While non-fungible token (NFT) trading volumes have increased significantly in the first three months of 2022, it turns out that this data is skewed by a phenomenon dubbed “Wash trading”. Let’s take stock to sort the true from the false.

A year 2022 wrong by the numbers

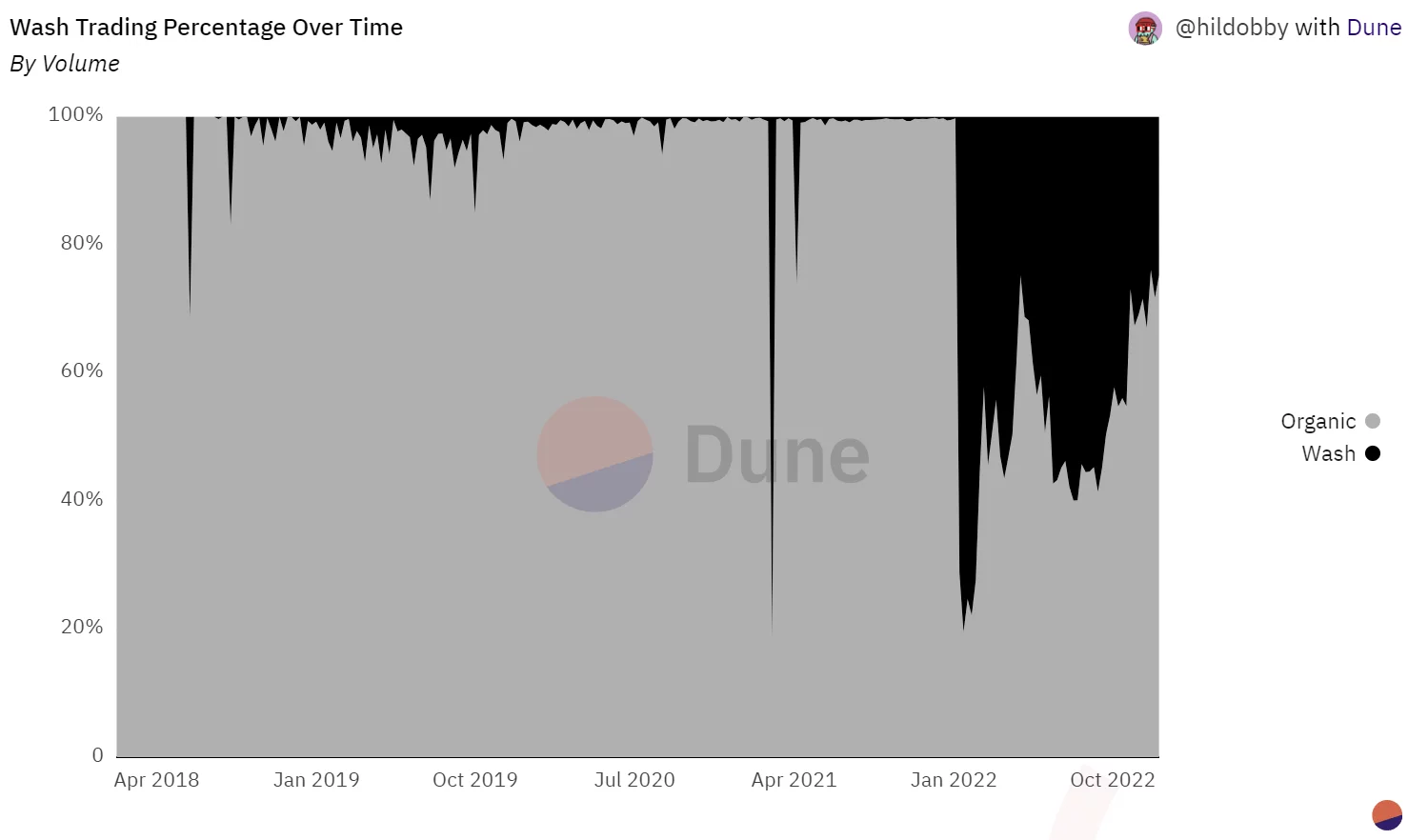

Could Ethereum (ETH) blockchain non-fungible token (NFT) volumes be misleading? According to Dune, a site specializing in data analysis, 58% of NFT exchanges in 2022 would be fake transactions from the “ wash trading ».

👉 Learn all about non-fungible tokens (NFT)

Wash trading, which could be translated as “volume manipulation”, is a technique for corrupting transaction volumes by artificially inflating the number of trades of a specific asset class.

While these market manipulations are illegal in many countries, they remain very present in the world of NFTs: the wash trading rate reached 80% in January 2022 :

Figure 1 – NFT wash trading rate between April 2018 and December 2022

While artificial trading volumes accounted for only a minority of transactions through the end of 2021, we are seeing an explosion of these fake exchanges throughout 2022.

👉 Want to know more about wash trading? Check out our guide on the subject

Alyra, training to integrate the blockchain ecosystem ⛓️

Reasons for wash trading

With the explosion in popularity of non-fungible tokens, the NFT collection industry has become increasingly competitive. To separate the wheat from the chaff, trading volumes serve as an indicator of the health and popularity of a collection.

As a result, various NFT projects and marketplaces attempt to increase their trading volumes through various mechanisms to gain market share. The most used method is the incentive by the distribution of tokens.

For example, the LooksRare marketplace, which specializes in NFTs, uses its cryptocurrency (LOOKS) to encourage investors to use its platform. In addition, it rewards its users with LOOKS tokens for their purchases and sales made on its marketplace.

However, wash trading occurs when a user moves one of his NFTs between two wallets that he controls himself. By spending a maximum of ETH (the cryptocurrency of the Ethereum network) in his fake transaction, the user secures a significant reward in LOOKS tokens while having kept his NFT. Thus, the platform’s trading volumes are altered by false transactions..

Cases of wash trading also take place when certain projects want to put themselves forward in the general ranking of NFT collections. By artificially creating high trading volumes, they attract the curiosity of certain investors who, afraid of missing an opportunity, will acquire these NFTs at a price far from their real value, all for the benefit of the project that manipulated its figures.

In this way, hundreds of millions of dollars flow artificially through the NFT sector. And despite the reduction in wash trading during 2022, this phenomenon still represents 25% of the exchanges carried out in December 2022 :

Figure 2 – Weekly NFT trading volumes between December 2020 and December 2022

On the chart above, we see that the highest weekly volume rate was around $5 billion in January 2022. However, subtracting artificial trading volumes from the calculation, August 2021 becomes the month with the most activity, with around $1.8 billion in weekly volume.

👉 To secure your NFTs, acquire a Ledger cold wallet

The best way to secure your cryptocurrencies 🔒

🔥 The world leader in crypto security

Are some marketplaces spared?

Since wash trading is mainly motivated by the financial reward granted by certain platforms, those operating without a token are spared this phenomenon.

While the volumes of the LooksRare and X2Y2 marketplaces distribute tokens to their users, their wash trading rate is respectively 98% and 86% compared to all of their volumes.

In contrast, the largest NFT marketplace, OpenSea, does not distribute rewards to its users: its wash trading rate is then around 2.5% of its volumes.

To get these numbers, Dune’s report is based on 4 factors to differentiate between organic volumes and artificially inflated volumes. According to him, a transaction is considered wash trading if:

- the buyer’s portfolio is the same as the seller’s;

- the NFT goes back and forth between two different wallets;

- a portfolio has bought or sold 3 or more times the same NFT;

- both buyer and seller were supplied with ETH by the same wallet.

Currently, the best method to limit wash trading seems to be removing trade rewards on platforms like LooksRare and X2Y2. But in the future, we can hope for a legislative framework to limit this phenomenon.

👉 For access to more analytics, join our private Cryptoast Premium group

Progress in the world of cryptocurrencies with Cryptoast experts 📘

Source: Figure 1 and 2 – Dune

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.

;Resize=(1200,627)&impolicy=perceptual&quality=medium&hash=9be199b301ad3c7214a26f2c0d0bc4b0eed3554547a2b328670d62194ffd0354)