On July 13, 2023, the cryptocurrency industry got good news when Judge Analisa Torres of the US District Court for the Southern District of New York ruled that Ripple did not violate securities law in selling its token (XRP) via public exchanges. That decision cuts against claims made by the SEC in both this suit and others against crypto industry giants like Coinbase and Binance that most cryptocurrencies should be regulated as securities like stocks and bonds. While the judge found that Ripple did violate securities law in its sale of XRP to institutional investors, the ruling has given the industry hope that other cryptocurrencies deemed securities by the SEC in other cases may see similar rulings, and be allowed to continue to trade as normal on exchanges, without the risk of securities law violations by token issuers or the exchanges themselves. But given the number of other legal cases underway, as well as Congressional momentum on crypto legislation, there’s still a lot to sort out.

Even so, this ruling made waves in the crypto world. How did the market react? We’ll break it down below.

Market reaction: Big moves for Ripple and other tokens previously deemed securities

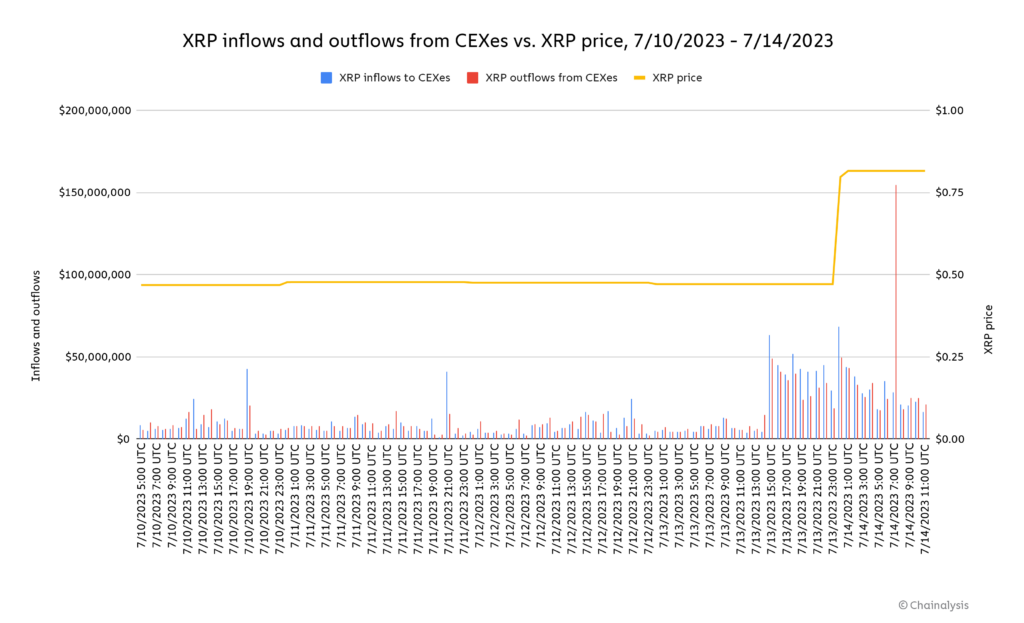

First and foremost, we saw a big jump in Ripple’s price and overall transaction volume. Ripple’s XRP price surged 87% yesterday on news of its legal victory, reaching a one-year high of $0.88. As of 1pm on July 14, its price sits at $0.72.

We can also see that XRP inflows and outflows from centralized exchanges spiked just prior to and during the price jump, as many users apparently looked to trade on the good news.

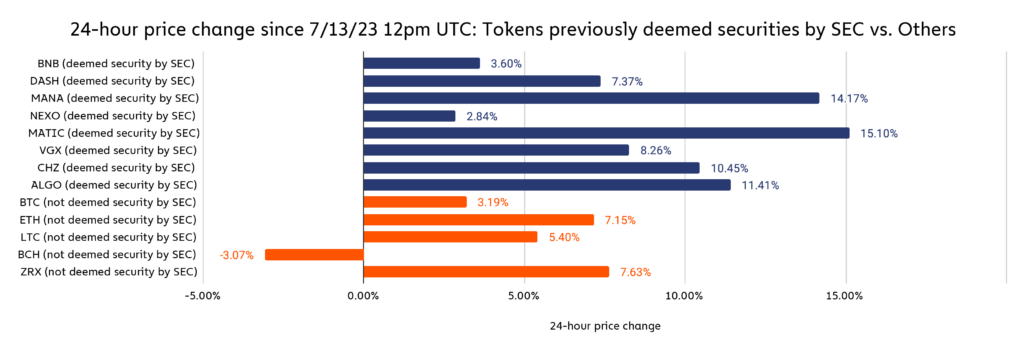

XRP isn’t the only token affected by yesterday’s decision though. The SEC had previously named several other tokens as securities in separate lawsuits under a similar framework to the designation of Ripple. Many of those tokens also saw large price increases as well, with users likely convinced the Ripple case bodes well for their own continued health and legality. Check out the chart below, which compares the 24-hour price performance since just before the announcement of the Ripple decision for several non-stablecoins previously deemed securities by the SEC versus a selected group of tokens not previously deemed as such.

Besides Bitcoin Cash, all of the tokens we look at showed at least modest gains — but those gains were significantly bigger for coins that have previously faced SEC scrutiny and been designated as securities in lawsuits brought by the regulatory agency. Similar to XRP, many of those tokens (but not all) also saw large increases in transaction volume.

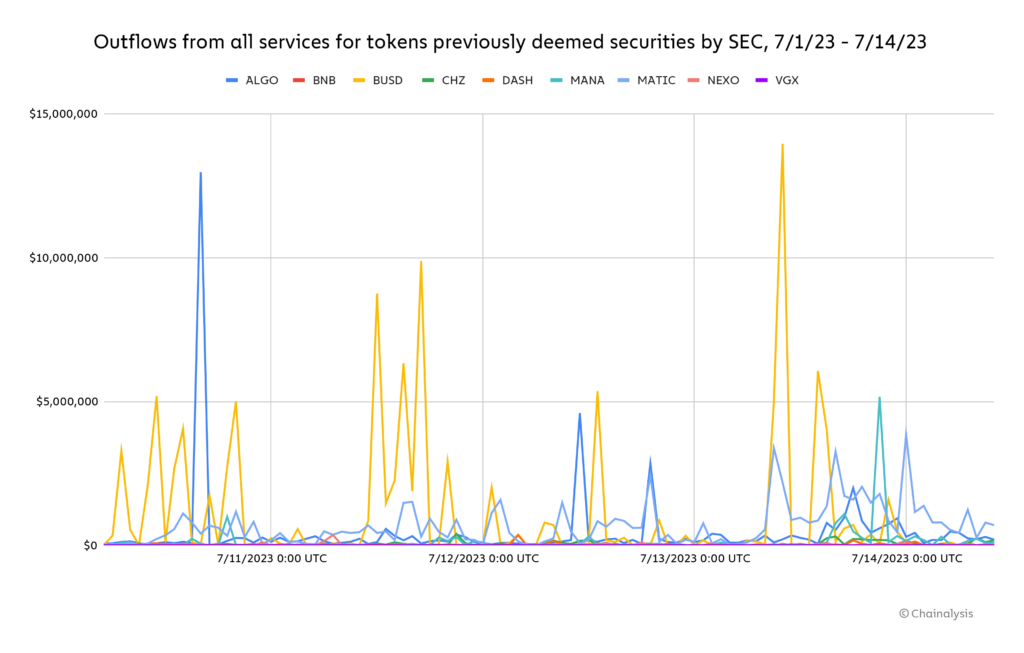

The outflows data suggests that, similar to XRP, interest grew in trading assets whose SEC designation as securities is now in question.

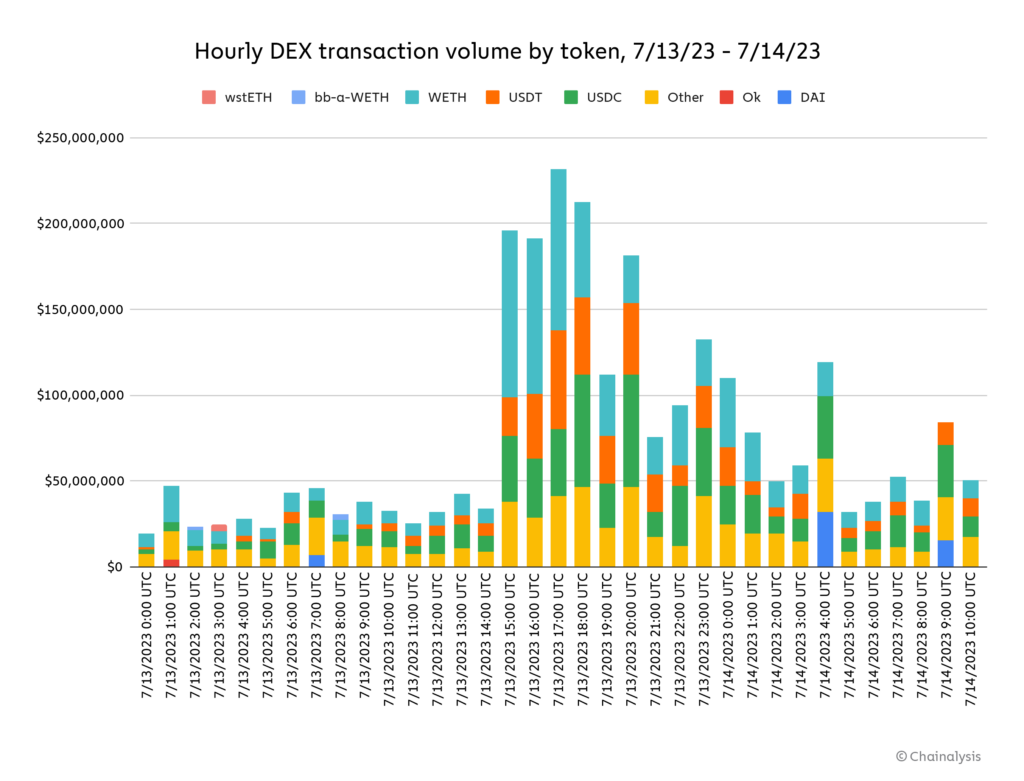

Finally, yesterday’s decision also seems to have sparked a large increase in DEX activity. Check out the graph below, which shows total DEX transaction volume by token in the hours directly before and after the Ripple decision.

In the hours following the Ripple decision, DEX traders ratcheted up their activity significantly, with most of the extra volume driven by wETH and stablecoins.

The market thinks big things are coming following the Ripple decision

It remains to be seen whether the Ripple decision will stand and how other tokens will be evaluated by regulators in the future. But the data we show above indicates that crypto users believe the Ripple decision is positive for the industry, as nearly all tokens are up and transaction volume has spiked. We’ll continue to monitor and provide updates when possible, and look forward to working with our industry and government partners to think about what US regulation of cryptocurrency might look like.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.