Now that a new year is upon us, Chainalysis has released 2022 data on illicit activity in the cryptocurrency ecosystem. If this analysis is very instructive, we will however note its limits which allow us to qualify the figures put forward.

The state of illicit transactions in cryptocurrencies in 2022

This week, Chainalysis published an excerpt from its report due out in February on illicit transactions in cryptocurrencies in 2022.

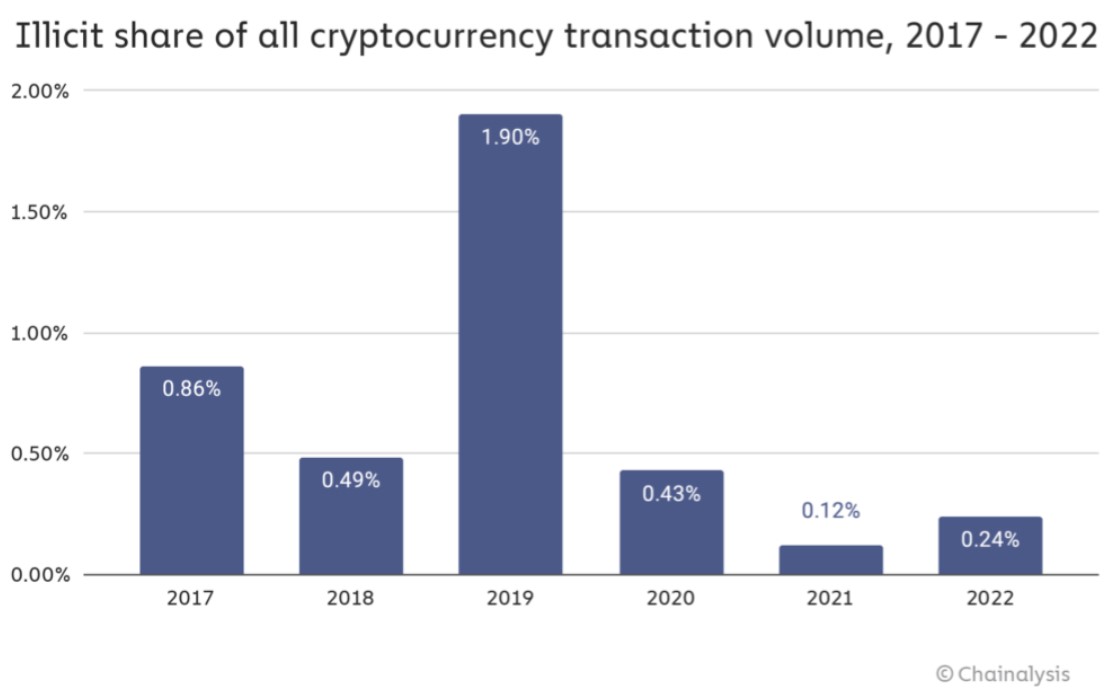

If the latter have unfortunately increased since 2021, however, they remain marginal at 0.24% of the total volume or the equivalent of a 416 transaction:

Figure 1 – Volume of illicit transactions in 2022 on cryptocurrencies

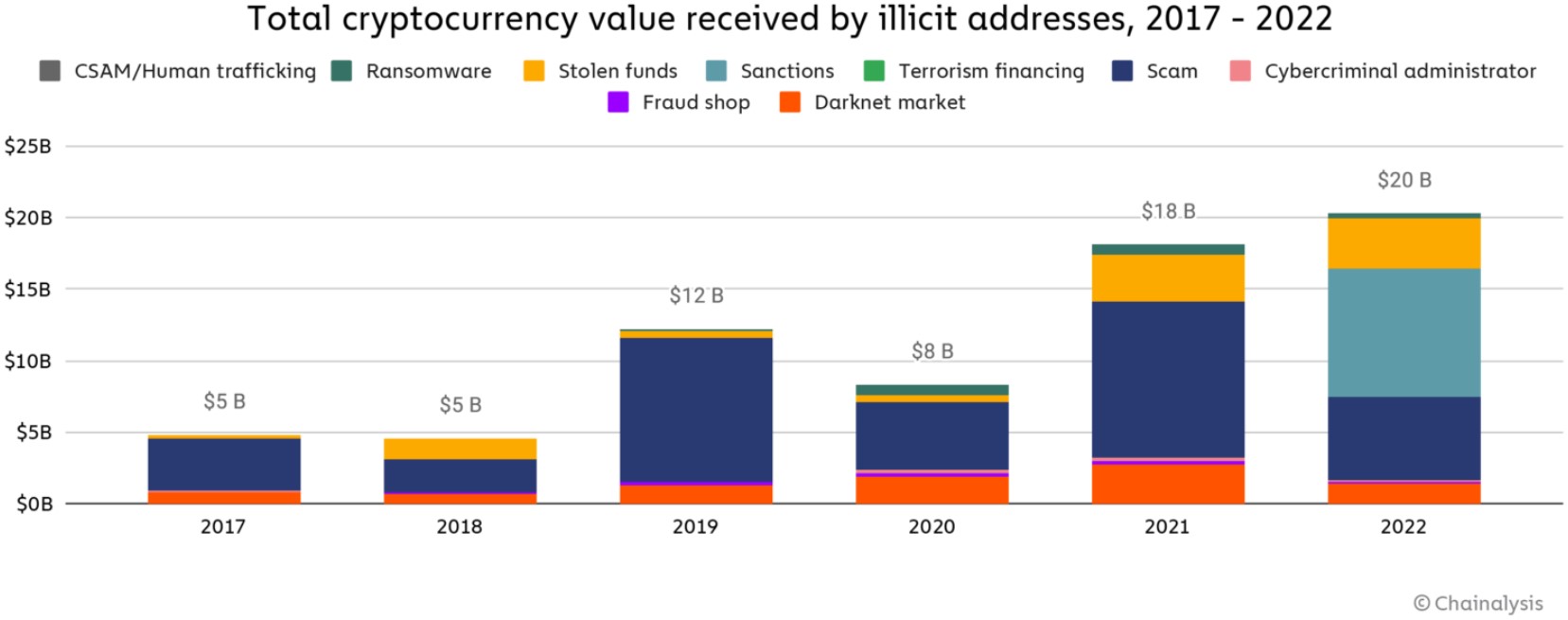

In terms of value, that’s $20.1 billion. If this data is indeed substantial, it should be rescaled, recalling for example that over the last 24 hours, Binance has generated more than $31 billion in spot trading volume.

If we look more closely at the activities that make up this study, we notice that 44% of volume involves transactions on addresses sanctioned by the Office of Foreign Assets Control (OFAC) of the US Treasury:

Figure 2 – Details of the types of illicit transactions

This data on OFAC’s sanctions is interesting, because it turns out that a large part of this 44% concerns the Russian exchange Garantexsanctioned in April 2022. As these sanctions taken by OFAC apply, in theory, only to American citizens, nothing prohibits Russians to use this local platform legally in their own jurisdictionwhich will however feed the data collected by Chainalysis.

👉 To go further – Train yourself in blockchain technology to gain independence

Alyra, training to integrate the blockchain ecosystem ⛓️

The nuances to consider in this data

In addition to the Garantex case, the Chainalysis analysis includes a few subtleties that qualify the data presented. First of all, this study only concerns on-chain datawhich are moreover the only verifiable ones with certainty.

This implies that transactions internal to an exchange, which are recorded in an account book outside the blockchain, cannot be taken into account. This then opens the debate on the activities of FTX, Celsius where other companies having defrauded in 2022, but whose activities are not reflected in the analysis.

It should also be noted that certain activities are difficult to quantify, such as the payment of drugs in cryptocurrencies, which can be compared to a simple transaction from an on-chain point of view.

Nevertheless, numbers are changing as Chainalysis finds new methods to monitor the full range of illicit activities in the ecosystem. Thus, if for example the value of 14 billion dollars was initially advanced for 2021, an update with new calculations brought this figure to 18 billion.

On the other hand, it would be easy to make a shortcut by saying that “illicit activity doubled in 2022», because we went from 0.12 to 0.24% of transactions. Nevertheless, such reasoning would be fallacious.. Indeed, if the criminal industry knows no respite, the cryptocurrency market has indeed experienced a drop in activity in 2022. Based on this observation, this mechanically increases the share of illicit transactions in the total volume. .

👉 Also in the news – SEC accuses Gemini and Genesis for their activities with retail investors

Progress in the world of cryptocurrencies with Cryptoast experts 📘

👉 Listen to this article and all other crypto news on Spotify

Source: Chainalysis

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.