of under-collateralization of a loan, funds from the Stability Pool are used to repurchase the collateral of the positions concerned, ensuring an orderly and transparent liquidation.

In exchange for their participation, Stability Pool depositors receive incentives in the form of returns, typically from fees generated or assets liquidated.

👉 Enjoy 0.5% bonus on your deposits in the USDC-fxUSD pool or in the f(x) v2.0 Stability Pool with our affiliate link or indicate the cryptoast code

Unlike most protocols for trading perpetual contracts, f(x) Protocol has no funding costa significant advantage in view of how much the latter can quickly quantify and negatively impact the final result of the “trade”.

According to the project, the move to V2 of f(x) Protocol represents a transformation that could redefine the standards of leveraged trading in DeFi in the future. By combining automation, asset diversification and liquidation protection, the protocol builds on new standards of accessibility and security.

This major development paves the way for broader adoption, both by institutional and retail investors, thereby contributing to the maturation of the f(x) Protocol ecosystem.

Ledger: the best solution to protect your cryptocurrencies 🔒

Source: f(x) Protocol documentation

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital