The price of Bitcoin has been in a consolidation phase below $100,000 since the middle of December, a pause which does not call into question the bullish cycle. On the contrary, this break gives it a well-constructed structure.

The Fed will be more accommodating than expected in 2025

The Fed therefore showed itself to be very pessimistic in its inflation expectations for the year 2025 during its last annual monetary policy decision, probably to see things coming and give itself some margin by also integrating the uncertainty of the effects of the fiscal policy of the Trump Administration.

But precisely, by being deliberately pessimistic, the Fed has actually given itself significant room for maneuver.

📈 To get my daily trading opinion on the Bitcoin price, join me on Cryptoast Academy!

The scenario of a single rate cut in 2025 and not before May seems far too restrictive to me, especially compared to expectations regarding the ECB. Such an expectation gap is exaggerated, at least it describes the darkest possible scenario in terms of disinflation.

I think the Fed will be significantly more accommodating in 2025, and ultimately this is a message that appears implicitly in the update of its macroeconomic projections.

By setting an employment alert threshold at 4.3% of the active population and a US inflation target of 2.5% at the end of 2025, the Fed has in reality given itself the means to resume its very quickly.

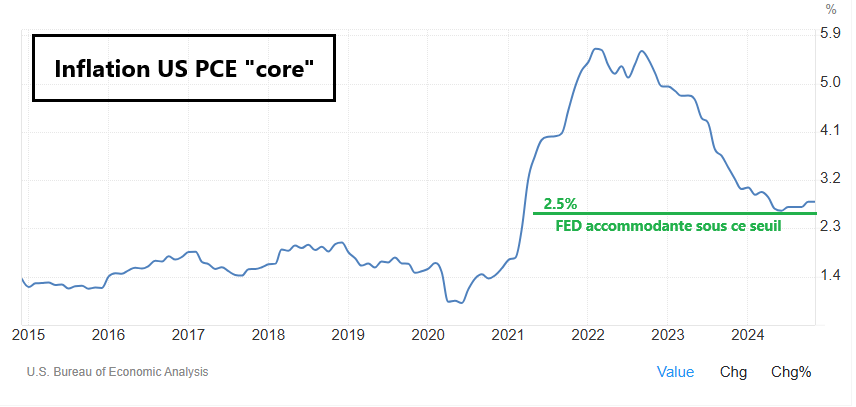

The US unemployment rate is in fact already at 4.25% of the active population and the PCE is very close to 2.5% in nominal and underlying versions.

🕐 Is it too late to invest in Bitcoin?

By starting from such pessimistic expectations (the nominal PCE and the core PCE are already close to 2.5% at an annual rate), the probability of having positive surprises in terms of inflation has considerably increased. Already, the PCE inflation update this December was well below expectations (0.1% monthly).

The rebound in inflation in Q4 2025 was largely built on a base effect and this base effect disappears from the first quarter of 2025. Ultimately, the cycle of rate cuts could resume from the first quarter of 2025, this will be a supporting factor for BTC.

Chart that represents the annual US inflation rate according to the Fed's favorite price index, the underlying PCE

Bitpanda: receive €50 bonus in BTC by creating an account

Bitcoin, I confirm my target of $140,000 for the first quarter of 2025

The price of Bitcoin has been in a pause phase since the middle of December and under the major resistance of $100,000. BTC has appreciated by more than 115% since the start of the year and has increased by 40% since Donald Trump's victory. A lateral transition of a few weeks is therefore not surprising.

When will the rise beyond $100,000 resume? This is a subject that I cover every morning in video on Cryptoast Academy.

Don't miss the bullrun, join our experts on Cryptoast Academy

Advertisement

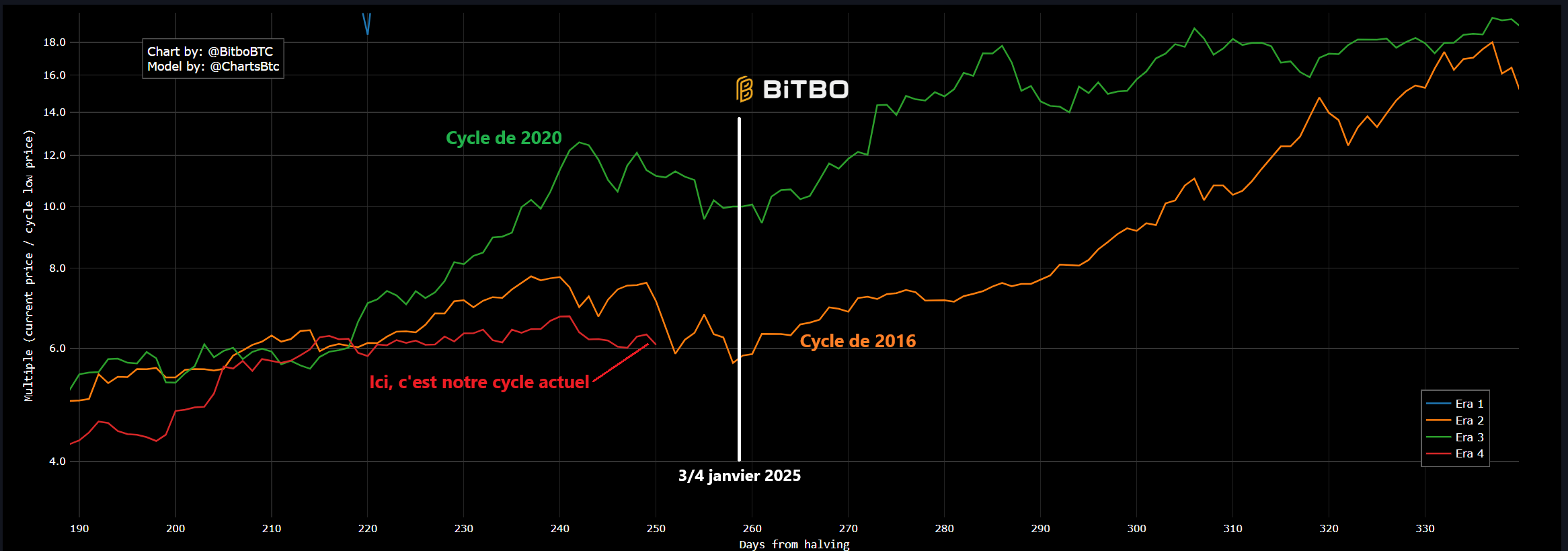

I share with you below a graph which argues in favor of a resumption of the rise in January 2025. This graph compares our current bullish cycle with the cycles of 2016 and 2020 taking into account the number of days elapsed since the halving .

Chart that compares the current Bitcoin bullish cycle to its 2 past cycles taking into account the number of days after the halving. Each cycle is represented by its multiple since the low point of the previous bear market

Chart that compares the current Bitcoin bullish cycle to its 2 past cycles taking into account the number of days after the halving. Each cycle is represented by its multiple since the low point of the previous bear market

Bitpanda: receive €50 bonus in BTC by creating an account

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital