Bitcoin sales by the German government continue, with 2,500 BTC recently sent to multiple exchanges. These transactions, along with those of the US government and the Mt. Gox refunds, are putting additional pressure on the Bitcoin price.

German government continues sales

Thanks to several judicial seizures, including one linked to the illegal streaming platform Movie2k, the German government recently held nearly 50,000 Bitcoins.

Other countries are in similar situations. The Chinese government is said to hold 194,000 BTC, mostly from the PlusToken Ponzi scheme shutdown, while the US government is said to hold 213,000 BTC, mostly from the Bitfinex theft and the Silk Road black market takedown.

🥇To go further, discover the top 10 entities richest in Bitcoins

A few weeks earlier, the German government transferred 6,500 Bitcoins to a new address, and then 2,500 BTC, worth about $160 million, were sent to exchanges like Kraken, Bitstamp, and Coinbase, presumably to be sold.

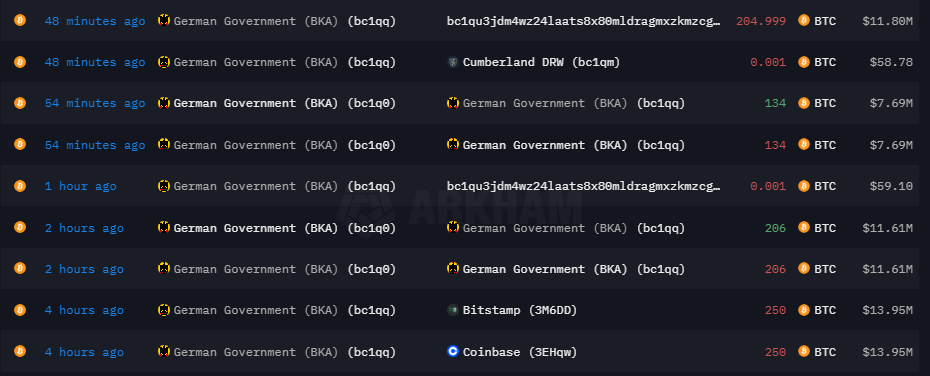

On-chain data this morning reveals that the German government has once again moved some of its funds to exchanges:

History of the latest Bitcoin transactions made by the German government

Indeed, thanks to Arkham's data, we can easily see the details of the transfers, which show: 250 BTC moved to Coinbase, 250 BTC to Bitstamp, and a transaction of 0.001 BTC, or $57, made to Cumberlandprobably serving as a test before sending more funds.

Coinbase: Sign up for the world's most reputable crypto exchange

These sales would be one of the triggers of the drop in the price of Bitcoin.

The German government's sales come at the same time as the U.S. government's sales and the refund of Mt. Gox customers, events that have helped push the price of BTC down in recent days, which recently hit $53,500.

Bitcoin price against the dollar shows German government selling 2,500 BTC

In fact, the United States government also made sales at the end of last June, transferring 3,940 Bitcoins, or $241 million, to Coinbase Prime, the platform dedicated to professionals and institutions.

At the same time, Mt. Gox began repaying its creditors, which, according to the latest news, could be completed within 3 months, announcing the imminent return of 140,000 BTC to the marketwhile they had been blocked by the platform for more than 10 years.

📰 Also read in the news: Bitcoin could “replace the dollar” and reach more than $1 million, according to Jack Dorsey

These recent movements of large amounts of BTC likely contributed to the decline in Bitcoin's price, especially since they occurred in the middle of summer, a period that is often bearish due to the lack of activity from professional investors.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Source: Arkham

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.