While the price of Bitcoin (BTC) reached historic highs in the weeks following the announcement of Donald Trump's victory in the American presidential elections, people who were previously reluctant are now being convinced by the interest of investing in the crypto. For its part, Blackrock literally recommends that investors add Bitcoin to their portfolio.

With this investment strategy, Blackrock ensures that investors “limit their risk of loss”

With the price of Bitcoin flirting with the $100,000 threshold, more and more people are interested in cryptocurrency, to the point of wanting to acquire it. In one of its reports published Thursday, asset manager Blackrock invites them to take the plunge, but sparingly.

Indeed, the BlackRock Investment Institute, the branch of the company specializing in market analysis, believes that “ investors with adequate governance and risk tolerance can include Bitcoin in a multi-asset portfolio » 60/40 type.

💡 Follow our guide to quickly and easily acquire Bitcoin (BTC)

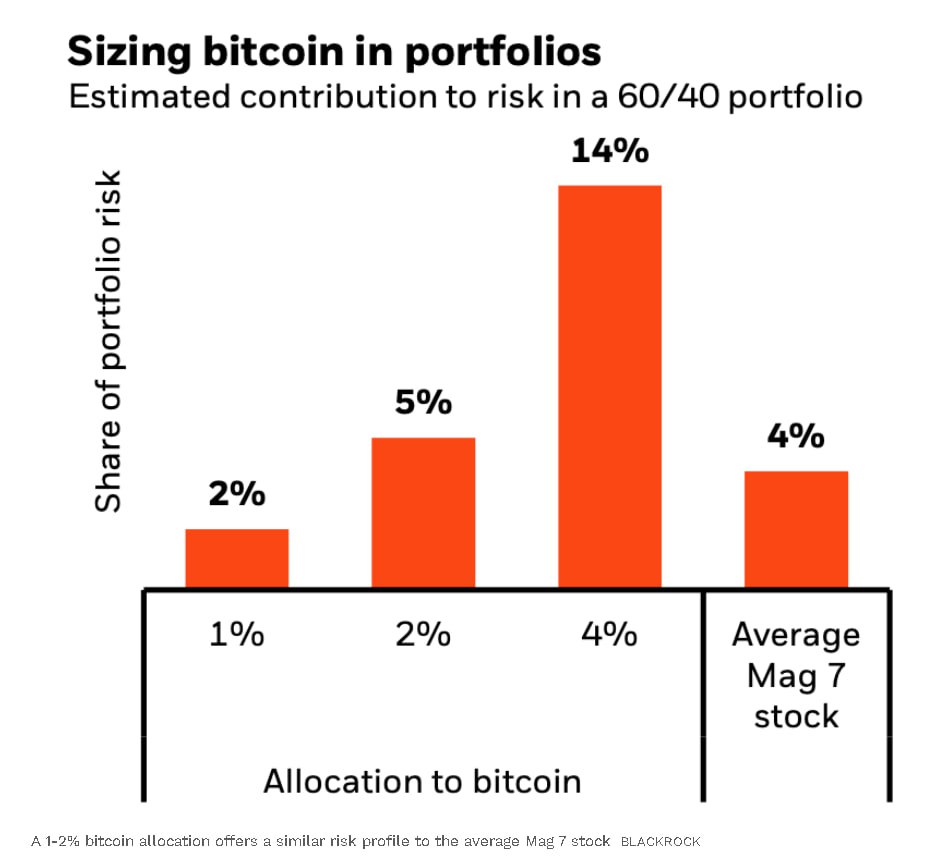

Thus, the company recommends that interested investors allocate up to 2% of their investment portfolio in Bitcoin. It would be a “ reasonable range » according to the report.

Owning 1-2% BTC in your portfolio is as risky as owning Magnificent Seven stocks

As Blackrock indicates, this model remains interesting for investors “ who tolerate the risk of Bitcoin ”, inevitably referring with notorious volatility cryptocurrency:

Even though the correlation between Bitcoin and other assets is relatively low, it is more volatilewhich makes its effect on the total risk contribution broadly similar. […] This is why adopt a risk budgeting approach for building your investment portfolio makes sense.

Buy cryptos on eToro

Would more institutional adoption allow Bitcoin to be a less risky asset?

However, this volatility could be less significant. For BlackRock analysts, the increasingly pronounced adoption of Bitcoin by institutional investors could bring more stability to the price of cryptocurrency:

In the future, if Bitcoin does indeed achieve widespread adoption, it could also become less risky – but at this point it may no longer have a structural catalyst for further significant price increases.

In short, for the asset manager, broader institutional adoption of Bitcoin would allow to stabilize its pricebut would prevent a significant increase in its price over a short periodas has been observed in recent weeks.

👉 Seen elsewhere – Cryptocurrencies, a shield against economic risks?

With the announcement of Donald Trump's victory in the American presidential elections, the cryptocurrency market is on the rise. Confident investors turned in particular to the spot Bitcoin ETFs launched last January, including the iShares Bitcoin Trust (IBIT) issued by BlackRock.

This had the effect of seeing the price of Bitcoin increase by almost 35%even reaching its ATH at $103,679 on December 5. For their part, BTC spot ETFs generated nearly $12 billion in net inflows since November 6.

🗞️ Pre-order our newspaper n°5 with exclusive content, including Cryptoast21

Source: Bloomberg

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital