After a historic Airdrop of $ 1.3 billion, Hyperliquid still reserves almost 39 % of its hype tokens supply for future Airdrops. Discover the strategies to maximize your eligibility chances now!

Will there be a 2nd Airdrop of Hyperliquid?

Hyperliquid is one of the most popular projects in the crypto ecosystem. Indeed, unlike most of the latter, The protocol benefits from total independence by the absence of professional investors.

This is in particular what allowed Hyperliquid to perform a historic ardrop, representing $ 1.3 billion. Following this event of considerable magnitude, the course of the Hype token appreciated heavily, reaching approximately 35 dollars per unit to his price record (ATH).

Although the first Airdrop of Hyperliquid was greatly appreciated by its users, There is a good chance that the next one (s) will be just as much. Indeed, while it represented 31 % of the total supply of hype tokens, The project has announced to allocate an additional 38.9 % for its future Airdrops.

🎁 Discover our guide to not miss any Airdrop in 2025

Although we currently have little information on the terms of these future Airdrops, it might be interesting to start positioning yourself by performing different tasks, in order to become eligible.

We will therefore via this article exhibit different ways which seem relevant to us to try to be eligible for the Airdrop of Hyperliquid.

Trader Hype crypto On the decentralized hyperliquid platform

Hyperliquid in a few words

You have certainly understood it when reading these few lines, Hyperliquid is somehow a success story, in web3 sauce.

While the decentralized exchange (DEX) of Hyperliquid is relatively recent, it is already positioned in 2nd place, behind its competitor Dydx, in terms of cumulative volumes on the trading of perpetual contracts according to Defillama data.

✅ Discover our top of the best decentralized exchanges in 2025

But recently, Hyperliquid is only just a DEX. It is also an ultra blockchain, or rather super efficient: Hyperevm.

This blockchain promises until 200,000 transactions per second (TPS), with an end less than the second. It was specially designed for high frequency trading, in parallel withHypercourthe new name of the Hyperliquid Dex.

Also, in this article we will focus more in Hyperevm and its decentralized applications (DAPPS) because we have already made a tutorial to trader on hypercore.

We also recommend that you start with this guide in order to have all the keys in hand for what will follow.

Transform crypto crashes into opportunities 🚀 Receive 7 exclusive tips to succeed where 90% fail!

Having followed step by step the tutorial mentioned above, you must already have funds on Hypercore. In order to maximize your chances of being eligible for the future Airdrop of Hyperliquid, We will have to make volume in tradingin spot or with a lever effect.

Long or shorts over 100 cryptos with hyperliquid

Watch out for levers

The leverage can cause partial or total capital loss. They are therefore to be used wisely and knowing the risks involved.

It is also possible to Place USDC in vaultsdigital safe, to gain a return. Different kinds of vaults exist on hyperliquid:

- The vaults of the protocol, such as hyperliquidity provider (HLP);

- User vaults.

While the HLP is supposed to provide a return in exchange for the liquidity deposited, user vaults are a way of doing copy trading. Users who deposit funds in this kind of vaults will gain (or lose) cryptos following the performance of the creator of the Vault in question.

It is also possible to come stake your hype from the hypercore interface. For this, it will be necessary:

- Transfer the hypes of the “Spot Wallet” to “Stuking Wallet”;

- Click on the “Stake Tokens” button;

- Choose the amount of Hype in Stake;

- Confirm the operation.

Attention to the deadline

To transfer hype from Stoking Wallet to the Wallet spot, you will have to wait a period of 7 days.

We also recommend that you share your sponsorship links to your friends who are not yet on hyperliquid. It is to remember that Affiliates obtain the greatest awards than the sponsors.

To support us, you can use our Cryptoast code when you start on hyperliquid.

Explore the applications of hyperevm

As we exhibited above, in order to maximize your chances of being eligible for the future Airdrop of Hyperliquid, It should not be content to make volume on hypercore.

Although Hyperevm is a still relatively recent blockchain, and that are few applications to be available to the writing of these lines, we think thatIt is important to create a good on-chain imprint.

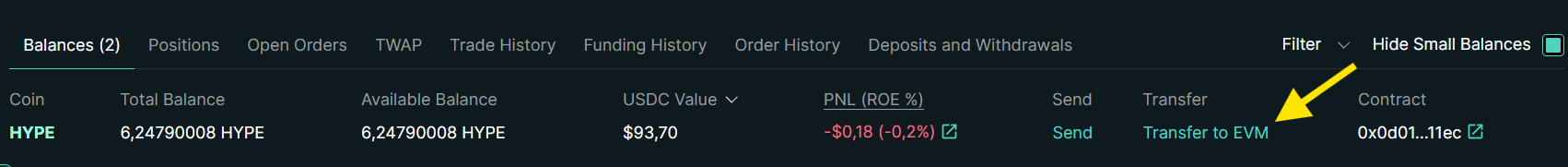

In order to transfer your hyperevm hypes, you will have to go to your portfolio and use the “Transfer to EVM” function:

Screenshot of the hypercore portfolio interface

Info block

Make sure your hype tokens are well in your “spot wallet” and not in your “Perps wallet”. In which case, use the “Transfer to Spot” function.

Long or shorts over 100 cryptos with hyperliquid

Decentralized finance (DEFI) on Hyperevm

On the side of decentralized finance (DEFI) on Hyperevm, some DAPPS begin to make a name for themselves.

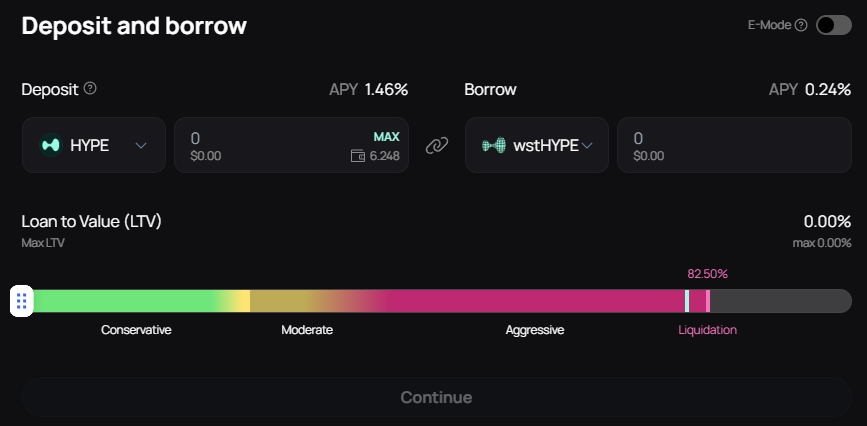

For example, it is possible to do lending/borrowing on the Morurr.fi application. Nevertheless, the active ingredients available for these uses are limited to the Cryptos following the writing of these lines: Hype, Whyp and Wsthype.

Interface of the mortor.fi application

Interface of the mortor.fi application

We can notice a point system integrated into the applicationwhich could serve as an eligibility criterion in the event that the project would launch its own cryptocurrency, and ultimately An Airdrop to its users.

We can also anticipate that several interesting features will be created soon such as sting and swaps directly from the Morurr.fi platform.

By the presence of their logo on the site, it is likely that the application integrates in the future the CRYPTOS USDC, WBTC and USDE to its services.

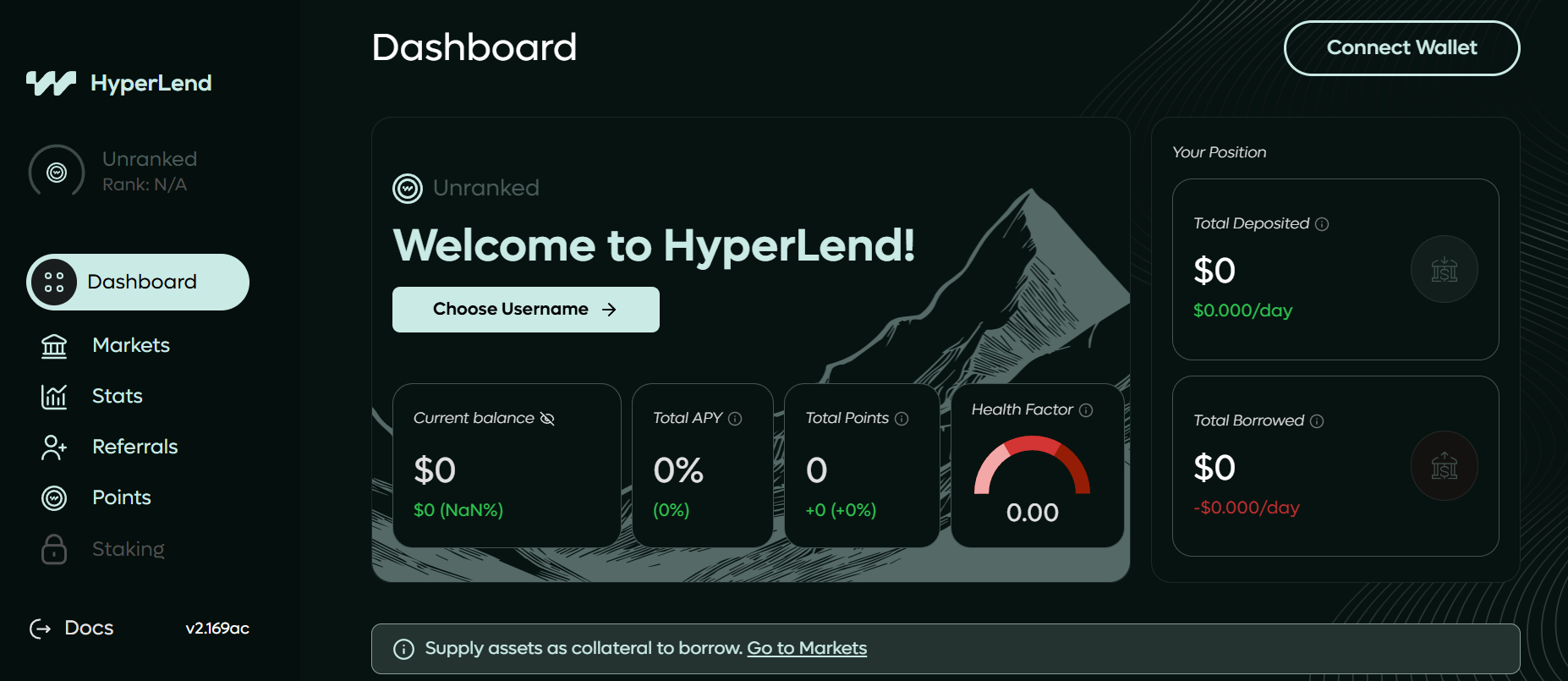

The DAPP Hyperlend (affiliate link) also offers Lending/Borrowing services with a neat interface. In just 24 hours after its launch, the protocol reached more than $ 6 million of total locked value (TVL).

Hyperlend application interface

As for Swaps to write these lines, decentralized exchanges (DEX) Hyperswap (affiliate link) and Kittenswap (affiliate link) offer these features with independent points systems.

Aevo: Cryptos trader not yet released on the market

Marketplace and NFT collections

As on many blockchains, NFTs are popular on Hyperevm. The Marketplace DRIP.TRADE stands out in this direction by offering its different collections on the network.

When writing these lines, the most popular NFT collection on hyperevm is Wealthy Hypio Babies:

Example of an NFT from the Wealthy Hypio Babies collection

Example of an NFT from the Wealthy Hypio Babies collection

The aesthetics of the NFT of this collection is reminiscent of the famous Milady Maker collection. Nevertheless, to have one of these precious NFTs, it will be necessary to pay 149 hype at least, which represents during the current price of the hype more $ 2,200. A pond Sum, which is not within the reach of all the wallets.

At this price, holding one of these NFTs is not without advantage. Indeed, Most NFT projects launching on hyperevm could offer Whitelists (WL) to Holdersin order to have a positive effect on their marketing.

Whitelists on NFT collections

The allocation of whitelists to popular NFT collections is a mechanism that is spreading more and more. Being whitisting provides access to the purchase of a preview NFT, often at a reduced cost compared to public launch.

Discover Cryptoast Academy's tips with the latest video on the subject: How to choose your NFT? 👇

Transform crypto crashes into opportunities 🚀 Receive 7 exclusive tips to succeed where 90% fail!

Depending on a step, a creator of content specializing in Airdrops, the NFT could have a role to play in the future Airdrop of Hyperliquid. In addition, collections to increasing popularity like Oily The Shapeshifter are also available on the Marketplace, at a significantly more affordable entry price.

Although there is not yet a point system on the Marketplace Drip.trade, we can notice a “Rewards” section. There is therefore also a probability that the project will carry out its own Airdrop, possibly in the form of whitelists.

Perspectives for the Airdrop of Hyperliquid

In this article, we have explored several avenues to become eligible for the future Airdrop of Hyperliquid, in particular via Hypercore and Hyperevm. Nevertheless, The hyperevm ecosystem is still relatively young and few applications are already available. Others will be released in the coming months and it may be interesting to position yourself early.

Also, we recommend that you Maximize your on-chain imprint by making transactions and adopting organic behavior.

Long or shorts over 100 cryptos with hyperliquid

Let us summarize the different ways of exposing themselves to the Airdrop of Hyperliquid.

Via Hypercore:

- Trading on hypercore (spot or lever);

- Deposit liquidity in certain vaults;

- Stike his hype;

- Use a rose (“cryptoast” code to support us) and share his own to your friends.

And via hyperevm:

- Swap Swaps;

- Do lending/borrowing;

- Own and trading NFT;

- Maintain a watch, and use the DAPPS that start on the network.

Finally, as in any hunting at Airdrop, Patience and regularity will be in order to hope to harvest the fruits of its work.

On cryptoast academy Take full guides for farm les airdrops

Advertisement

Sources: Pasheur, GHz

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital