The price of gold has risen significantly since November 2022, with a sharp rise during the Silicon Valley Bank collapse in March. Gold-backed stablecoins, like PAXG and XAUT, also saw an increase in their market capitalization, together surpassing $1 billion. For its part, Bitcoin is decorrelated from the main stock market indices and shows a strong correlation with gold and silver.

The price of gold on the rise, the capitalization of the stablecoins which are backed by it too

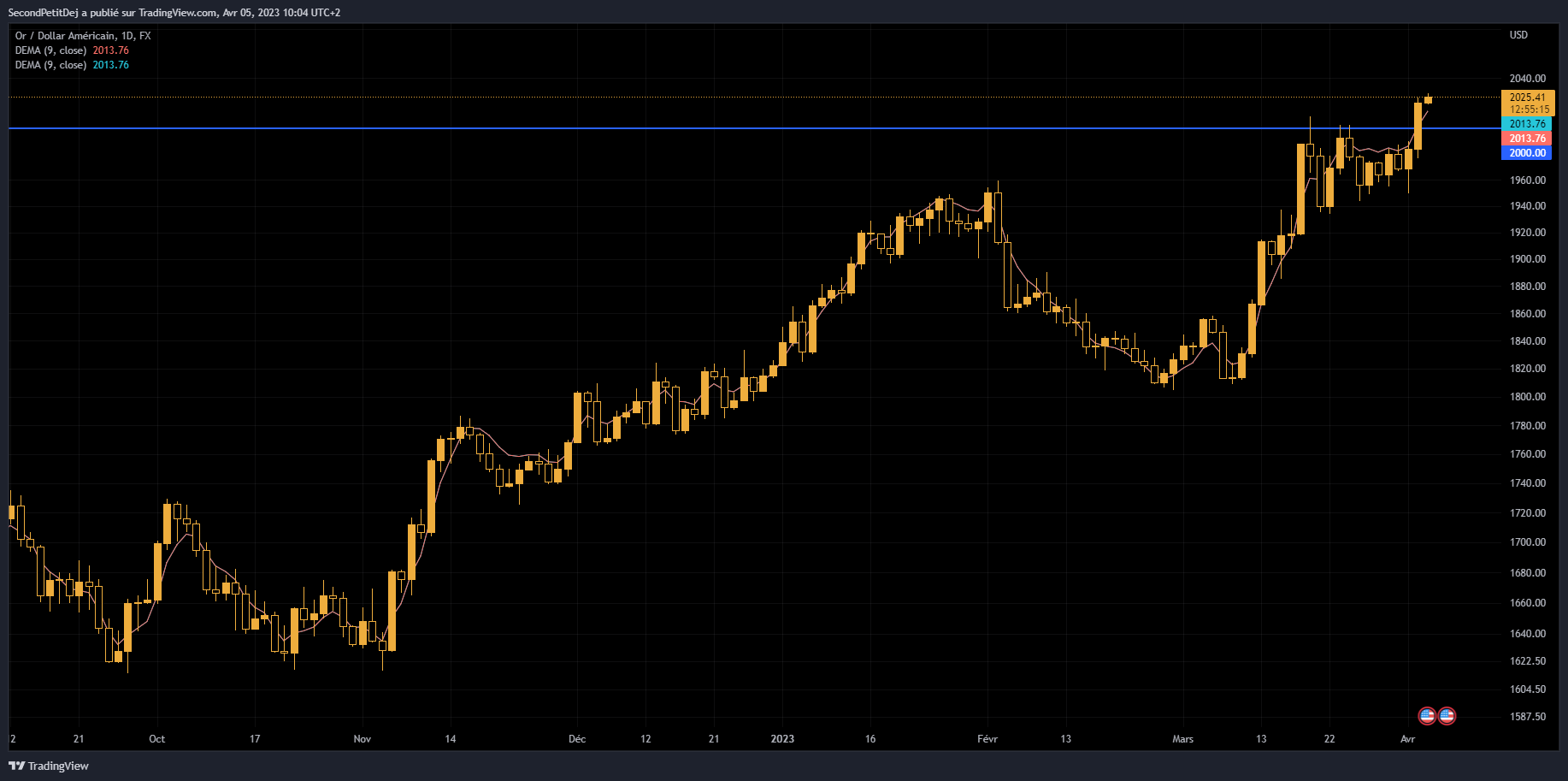

While the price of gold has been on an upward trend since November 2022, we can note that this increase has been particularly pronounced since March 10a date that corresponds to the collapse of the Silicon Valley Bank (SVB), whose fallout is still being felt in banking circles.

Figure 1 – Evolution of the price of gold against the US dollar (XAU/USD)

This interest in gold, a historic safe haven that has survived wars and times, is also felt in the stablecoins backed by it. Effectively, the market capitalization of gold-backed stablecoins just passed the symbolic billion dollars.

The gold-backed stablecoin market is almost exclusively limited to PAXGissued by Paxos (which until very recently issued Binance’s BUSD) as well as the XAUT issued by the giant Tetherthe American company that is also in charge of the most capitalized stablecoin in the cryptocurrency market, namely USDT.

👉 Discover our presentation of Gold Avenue, a simplified solution to buy gold

Buy gold made easy

€50 off from 500 € of purchase with the code CRYPTOAST2023

Bitcoin (BTC) decorrelates from indices and approaches gold

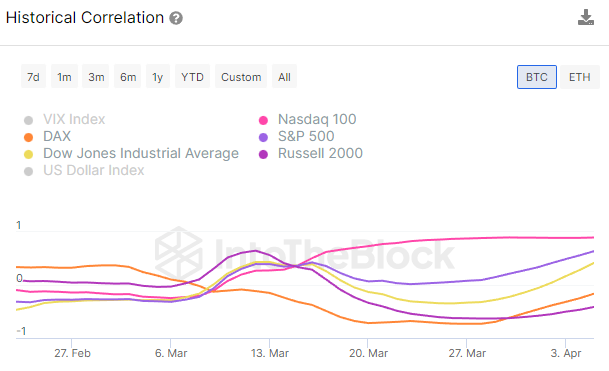

Except for the Nasdaq index, which includes a large majority of companies operating in the technology sector, we can observe that Bitcoin (BTC) has de-correlated significantly from major stock market indices such as the S&P500, the DAX or the Dow Jones Industrial Average, as we can see below (the closer the curve is to 1, the more pronounced the correlation):

Figure 2 – Correlation between BTC and different stock indices

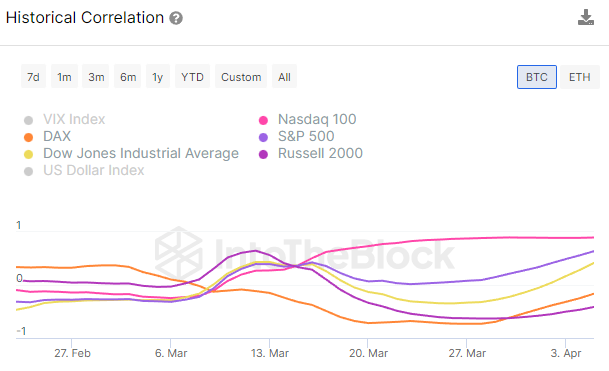

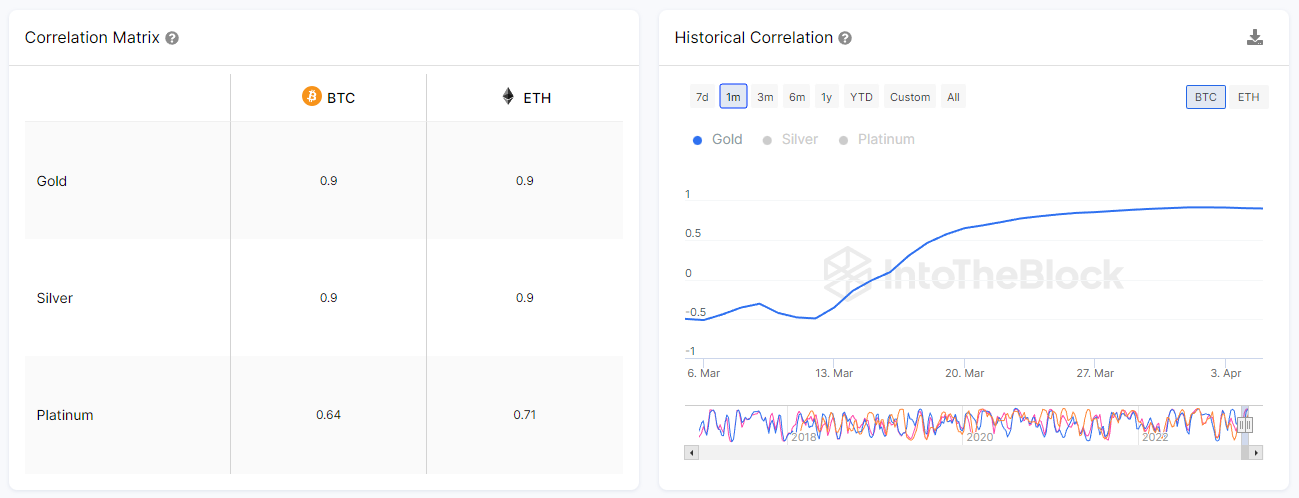

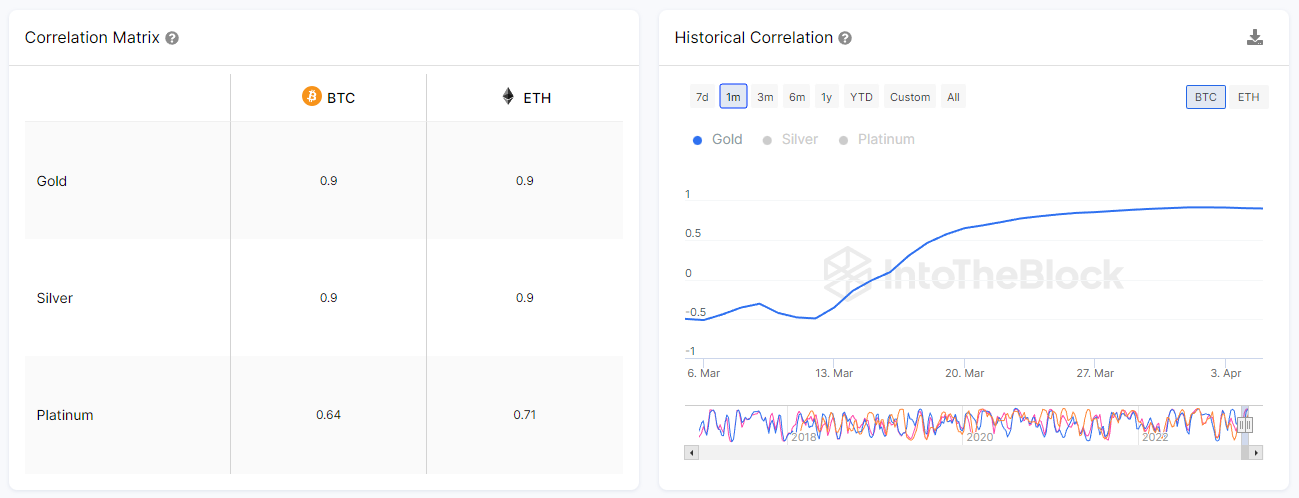

On the contrary, bitcoin seems to correlate more with gold, which constitutes a safe haven in the face of the ambient banking uncertainty, among other things. Bitcoin and Ether (ETH) thus have a very high correlation of 0.9 with gold, but also with silver:

Figure 3 – Correlation between BTC and gold

This proves that for a growing number of investors, Bitcoin seems to be registering as a safe haven, a trend that we did not observe in 2022, for example. However, although the correlation between BTC and the golden rare metal is very important, it should however be noted that the volatility of the king of cryptocurrencies remains much higher than that of gold.

While the price of Bitcoin has increased by 72.5% since January 1, gold very recently broke above its historical resistance of $2,000an event that had occurred twice in the past, namely in August 2020 and March 2022.

Often nicknamed “digital gold”, Bitcoin also shares with gold the particularity of being rare, since only 21 million units of the cryptocurrency will be available.

👉 Can Bitcoin and gold be complementary? Find out through our interview with Alessandro Soldati from Gold Avenue

Buy gold made easy

€50 off from 500 € of purchase with the code CRYPTOAST2023

Sources: TradingView, CoinGecko, IntoTheBlock

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.