By offering a spot market and a derivative products market, more particularly perpetual contracts, Hyperliquid quickly developed, making a name for itself in the decentralized exchanges market (DEX). Its success is also reflected in figures, the protocol having managed to generate more income than Ethereum in recent days.

Hyperliquid, the protocol that rises to the detriment of its competitors

Hyperliquidthis layer 1 behind the decentralized exchange (DEX) offering a spot market and a derivative product market, managed to surpass Ethereum By generating more weekly income than the blockchain co -founded by Vitalik Buterin.

🔎 All about the hyperliquid ecosystem (hype)

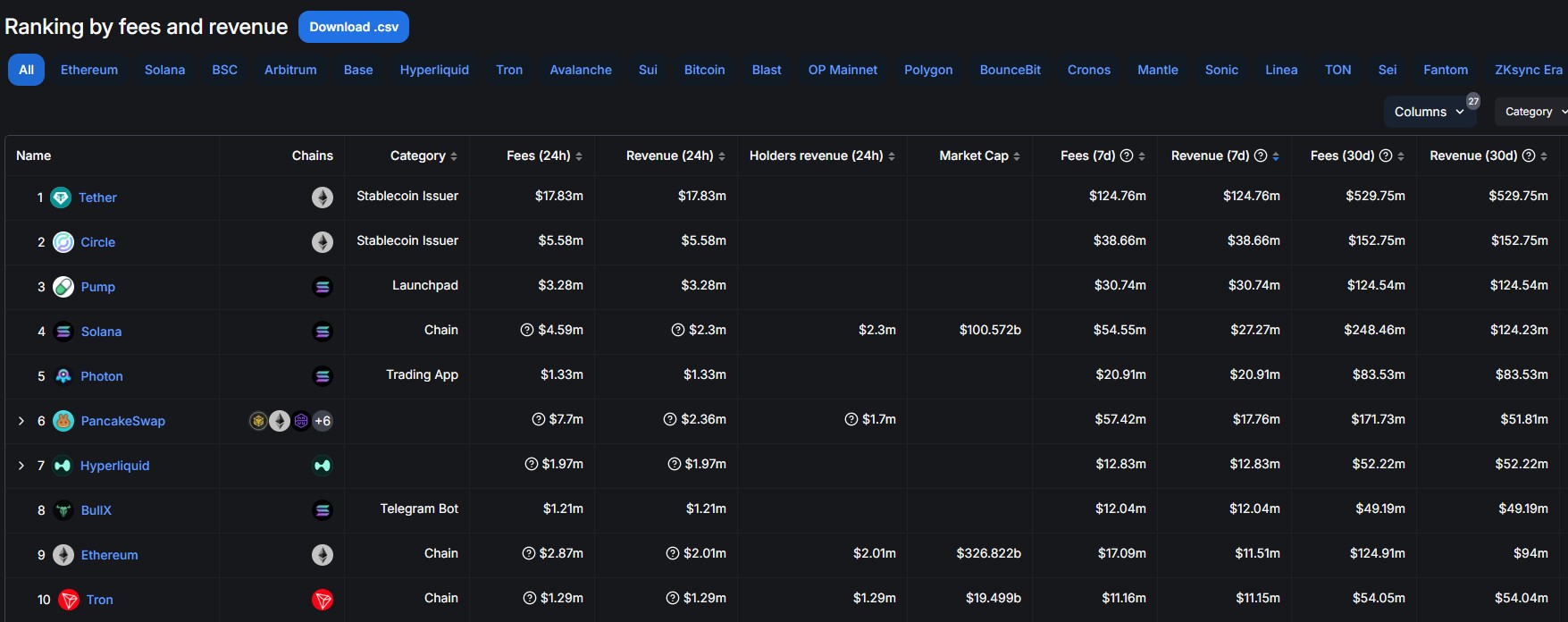

According to Defilalama data, Hyperliquid has recorded $ 12.8 million income over the period from January 27 to February 3, $ 1.3 million more than Ethereum and its $ 11.5 million. This trend is still confirmed at the moment since over the last 24 hours, Hyperliquid has generated for $ 2.53 million income against barely $ 1 million For Ethereum.

Hyperliquid continues its ascent and grabbed market share with the largest protocols

This increase in protocol income reflects its rapid ascent as essential platform for the negotiation of perpetuals. Thus, on February 3, Hyperliquid had recorded a daily volume of transactions about $ 470 millionor almost double the figure it displayed at the end of last year.

The decentralized exchange behind the Layer 1 managed to make a name for itself, grapping the market shares of actors who are established in the Dex sector Like GMX or DYDX. As a structuring pillar of its success, Hyperliquid can count on his native token, the hype.

Occasionally of a highly anticipated Airdrop At the price of $ 3.90, cryptocurrency experienced significant growth, even exceeding 34 dollars at the end of December. Depending on the price of the hype, the token is negotiated at just over 26 dollars Currently.

In addition, the platform's objectives remain ambitious. After proposing the Hype Staking at the end of last year, Hyper Foundation, the Hyperliquid entity, announced that he wanted to launch A Smart Contracts platform based on Ethereum Virtual Machine (EVM). An initiative that aims to diversify its income and justify the program of its native token.

https://www.youtube.com/watch?v=qpyav5la60k

Try Hyperliquid: a decentralized trading platform!

Ethereum in difficulty, struggling to compete with newcomers to the market

These good hyperliquid results also highlight the difficulty of Ethereum to compete with emerging blockchains Sometimes offering faster transactions and lower costs. The evolution of the geopolitical context Can also explain the craze for other networks at the expense of Ethereum.

For example, the Solana blockchain recently benefited renewed interest around the sameespecially with the launch of Trump and Melania tokens, to record record results throughout the month of January.

📰 In the news – according to Vitalik Buterin, the next big update of Ethereum (ETH) is expected for Mars

In parallel, Ethereum has known a High drop in income in 2024 After the Dencun update deployed last March had a significant impact On the fee of the Layer 2.

Finally, Ethereum knows some difficulties. Indeed, in recent weeks, tensions have appeared between members of the community regularly operating the blockchain and The Ethereum Foundationthe entity which deals with the development and management of the network. Discords that do not serve the image of the blockchain.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Source: Defillama

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital