This blog is an exception from our new guide: The 2024 Crypto Maturity Journey. Inside, we lay out a framework for how traditional financial institutions can build cryptocurrency product offerings in iterative stages. Read the whole thing here!

Over the last few years, cryptocurrency has become a mainstream asset class, with institutional investments as one factor in boosting adoption around the world. In 2024, several notable developments have solidified crypto's presence in traditional finance (TradFi). Institutions such as BlackRock, Fidelity, and Grayscale have launched Bitcoin and Ethereum ETPs, providing a more accessible avenue for retail and institutional investors to gain exposure to these digital assets. These financial products have shifted conversations toward understanding the investment merits of crypto alongside those of traditional securities.

Moreover, the tokenization of real-world assets, such as bonds and real estate, is also gaining traction, enhancing liquidity and accessibility within financial markets. Siemens' issuance of a $330 million digital bond exemplifies how traditional financial institutions (FIs) are adopting blockchain for more efficient operations. While many similar institutions have already begun incorporating crypto into their service offerings, others remain in the evaluation phase.

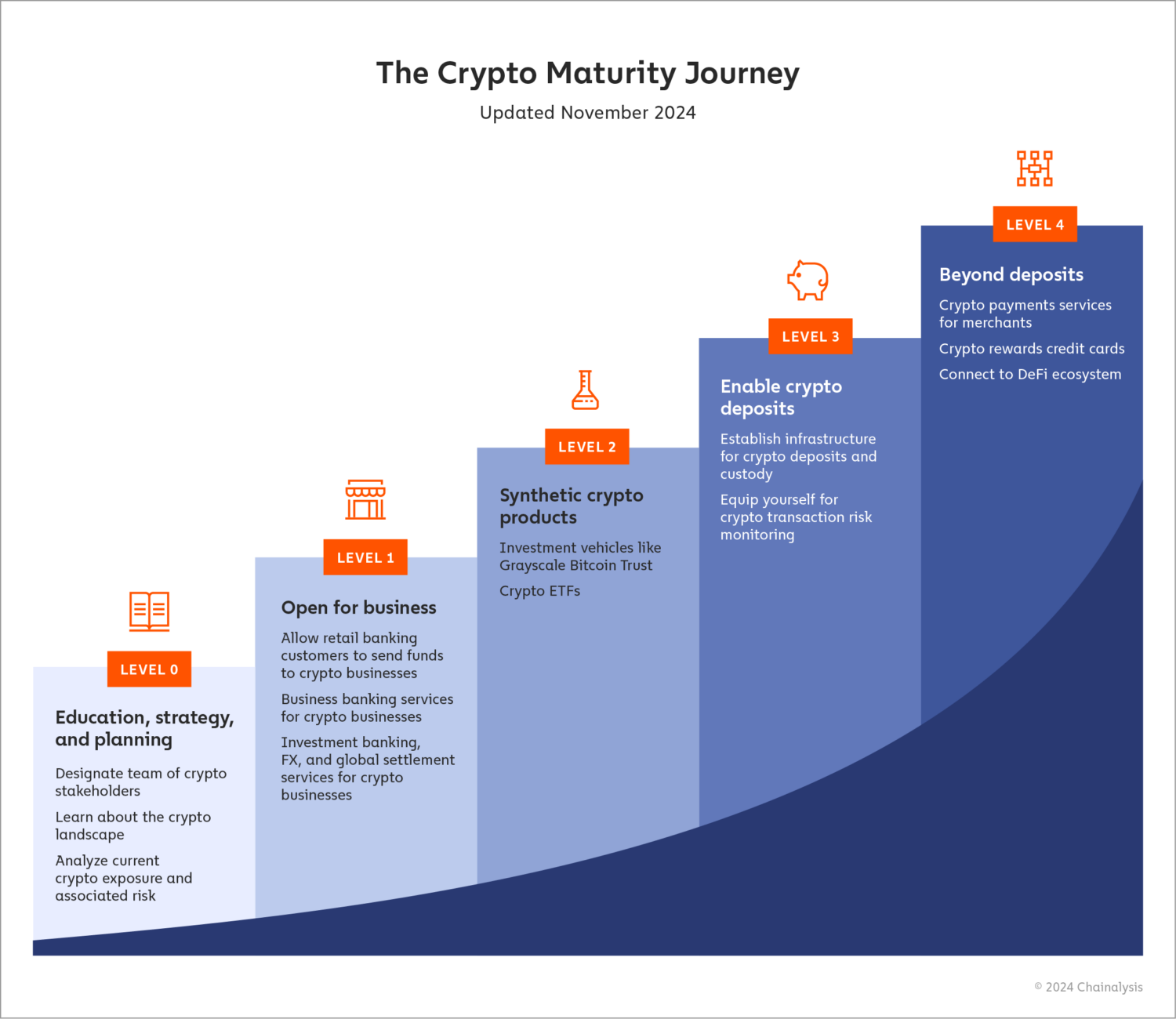

For this reason, we've created the Crypto Maturity Journey, a resource for traditional FIs interested in offering cryptocurrency products. The Crypto Maturity Journey outlines considerations for cryptocurrency product rollout, enabling FIs to evaluate market opportunities while simultaneously addressing regulatory and compliance requirements.

The Crypto Maturity Journey explores five typical levels of cryptocurrency adoption for FIs:

- Level 0: Education, strategy, and planning

- Level 1: Open for business

- Level 2: Synthetic cryptocurrency products

- Level 3: Enable crypto deposits

- Level 4: Beyond deposits

Download the full guide to learn more about the 2024 Crypto Maturity Journey, with examples of how different financial institutions have launched cryptocurrency products at each stage!

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient's use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

![[GUIDE PREVIEW] The 2024 Crypto Maturity Journey: How Traditional Finance Can Adopt Cryptocurrency in Stages [GUIDE PREVIEW] The 2024 Crypto Maturity Journey: How Traditional Finance Can Adopt Cryptocurrency in Stages](https://www.chainalysis.com/wp-content/uploads/2024/11/blog-banner.png)