Dogecoin recently broke its neutrality zone, a worrying technical signal for the Haussier camp. This rupture puts an end to a period of consolidation previously observed and could strengthen the lower bias already installed on the markets for the DOGE.

Dogecoin, a fuel rocket?

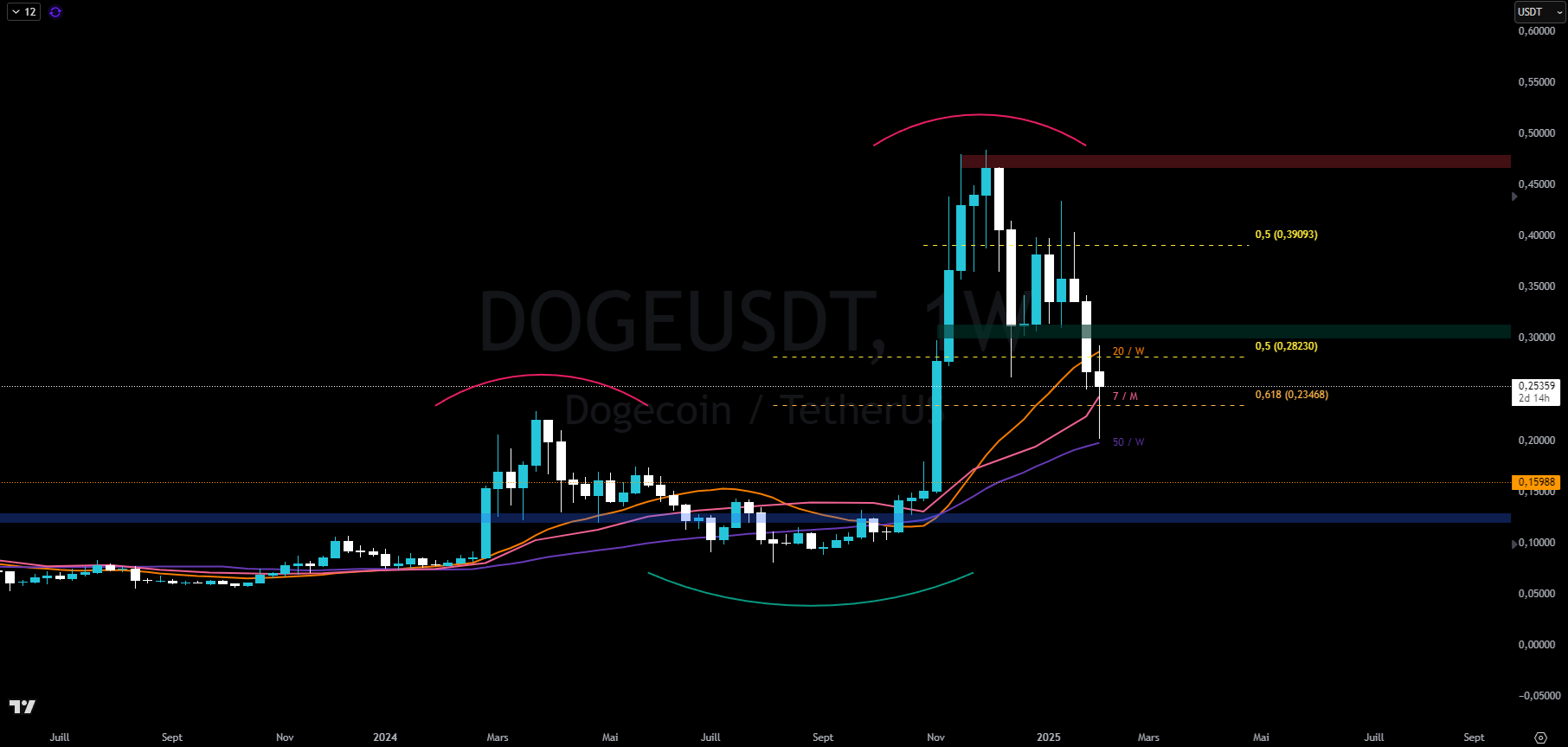

We are Friday 07 February 2025 and the Cours du Dogecoin (DOGE) evolves around $ 0.25.

The latest analysis we have carried out about DOGE dates back to January 27, 2025, when its price was moving around $ 0.33. Since then, the price action has continued to fall back, marking a new low weekly point at $ 0.2.

| Pairs with Dogecoin | 24 hours | 7 days | 1 month |

| DOGE / USDT | -4.10 % | -22.80 % | -27.10 % |

| Doge / bitcoin | -2.80 % | -17.30 % | -28.60 % |

👉 How to easily buy dogecoin (Doge) in 2024?

THE narrative samewhich hitherto attracted a large part of the capital, crosses a period of widespreadlike the entire Crypto market. There proliferation and the big Diversity of tokens In this segment amplify the impact of lowering pressures, resulting in the weakest assets to new low points, sometimes historical.

In this Tokens jungleTHE DOGEundisputed leader of the same narrative, shows a notable resiliencedespite a Obvious technical break. However, in a context where good newsthat they come from American policies or influencers, seem to have less impacta real recovery from the market to the north could take time.

GMGN: The platform to buy the same corners easily

On the side of derivative marketsTHE DOGECOIN (DOGE) maintains its position among the most traded assetsoccupying the 5ᵉ place in terms of volumes over the last 24 hours and also the 5ᵉ place for the amount of Open interests (OI).

The asset thus continues to assert his leadership Among the same In terms of speculation. During our latest analysis, the Trumpwhich competed with the DOGE in terms of exchange volumes, now seems to lose speed, restoring the DOGE first place in the Narrative of the same.

THE Open Interest (OI) from Dogecoin have decreased by 17 % this week, accompanying a drop in prices and a reduction in financing costswhich even spent a few hours in negative territorytranslating a very pessimistic feeling on the market.

However, in the past few days, thebalance seems to have recoveredwith long positions which take over in a context where the oi remain stable. This phenomenon indicates that sellers gradually reduce their positionsin a market that shows signs of stabilization.

THE DOGE also keeps the 8ᵉ place classification by market capitalization within the crypto ecosystem, with a value of $ 37.48 billion (-12 billion). This position confirms its status as undisputed leader of Sector of the same.

Trade cryptos on binance, exchange n ° 1 in the world

Range break and weekly downward trend

THE tidy that we had mentioned in recent weeks has been broken during a Powerful impulsive movementconfirmed in weekly fence. This movement questions the side construction and now places the asset in a weekly downward trendexerting increased pressure on Key dynamic supports.

The asset is now evolving under his Mobile average at 20 weeksa critical level. L'Excess observed on Monday, February 3 even reached the Mobile average at 50 weekswhich remains a strategic landmark and the guarantor of a possible upward resumption in the medium term.

Thus, the hollow formed this week is a significant benchmark For future evolution. A break under this Low wick at 0.2 dollars would probably train a downward continuationwith a potential target located in the 0.10 to 0.15 dollar area. On the other hand, a Reintegration above $ 0.30 could allow the DOGE to find her tidywith a classic movement aimed at reaching the opposite terminal.

Try Dydx now: the favorite DEX of Crypto traders!

We are now under the rangebut the current area could represent a Interesting point for a rebound. The lower movement has retraced until level of 0.618 of the entire bullish phase of the last quarter of 2024. A favorable fence could be considered if we manage to maintain the level of $ 0.24.

To keep a positive polarityhowever, it would be necessary to reinstall yourself beyond $ 0.28. This level is strategic because it corresponds to the Mobile average at 20 weeks as well as 50 % tracetwo major technical thresholds which will have to be reconquered to find an upward dynamic.

It's on the monthly configuration that we find the clearest indices for a reconstructionalthough this process could require time. THE Bollinger bands monthly remain openleaving the door to a certain volatilitywhile in the weekly, they begin to closesuggesting the implementation of a more sustainable consolidation.

Another key level to watch is the Mobile average at 7 monthscurrently positioned around $ 0.25. This level will be decisive during the next monthly fence. Keeping it in support would constitute a positive signal For a possible revival of the upward dynamics on this unit of time. However, this maintenance remains permissive Regarding potential volatility of the Next 3 weeksleaving the possibility of a fluctuating movement before stabilization or revival.

Dogecoin's course graphics

In summary,, THE Dogecoin has corrected strongly under the pressure of a market which gives in the field to the seller camp. The DOGE has just scored a new low point in weekly and stabilizes before the next movement. At the current prices development stage, if a rebound seems most likely, we cannot exclude a downward continuation scenario.

So, do you think the Doge can already go back to the high terminal of its range? Do not hesitate to give us your opinion in the comments.

Have a nice day and we meet next week for a new analysis.

Trade cryptos on binance, exchange n ° 1 in the world

Sources: tradingview, quince, glassnod

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital