Richard Teng, CEO of Binance, says it himself: “2024 was a pivotal and landmark year for the cryptocurrency industry.” With the crypto market booming, the exchange took the opportunity to record record net inflows and thus increase its lead over other crypto platforms.

Binance records record net inflows, driven by market rise

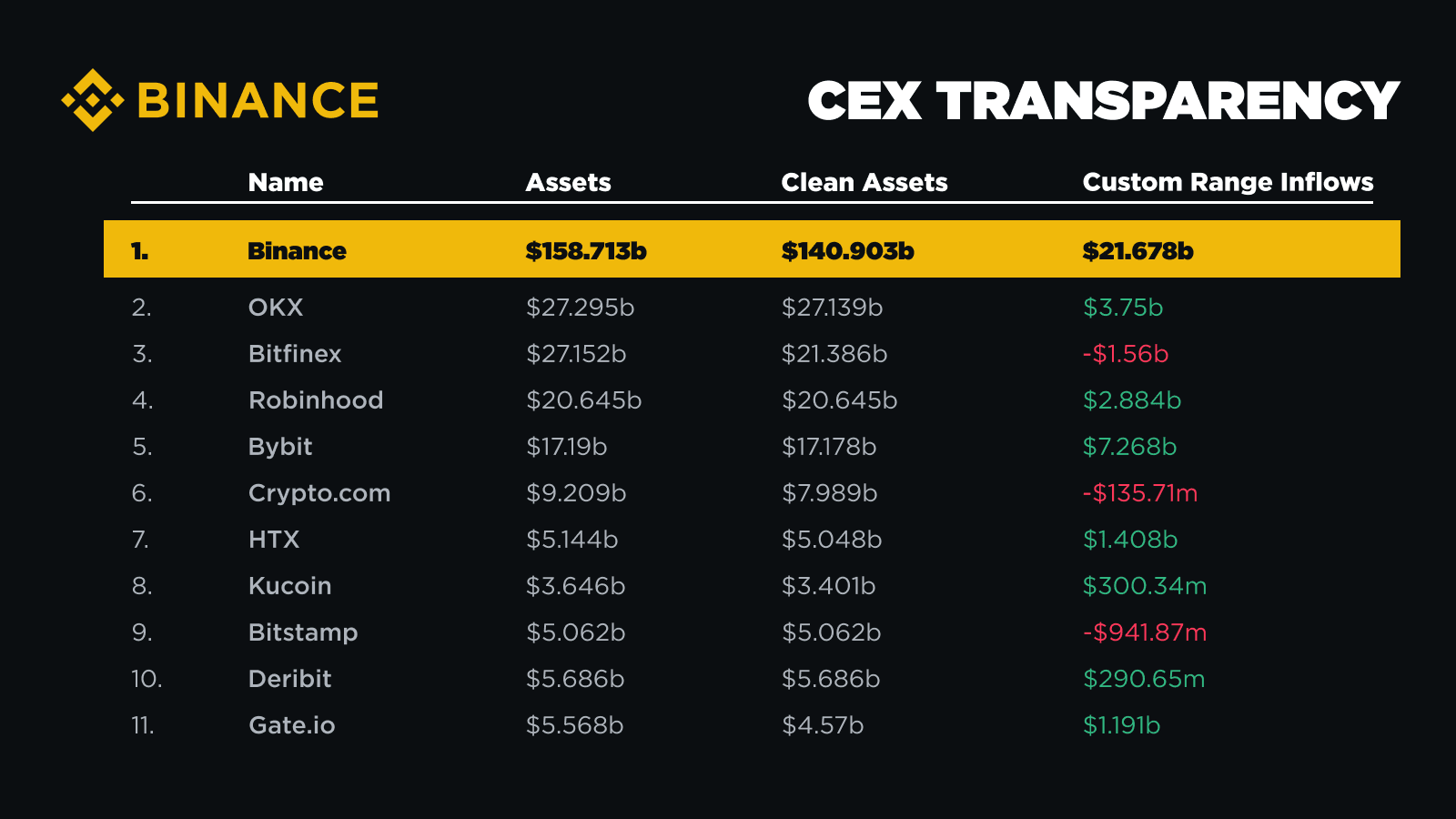

As the year ends, Binance presented the results of its crypto platform for 2024. The exchange attracted a total of $21.9 billion in net inflows coming from the deposits of its individual or institutional users.

Thanks to this positive inflow, Binance would be by far the centralized exchange (CEX) on which the most funds are deposited. For comparison, the 10 cryptocurrency exchanges that follow the company in the ranking attracted $15.9 billion in net inflowsor 27% less than Binance.

The second CEX in the ranking, OKX, is far behind, with $3.75 billion in net inflows over 2024

As the ranking attests, some exchanges that are well established have not necessarily had a good year, recording net outgoing flows. This is the case of Bitfinex, Crypto.com and Bitstamp.

It is still important to note that several widely used exchanges such as Coinbase are not included in the ranking. Indeed, DefiLlama, the entity which established this ranking, did not have transparent access to data allowing it to best appreciate the trading volumes of these platforms.

Open an account on Binance, the world’s #1 crypto platform

For the exchange, the arrival of spot BTC ETFs has allowed institutional investors to get involved in cryptocurrencies

“ 2024 was a landmark year for the crypto industryand we are incredibly grateful to our nearly 250 million usersand this figure continues to increase, who continue to trust Binance as their trading platform of choice said Richard Teng, CEO of Binance, upon announcing the results.

For the exchange, this year 2024 was marked by several events which allowed it to consolidate its leading position among CEXs. Binance particularly mentions the launch of spot Bitcoin (BTC) ETFs in the United States “ which allowed institutional investors to more easily access the world of cryptocurrencies “.

This introduction of BTC Spot ETFs allowed to boost the price of Bitcoin throughout 2024. This can be seen in particular in the average BTC deposit made by exchange users. This value is passed from 0.36 BTC at the end of 2023 to 1.65 BTC Currently. As for dollar deposits, the figure increased from $19,600 to $230,000 in just 1 year.

All these results underline “ the growing importance of cryptocurrencies in the financial world » according to Binance, which “ are no longer an alternative asset class but an integral part of the global financial system “.

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital